Cards

Best Mastercard cards in Portugal

Choosing a card can be difficult! What advantages and fees to take into consideration? See the best Mastercard cards in Portugal!

Advertisement

Discover the best Mastercard card options: unique advantages!

There are several Mastercard card options available on the market, but which are the best in Portugal?

What are the advantages, discounts, benefits? Therefore, it is important that you know everything about a card before making a request.

Revolut Standart or Revolut Metal card: which is best?

Revolut Standard or Revolut Metal card? Both offer exclusive benefits for those looking for a quality financial product, such as international coverage, cash back and more.

Continue reading this post to discover a special selection with 8 card options for you to choose the most advantageous!

Furthermore, you will also know the best way to choose the right Mastercard for you and what to take into consideration!

What to consider with your Mastercard card?

Firstly, you need to know that each card is intended for a different profile. So, it's important to know which one is yours.

Additionally, you need to take into account some factors such as Charges, Coverage and Benefits. Shall we check it out?

Charges

The most important thing here is to know what fees the card charges you. For example, is there an annual fee for this card? Also, do you pay to apply for it? What is the APR percentage?

So, keep an eye on all possible charges on your card so that you don't end up spending more than you can on maintenance! But rest assured, there are cards with very low fees!

Roof

Are you going to travel or do you like to shop virtually in other countries? Pay attention to whether the card only serves the national market, or also works in other countries.

You may end up in shock when you need to use your card in an international situation! So, check it out properly.

Benefits

What advantages does this card offer? Why does he stand out from the others? So, does it offer any kind of cashback, discounts or promotions? Is there any different technology?

Pay attention to this point, as this is where most of the differences between the cards lie!

Discover the Finance Portal: see how it works, main services and how to use it

The Finance Portal is a website that belongs to the Portuguese Tax and Customs Authority. Therefore, it is possible to find financial and tax information and services there.

What are the best Mastercard Cards in Portugal?

Now that you know what to focus on, let's take a look at the list we've put together exclusively for you! After all, what are the best cards in Portugal with the Mastercard brand?

CTT

This CTT bank card is one of the best Mastercards available. Therefore, it does not charge any annual fee and its APR is 16.0%.

Know that this is an international credit card that works very well for everyday use.

In this way, it offers a cashback program of 4% in supermarkets, restaurants, food delivery apps and in official CTT stores.

Furthermore, the card offers security, transfer and payment splitting options. It's an interesting option!

How to request the CTT card?

Request your new CTT card today, full of benefits and without charging an annual fee. Earn money on your expenses and also have a complete digital account!

Santander Totta Mundo 123

This credit card from Santander bank has free annual fees for the first 3 months only. To request it you need to open an account, but the APR is only 13.4%.

In addition, it offers international coverage and several discounts. For example, you earn one mile per euro spent!

You can also have insurance on your card. Other advantages are discounts at gas stations, refunds on purchases and contactless payment, for example. Furthermore, you can have a limit of up to 10,000 euros.

How do I apply for the Santander Totta Mundo 123 credit card?

Learn today how to apply for the Santander Totta Mundo 123 card. This way, you can count on a series of benefits, such as the Mastercard brand and discounts from partners!

Cetelem Black Plus

This credit card from Cetelem bank has an APR OF 16% and there is no annual fee! It is a great option among Mastercard cards in Portugal.

Furthermore, with this international card you have access to the 3D Secure security service.

Another interesting advantage is the possibility of making your invoice payments more flexible. Therefore, the minimum value is 3% of the total value. Furthermore, the card offers an interesting cashback program.

Thus, you receive 3% from your purchases in restaurants, gas stations and supermarkets. It's an incredible opportunity!

How to apply for the Cetelem Black Plus credit card?

Requesting the Cetelem Black Plus card is a simple, fast and secure procedure. So, see how to order yours and enjoy its exclusive benefits, such as Mastercard and cashback!

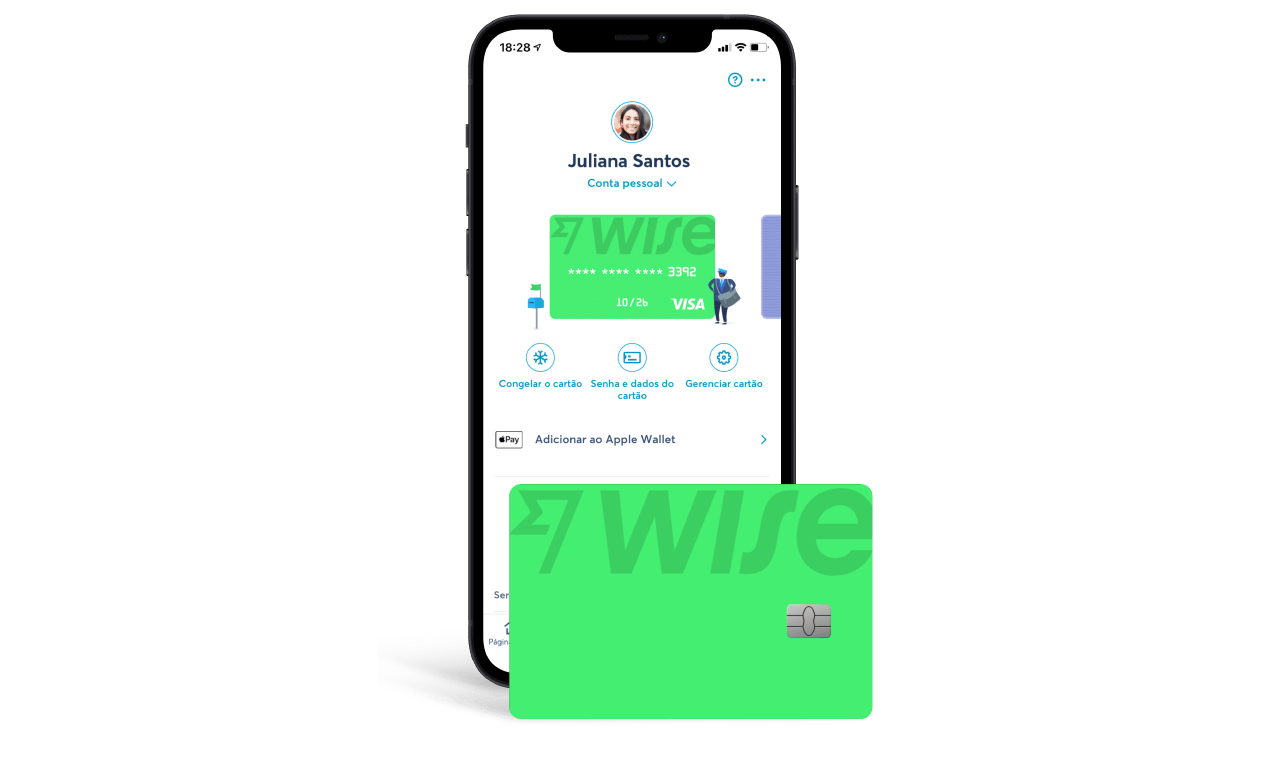

Wise

The Wise debit card offers several possibilities for you. With the Mastercard brand and no annual fee, it offers international use! Furthermore, this is the ideal card for relationships between countries.

For example, if you receive payments abroad or in another currency. This is because it has several advantages. Such as reduced exchange and conversion fees.

Furthermore, you don't pay maintenance fees and can move your money between 50 different currencies. Therefore, this card is ideal for you to travel abroad.

Despite this, a disadvantage is that it only works for the United States, New Zealand, Australia, the European Union and Canada.

How to request the Wise card?

Requesting the Wise card is very easy. After all, it happens online and quickly, without any type of complications. Learn, step by step, how to do it today and enjoy a card with no annual fee!

Miles & More Classic

Now, if you want to acquire miles, one of the best Mastercard cards in Portugal is the Miles & More Classic!

All purchases made generate a return of miles for you to enjoy and travel. Plus, you already receive 2,000 points for your first membership!

This card has an APR of 15.9% and is for international use. And, in addition, it offers discounts at partner stores.

On the other hand, the annual fee is a little expensive, at 25 euros. But, if you spend a lot on the card and use your miles, the value can make up for it.

How do I apply for the Miles & More Classic credit card?

If you are looking for a financial product full of advantages, see here how to order the Miles & More Classic card! With it, you can enjoy incredible benefits, such as a miles program and Mastercard brand!

Openbank R42 Metal

This debit card offers great advantages, especially for those who want to travel.

Despite charging an annual fee of €13.99, this Mastercard has a large system of partnerships and discounts. Like AVIS, SKYCenter and Booking.com, for example.

In addition, you are entitled to a unique concierge service that helps you plan and organize your trip. This service ranges from creating itineraries and purchasing tickets.

Furthermore, if you lose any luggage or your flight, the card is insured to give you peace of mind.

Although it costs a little more, the benefits of traveling with peace of mind can be worth it.

How to order the R42 Metal debit card?

Learn today how to order the R42 Metal card. So, see how to guarantee all the benefits of the financial product, such as payment by contact, online membership and special services to help you when traveling!

Revolut Metal

Our last option is from Revolut bank, which offers the Mastercard Metal card! This is a card of the same level as the previous one.

It charges an annual fee of €13.99 per month, but offers cashback for more than 30 currencies, including cryptocurrencies.

In fact, it has several advantages in travel situations, such as using a VIP lounge for customers in airport lounges.

In addition, it has travel, baggage and flight delay insurance. Furthermore, it offers up to 10% cashback on accommodation reservations around the world. These are wonderful benefits!

How to apply for the Revolut Metal card?

The Revolut Metal card offers free health and travel insurance, as well as cashback and other benefits. Then learn how to do it in just a few steps without leaving home.

Other tips

Now that you know the advantages of the best Mastercard cards in Portugal, how about seeing tips on the best consolidated credits? So click on the link below and discover everything about this topic!

Best consolidated credits approved instantly: see!

Do you want to know which are the best consolidated credits with instant approval? So you are in the right place! Check out safe alternatives on the market!

About the author / Filipe Travanca

Reviewed by /

Senior Editor

Trending Topics

MaxMat Recruitment: how to work at the company?

MaxMat recruitment seeks proactive employees, with the ability to work under pressure and carry out services efficiently!

Keep Reading

Discover all the types of Agricultural Credit!

There are more than 10 types of credit available at Crédito Agrícola! Discover and choose the one that suits your reality!

Keep Reading

Download the EuroBic Net app: Simplify your financial life!

The EuroBic Net app offers resources for customers to facilitate their transactions. So, make transfers, check statements and more!

Keep ReadingYou may also like

How to sign up for the Nickel Classic card: agents across the country!

You can sign up for the Nickel Classic debit card by going to various locations across the country. Discover all the information now!

Keep Reading

How to choose between government aid?

How to choose which government aid is ideal for your situation? Access now, discover the options and learn how to apply!

Keep Reading

How to get the Abanca Gold card?

To apply for an Abanca Gold credit card, simply access the official website and fill out the proposal! Following the instructions. Look here!

Keep Reading