Credit

How do I apply for Financial Liberty Credit?

Applying for Financial Liberty Credit is very easy! Keep reading and learn the step by step for this. This way, you can combine several debts into one with lower interest and payments!

Advertisement

Financial Liberty credit: simulate and contract without leaving home

When you take out Financial Liberty Credit you access a service that will help you have extra money and reduce your expenses. So find out more!

Step by step to apply for Financial Liberty Credit

Finally, Credit Financial Liberty is of the consolidated type. Therefore, your contract depends on two or more debts from previous loans.

Request online

First, to do this, go to the Financial Liberty website. Then, click on “Services” > “Consolidated Credit”. See the details and click on the option to simulate.

Then, fill in the data regarding the total outstanding debts, whether or not there are delays in installments and other required information. Then send the form and wait for a simulation. Finally, next, gather the documentation required by Financial Liberty.

Therefore, its professionals will analyze your request and bring together the available alternatives. When choosing, in fact, you also receive assistance from them regarding the best alternative. Finally, choose the bank, follow Liberty's instructions and obtain credit approval. So, with that, save and have extra money!

Request via the app

However, there is no option to contract Financial Liberty Credit via application. Therefore, you must use the website by accessing it from your computer or cell phone and following the steps listed above!

Recommended alternative: Mr Finan Consolidated

Finally, Crédito Financial Liberty is not the only consolidated type on the market. In this sense, another alternative is Mr Finan, which also helps you concentrate debt and obtain better interest rates. So see their comparison in the table below and then click on the link to learn more about this other alternative!

| Financial Liberty | Mr Finan | |

| Interest rate | Uninformed | Depends on credit |

| Payment deadline | Up to 7 years | Between 24 and 84 months |

| Approval | Online | Online |

| Benefits | Credit risk analysis; extra money; monitoring the request by trained professionals; legal support after taking out credit; online simulation. | Online hiring; Concentrate your debts in a single installment, saving up to 60%; Organize your finances and save money in the budget; Increase your purchasing power; Simplify your payments. |

Finally, check out the following article to learn more about MrFinan.

How to apply for MrFinan personal credit?

MrFinan personal credit can be perfect for those looking for a loan to cover other debts and organize their financial life. See how to request here!

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

Get to know the Bitcoin.com brokerage: what is it and how does it work?

Get to know the Bitcoin.com broker and how it works. Buy, sell and trade Bitcoin, Bitcoin Cash, Ethereum and selected cryptocurrencies.

Keep Reading

Banco Bankinter Review: get to know the institution and what it offers!

Access this review of Banco Bankinter and get to know this institution that offers options for accounts, cards, insurance and investments!

Keep Reading

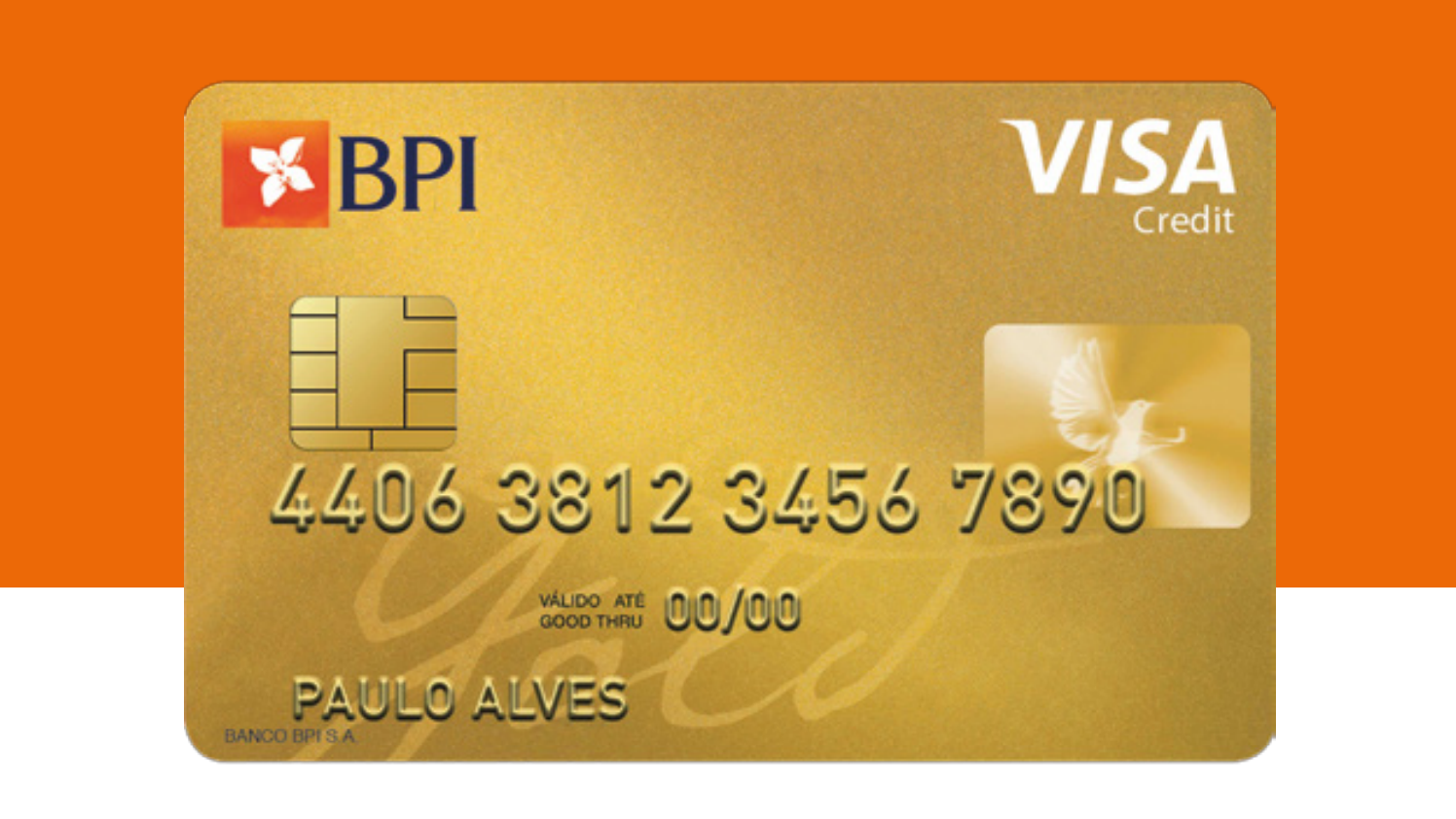

How to request and activate the BPI Gold credit card?

See how to request and activate BPI Gold, the premium card that brings advantages such as exclusive assistance and international coverage!

Keep ReadingYou may also like

How to subscribe: Support Gas 2022 Program?

Do you want to know how to subscribe to the 2022 Support Natural Gas Program? Your company can participate through Balcão dos Fundos.

Keep Reading

Discover the Stream prepaid card

The Stream prepaid card is suitable for young people up to 20 years of age and has exclusive benefits, such as a Visa card. Find out more!

Keep Reading

Discover the Banco Best account and its benefits!

Looking for a bank account alternative? Find out everything about the Banco Best account and take advantage of the miles program, online membership and more!

Keep Reading