Cards

N26 Metal or N26 card: which is better?

Whether the N26 Metal or N26 card, both have international coverage and the Mastercard brand. So, compare their similarities and differences and choose the best option for your financial life!

Advertisement

Discover the best card for you

Choosing a credit card is not always simple. And staying between N26 Metal or N26 is natural, especially for customers of the German fintech that operates throughout Europe.

After all, it is common for companies to have more than one type of card. Each of them, then, differs in terms of the audience they target. Likewise, in relation to the advantages and disadvantages, as well as the differences.

And all of this must always be taken into consideration. Otherwise, it is possible that the choice will not be the right one and, as a result, you will incur a lot of unnecessary headaches. Also, be sure to consider that your choice will have an impact on your pocket.

This impact occurs due to the fact that there may be an annual fee charged for the card's additional benefits, which you access without paying more for it. Did you find it complicated? Well, don't worry! Below you will find all the information to choose between the N26 Metal or N26 card assertively and consciously.

How to apply for N26 debit card

The N26 card has international coverage, Mastercard brand and has a free annual fee. See how to request yours!

How to apply for the N26 Metal credit card

The N26 Metal credit card is an excellent option for those looking for different options, with insurance and international coverage. See how to request yours!

| N26 Metal | N26 | |

| Annuity | €16.90 per month | Free |

| Do you accept denial? | Uninformed | Uninformed |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Travel insurance (life, loss or loss of luggage, ticket cancellation, car rental, medical coverage), classification of account amounts in up to 10 subaccounts, online membership, cell phone insurance, worldwide withdrawals, transfers unlimited and only charged exchange rates. | Online request, purchases in other European countries, application to track expenses and purchases, customization of card color, free annual fee |

N26 Card

The N26 card is a very simple card. Firstly, it is worth highlighting that it is not credit. That is, it only allows purchases by debit and cash. To do this, it relates to a digital account in which you can manage your money, make transfers and payments.

The card has the International Mastercard brand. Therefore, even if it is not credit, it allows use in different places around the world.

N26 Metal Card

On the other hand, we have the N26 Metal card, which is a superior version of the alternative seen before. Despite this, there is no granting of credit here either. In other words, this card is also limited to debit and purchases in cash and in single installments.

Again, then, the card is related to a digital account, in which you can manage your money, transfer it and use it in different ways. What does not exist, then, is the possibility of purchasing on credit and in installments.

In both cases, however, it is possible to request credit in the future. This will depend on the credit analysis and your behavior as a consumer and fintech customer. Therefore, there is no guarantee of release.

N26 Card Advantages

It is impossible to choose between the N26 Metal or N26 card without first knowing the positive points of each of them. Let's start, then, with N26, the simplest, but full of its own benefits. Check out:

- Online membership;

- Application to track your expenses, balance and transactions;

- Mastercard flag;

- Create tags (sessions and markers) to classify your most common expenses and thus help with financial organization;

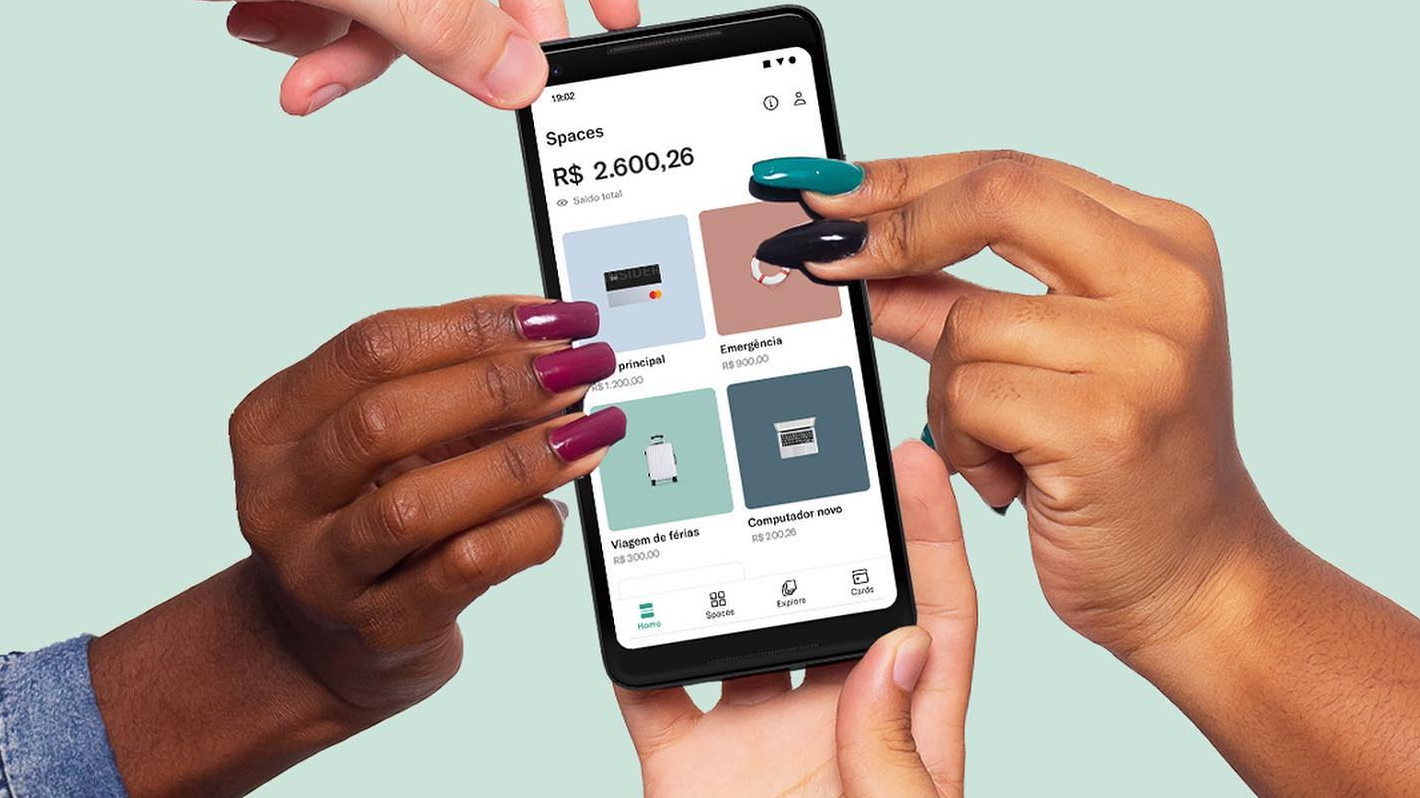

- Space function, which allows you to create profiles (for different people in the family) within the same account to manage your money;

- International use;

- Personalize your card by choosing the color you want;

- Possibility of contracting additional services, such as credit card (depends on credit analysis and annual fee payment);

- No annual fee.

Advantages N26 Metal Card

Just like the N26 card, the N26 Metal also has its benefits that should be included in your analysis before making a definitive choice. Therefore, learn about the advantages of this alternative and see whether or not it is perfect for you:

- Online membership;

- Application to track expenses, balance, limits and transactions;

- Mastercard International Flag;

- Emergency medical coverage that covers you, your spouse, and your children (which also includes dental insurance and winter sports insurance;

- Insurance against flight delays and baggage coverage or lost luggage and Travel Cost Reduction Insurance or cancellation insurance;

- Insurance for bicycle, scooter and car sharing and car rental on trips;

- And cell phone insurance against theft, theft and loss;

- Open up to 10 subaccounts to organize your money;

- Withdrawals of up to 2.5 thousand Euros per day and up to 20 thousand Euros monthly;

- Unlimited transfers and only exchange rate charges.

Disadvantages N26 Card

Furthermore, the comparison between the N26 Metal or N26 card requires analyzing the negative points of each of them. First, then, look at the bad or not-so-attractive points of the N26:

- Annual fee collection;

- Debit card only offer;

- Exclusive for those who reside in Europe or have European citizenship;

- Waiting line to open an account to obtain a card.

Disadvantages N26 Metal Card

The negative points of the N26 Metal card are the same as those of the N26. Therefore, they correspond to the following questions:

- Exclusive for those who reside in Europe or have European citizenship;

- Collection of annual fees

- Release of debit cards only;

- Waiting line to open an account to obtain a card.

N26 Metal or N26 card: which one to choose?

Well, now you've seen everything about these two cards that belong to N26. But then, which one to choose? In this case, consider the points that are most important to you. For example, would you rather have access to insurance or get rid of annual fees?

Likewise, think about questions about what benefits you are looking for in a card. But if you're still not sure of the best option for you, how about finding out about another incredible card available on the market? Check out more information about the EuroBic Soft card below!

How to apply for the Eurobic Soft credit card

The EuroBic Soft credit card is perfect for those looking for convenience and don't want to pay high fees for it. See here how to request yours!

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

TAP Classic or TAP Business card: which is best?

Whether it's the TAP Classic or TAP Business card, both offer travel benefits and international coverage. Compare and choose yours!

Keep Reading

My Nickel debit card: how does it work?

Do you want to know how the My Nickel Card works? Have a personalized name card with exclusive benefits and advantages!

Keep Reading

N26 accounts in Portugal: what are they and how to join?

N26 accounts in Portugal are diverse and each of them has its own benefits. Discover them now and find out the advantages they offer!

Keep ReadingYou may also like

Discover Oanda Brokerage: more than 70 currencies and several deposit options

The Oanda broker offers more than 70 currency possibilities and several deposit options for you to choose from in transactions.

Keep Reading

Discover Agricultural Credit: invest in your projects in different ways!

Discover Crédito Agrícola and its services and projects. So, see how to get financing to invest and get your dreams off the ground.

Keep Reading

How to work at McDonald's: take advantage of updated salaries!

Working at McDonald's can be a great experience for you! Vacancies range from attendant to manager and salaries rose by 7% in 2023!

Keep Reading