Cards

Wise or BPI Electron card: which is best?

Are you in doubt between the Wise card or the BPI Electron? So be sure to check out the similarities and differences between each of them to find out which of these options is best for you!

Advertisement

Which card is best for you: see the advantages and disadvantages of Wise or BPI Electron cards and find out which one to choose

Wise and BPI Electron cards can be great options for those looking for a debit card. This way, find out everything about each of them and see which one fits best into your life!

Both are cards from Portuguese banking institutions. They bring advantages as well as disadvantages. Therefore, it is necessary to know each of them to make an informed choice.

Continue reading to find out everything about each of these cards. This way, clear all your doubts and make the right choice!

How do I request and activate the BPI Electron card?

Learn how to request and activate the BPI Electron debit card and have a quick and practical tool for payments and purchases at your fingertips!

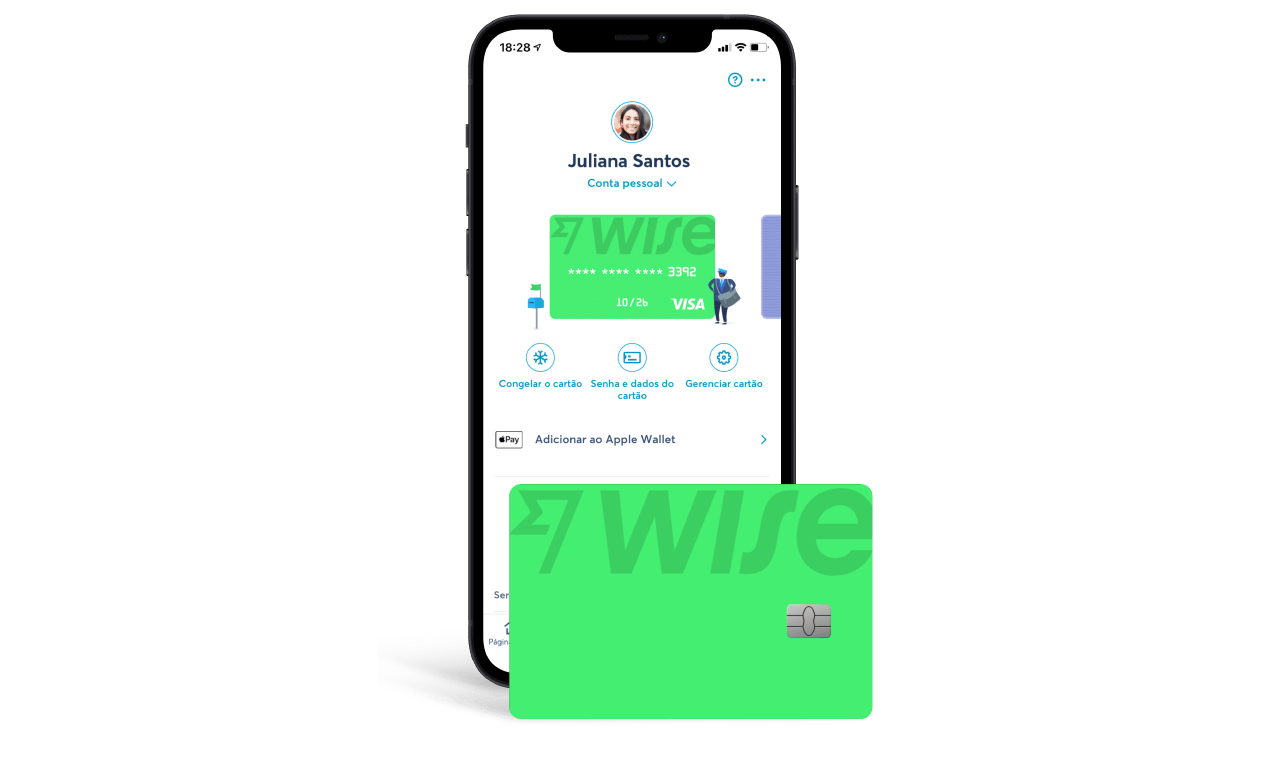

How to request the Wise card?

Learn the quick step-by-step guide on how to apply for a Wise debit card online!

| Wise Card | BPI Electron Card | |

| Annuity | Exempt | Not informed / Issuance fee 20 Euros |

| Do you accept denial? | Uninformed | Uninformed |

| Flag | MasterCard | Visa |

| Roof | International | International |

| Benefits | Reduced exchange rates, move your finances in 50 different currencies, use abroad, conversion rates from 0.35%, choose your main currency with no fees for transactions made with it, no maintenance fees, monthly withdrawals of up to 200 Euros without payment of fees | Debit card, contactless payment, Visa brand, ATM compatibility, allows monthly withdrawals, payments and transfers, international coverage |

BPI Electron Card

First, let’s look at the BPI Electron card. It is a very simple card, but also functional. It is debit and does not have a credit function. Therefore, to use it you need to have an account balance. Furthermore, it is not suitable for purchases in installments.

However, among the features that this card offers are payments at national and international establishments. Also, for cash withdrawals, transfers and deposits.

Wise Card

Like the previous card, Wise is also a debit card and does not offer a credit function. Therefore, like BPI Electron, Wise is only used to make purchases and payments in cash. Again, it is not possible to make purchases with payment when the invoice is due.

Just like the previous card, this one also repeats the fact that it is international. However, instead of a Visa brand, it has a Mastercard brand. This way, you can use it all over the world!

Furthermore, to obtain this card and its features it is necessary to create a current account with Wise. Only then will it be possible to have it and make cash purchases all over the world.

Advantages of the BPI Electron Card

Firstly, check out what advantages the BPI Electron debit card offers and, afterwards, see what the benefits of Wise are!

- Debit card;

- International Visa flag for use abroad;

- Compatibility with ATMs, allows monthly withdrawals, payments and transfers.

- Contactless payment.

Wise Card Advantages

On the other hand, see what benefits the Wise debit card offers:

- Online membership;

- Free annual fee;

- International Mastercard flag;

- Reduced exchange rates;

- Move your finances in 50 different currencies;

- Outdoor use;

- Conversion rates from 0.35%;

- Choose your main currency with no fees for transactions made with it;

- No maintenance fees;

- Monthly withdrawals of up to 200 Euros without paying fees.

Disadvantages BPI Electron Card

However, cards don't live on benefits alone, and with BPI Electron and Wise this would be no different. See, first, what are the negative points that BPI has in this debit card:

- Exclusive for those residing in Portugal;

- In-person membership, without the possibility of hiring online;

- Only those who already have a current account at the BPI banking institution can obtain the card;

- There is no possibility of obtaining a credit card, so it is only limited to debit cards.

Wise Card Disadvantages

Just like the BPI Electron card, the Wise card also has some disadvantages. See what they are:

- Exclusive for those living in the European Union, United States, Canada, Australia or New Zealand;

- It only offers the debit option, without the possibility of obtaining a credit option, nor by using the card over time and developing a relationship with the institution.

Wise or BPI Electron card: which one to choose after all?

Both cards have some advantages, but they are also somewhat limited. After all, they only have the debit function. Furthermore, they are international and allow use abroad.

In this way, they are quite similar. The differences basically refer to the brand, as one is Mastercard and the other is Visa. They also belong to different banks, so to obtain any of them it is necessary to open an account with the respective banking institutions.

Another point is that the card belonging to Wise has withdrawal limits per month, something that BPI does not impose. On the other hand, the Wise card does not charge any annual fee, while BPI charges a card issuance fee.

Therefore, just reflect on what your preferences are and which of these cards offer conditions that really interest you. On the other hand, if your interest is in having a credit card, unfortunately none of these alternatives are the best for you.

Under this hypothesis, then, get to know another card belonging to BPI, BPI Gold. This way, see an option full of advantages and that is more comprehensive. See below how to request and activate the BPI Gold card!

How to request and activate the BPI Gold card?

Learn how to apply for and activate the BPI Gold credit card, the premium card with up to 50 days of interest-free credit!

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

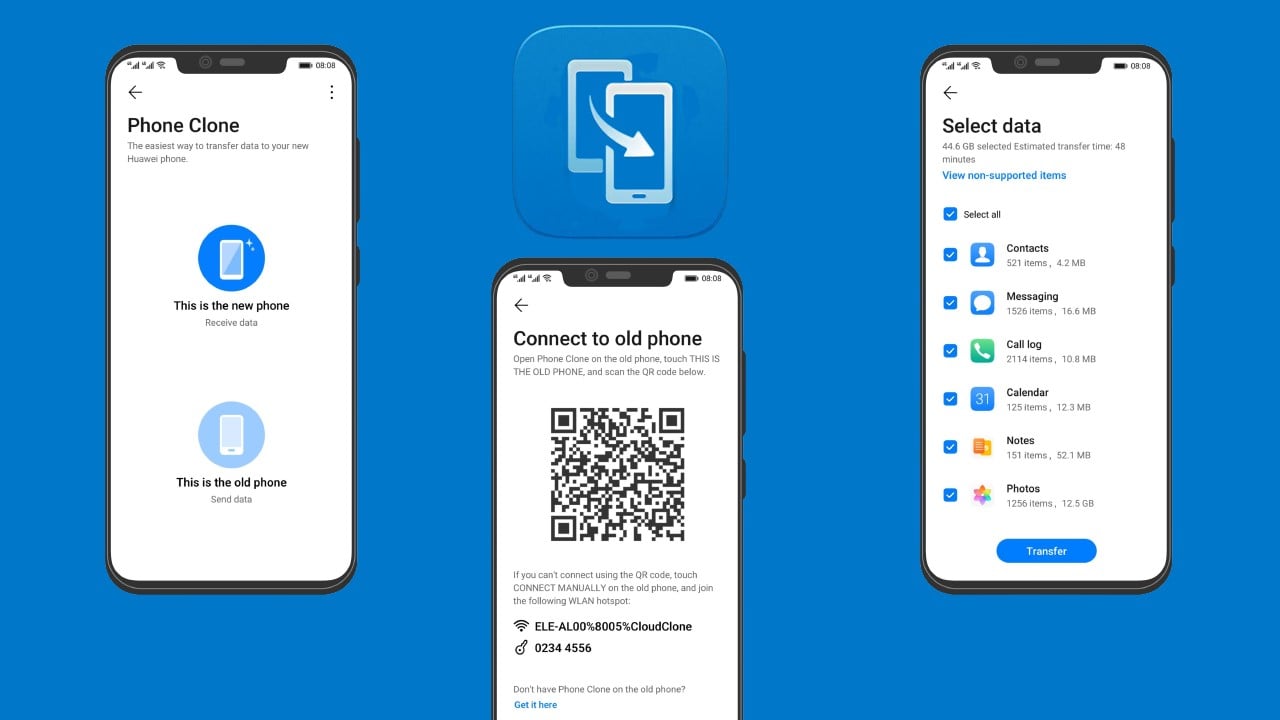

App Phone Clone: the solution to migrate your data

Don't depend on the internet! Transferring your data from an old device to a new one can be quick and easy using the Phone Clone app!

Keep Reading

Universo credit card: how to join online

The Universo Card is a possibility offered by Worten stores to facilitate your purchases wherever you want!

Keep Reading

How to get a credit card with a high limit in Portugal: tips and strategies

Having a high limit on your credit card may seem difficult, but it is possible, just follow some tips to take advantage of all the benefits.

Keep ReadingYou may also like

Discover Cofidis personal credit!

Cofidis personal credit offers good interest rates and can help you balance your finances. See its advantages here and find out more!

Keep Reading

Galp Electric Mobility Card: accelerate towards a clean future!

Enjoy a 16% discount and other benefits when charging your electric car with the Galp Electric Mobility Card!

Keep Reading

How to choose housing credit? Do it safely and with good payment conditions

Do you want to know how to choose housing credit safely and with good conditions? So use simulators! See other special tips here.

Keep Reading