Cards

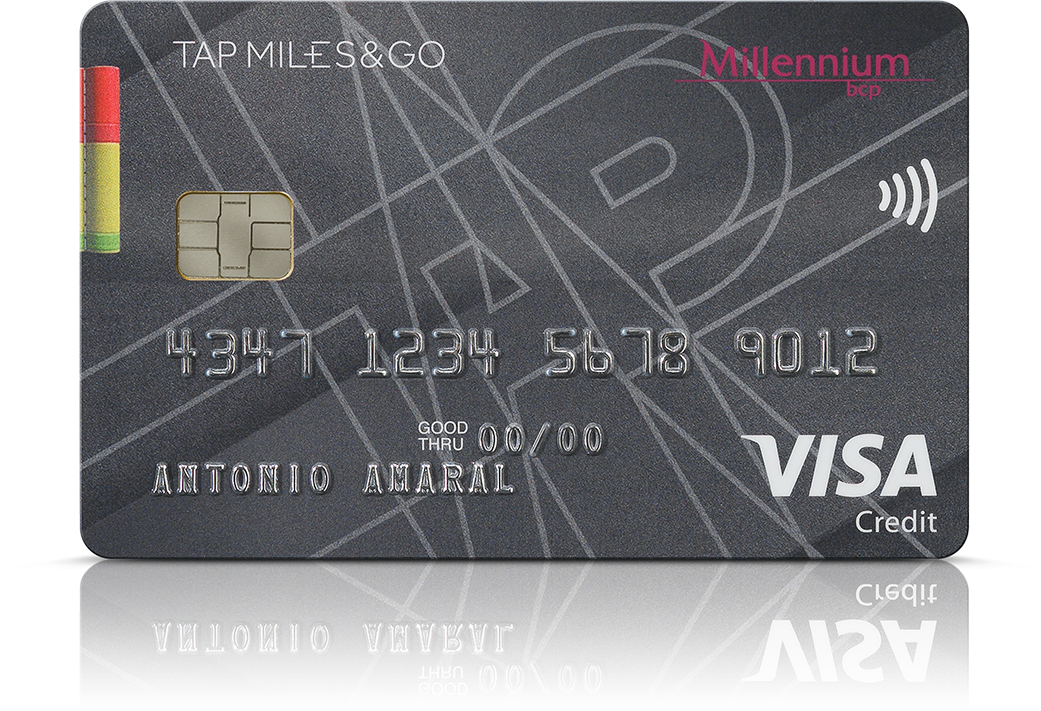

TAP Classic or TAP Platinum card: which is best?

Whether it's the TAP Classic or TAP Platinum card, both have advantages for those who like to travel, such as a miles program and insurance. Compare here and choose what suits you best!

Advertisement

Discover the best card for you among the Platinum options

Firstly, before choosing between the TAP Classic or TAP Platinum Card, consumers should carefully analyze their features and benefits. The financial institution is the same, but the consumption profile is different.

Generally speaking, the TAP Classic credit card charges an annual fee of €40.00 from cardholders. In addition, an additional stamp tax fee APR 15.6% is added. Even so, holders have payment flexibility.

On the other hand, the TAP Platinum credit card, even if issued by the same financial institution, has more advantages. However, to access all these possibilities, a fee of €300.00 is charged.

Before requesting one of the financial products, consumers should analyze its characteristics, advantages and disadvantages. Check out a comparative table below for the TAP Classic or TAP Platinum Card.

How to apply for the TAP Platinum card

TAP Platinum is a credit card full of advantages, such as a Visa brand and a miles program. See how to apply for the TAP Platinum card!

How to request the TAP Classic card

Do you want to apply for the TAP Classic card and obtain a series of travel benefits? So, check out the step-by-step guide to do it!

| TAP Classic | TAP Platinum | |

| Annuity | 40,00 € | 300,00 € |

| Do you accept denial? | Uninformed | Uninformed |

| Flag | Visa | Visa |

| Roof | International | International |

| Benefits | Miles Program; Insurance and Assistance; Payment flexibility. | Miles Program; Extra Baggage; Avoid queues at check-in; Insurance and Assistance; Payment flexibility. |

TAP Platinum Card

Before choosing between the TAP Classic or TAP Platinum Card, consumers should compare the general aspects of the financial products. After all, even if they are issued by the same financial institution, their characteristics are different.

In general terms, the card is issued under the Visa brand, accepted in national and international establishments. However, to access all exclusive benefits, you must pay an annual fee of €300.00.

If approved to obtain the TAP Platinum credit card, cardholders obtain a series of exclusive advantages, including: miles program, flexible payment and access to insurance and assistance.

Holders of this product get 2.00 miles for every €1 spent with their credit card. In other words, when you accumulate the necessary miles, you can exchange them for airline tickets that interest you.

TAP Classic Card

It is necessary to compare the TAP Classic or TAP Platinum Card options before submitting the request form.

One of the main differences of the TAP Classic credit card is, without a doubt, the annual fee. After all, to access all the exclusive benefits of this product, a fee of €40.00 will be charged.

This model is also issued under the Visa brand, in addition to having benefits linked to the brand itself and the credit card. Furthermore, the product has international coverage, accepted in national and international establishments.

All transactions carried out with this credit card also accumulate miles. In other words, for every €1 spent using this payment method, 1.00 miles are accumulated. At the end of the score, it is possible to exchange for airline tickets.

TAP Platinum Card Advantages

Firstly, before choosing between the TAP Classic or TAP Platinum Card, consumers should research all the features and advantages of the models. And, once you discover this information, the next step is to compare the modalities. So see the benefits below.

- Miles can be exchanged for airline tickets.

- For every €1 spent with your credit card, 2.00 miles are accumulated.

- Exclusive offer of 8,000 miles with the financial product subscription.

- When renewing the financial product, you have an additional 4,000 miles.

- Partial payment with 15.6% APR.

Furthermore, when issuing the TAP Platinum credit card, cardholders have access to the following advantages: extra baggage, the possibility of avoiding queues at check-in, saving time with the Fast Track and relaxing in the VIP Lounges.

TAP Classic Card Advantages

However, unlike the previous modality, there are some differences in each option. In this sense, check out the main benefits below.

- Miles can be exchanged for airline tickets.

- For every €1 spent with your credit card, 1.00 miles are accumulated.

- Exclusive offer of 1,000 miles with the subscription to this financial product.

- When renewing your credit card, you earn an additional 1,000 miles.

Furthermore, to access all these exclusive benefits, consumers do not need to change banks. To do this, simply indicate the IBAN of a bank account you hold so that the association can be made.

Disadvantages of the TAP Platinum Card

So, now that you know the main advantages of both models, the next step is to discover their disadvantages. After all, just like any financial product, these characteristics make all the difference.

In short, to access the TAP Platinum credit card, consumers must pay an annual fee of €300.00.

Disadvantages of the TAP Classic Card

Just like any financial product, the TAP Classic credit card has membership disadvantages. Knowing these characteristics is essential, as they make a total difference in any financial product.

In short, to access the TAP Classic credit card, consumers must pay an annual fee of €40.00. In other words, this is the main disadvantage of the model.

TAP Classic or TAP Platinum card: which one to choose?

Now that you know the main characteristics, advantages and disadvantages of financial products, the next step is to compare the options and choose the one that best meets your needs.

Finally, before choosing between the TAP Classic or TAP Platinum Card, remember to check the membership terms. And once you verify this information, filling out the request form becomes easy.

Finally, now that you know the TAP, Classic and Platinum card options, how about finding out about another Platinum card? Then see the Bankinter Platinum credit card below!

How to apply for the Bankinter Platinum credit card

The Bankinter Platinum credit card is an excellent option for those looking for benefits when using credit, it has international coverage, as well as other advantages. See how to request!

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

Recommender Senhor Cartão – SKY AIRLINE in Chile!

With Sky Airlines in Chile you can find tickets with a discount of up to 60% on the airline's website and enjoy great benefits!

Keep Reading

How do I apply for Financial Liberty Credit?

Needing money? So see how to do it, online, without leaving home. Learn how to take out Financial Liberty Credit!

Keep Reading

Credit card for foreigners: how to get one?

Did you know that it is possible to obtain a credit card as a foreigner in Portugal? You just need to choose the best banking option for you!

Keep ReadingYou may also like

Bankinter Power or Bankinter Premier card: which is best?

In doubt between Bankinter Power or Bankinter Premier? So find out all about its advantages, such as contactless technology and Visa!

Keep Reading

How do I apply for the Millenium BCP Platinum card?

Want to know how to apply for the Milenium BCP Platinum Visa card with special conditions, click here and find out! Don't miss the opportunity!

Keep Reading

N26 Portugal: Discover the benefits of being a digital bank customer

Banco N26 has been operating in Portugal since 2016 and offers a free account to make your transactions simple and worry-free!

Keep Reading