Cards

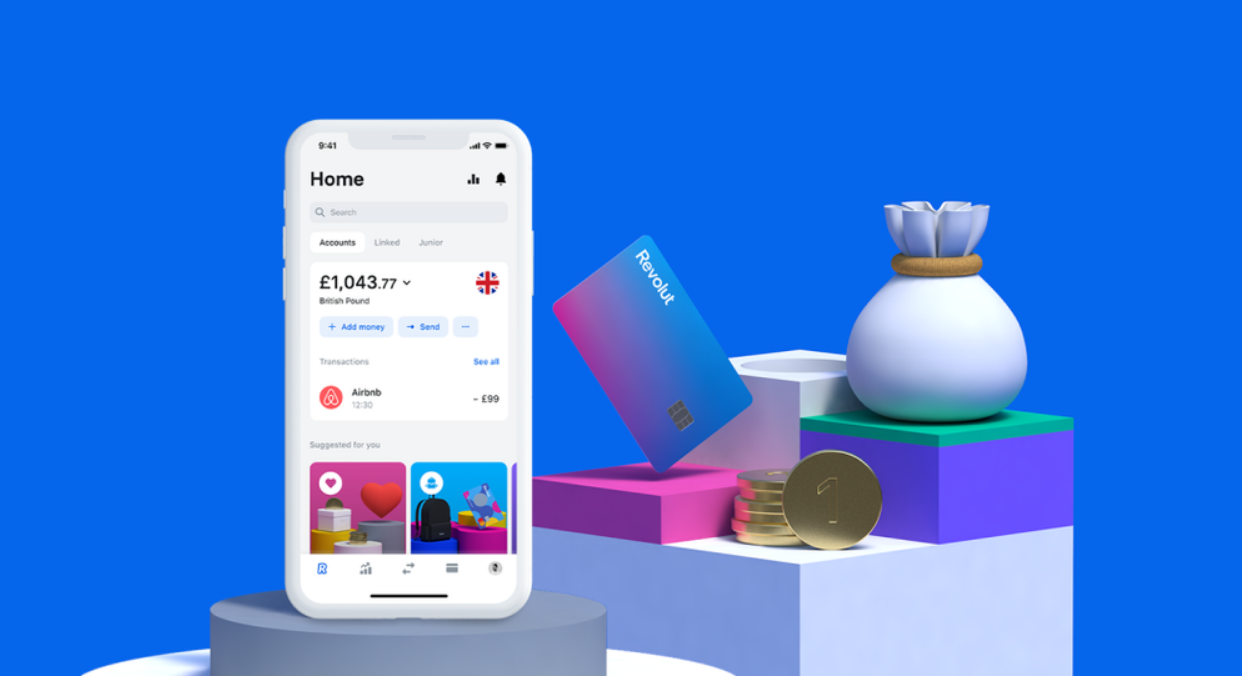

Revolut Standart or Revolut Metal card: which is best?

Revolut Standard or Revolut Metal card? Both offer exclusive benefits for those looking for a quality financial product, such as international coverage, cash back and more. See their differences and choose your favorite!

Advertisement

Discover the best card for you among these Revolut options

Choosing a credit card is a complicated task, but not impossible. Just like any financial product, the Revolut Standart or Revolut Metal Card has different characteristics and advantages, even if they are issued by the same institution.

So, to have access to the best payment method, it is important to compare the versions and choose the one that best meets your needs. And, for this to be done, it is important to discover the main details of these financial products.

Although they are issued by the same financial institution, each one serves a different consumer profile. In other words, even though they are great allies for your daily purchases, the models meet different economic profiles.

The first step in choosing between a Revolut Standart or Revolut Metal Card is to compare the versions. So, if you are looking for a credit card that meets your needs, see a comparison table.

How do I apply for the Revolut Standard card?

Requesting the Revolut Standard card is very simple and practical. See here how to order it without any worries and take advantage of its advantages, such as international coverage and an app to track your finances!

Revolut Metal Credit Card

The Revolut Metal credit card has numerous benefits, has the two main brands in the world (Visa and Mastercard), in addition to having a Cashback program! See how to request here.

| Revolut Standard | Revolut Metal | |

| Annuity | Exempt | €13.99 per month |

| Do you accept denial? | Uninformed | Uninformed |

| Flag | Visa | MasterCard |

| Roof | International | International |

| Benefits | Online application process and immediate approval | Cashback Program (money back) |

Revolut Metal Card

To choose between the Revolut Standart or Revolut Metal Card, the first step is to find out the general information about the versions. After all, even if they are financial products from the same company, their characteristics are different.

The Revolut Metal card is a robust version. In other words, to have access to this financial product, it is necessary to meet some requirements. Issued under the Mastercard brand, payments can be made at national and international establishments.

However, for purchases to be made, it is essential that the establishment is accredited with the brand. It is worth mentioning that all your purchases are converted into cash back through the Cashback Program.

However, this is not the only advantage of the model. To have access to this product, it is important to have all the knowledge about it, especially to find out if it meets your consumption profile.

Revolut Standard Card

Just like the previous model, it is important to find out general product information to make the best choice. Ultimately, when choosing between the Revolut Standart or Revolut Metal Card, knowing the details makes all the difference.

Unlike the previous model, this is a simpler version proposed by the financial institution. Issued under the Visa brand, the Revolut Standart card is accepted in national and international establishments, as long as they are accredited.

One of the biggest advantages of the model is, without a doubt, the exemption from paying the annual fee. Furthermore, the entire application process is done online, with immediate pre-approval!

All these features make this model the best choice for those who want something simple but meets their needs. It is worth mentioning that the TAN and APR rate is 0.00%.

Revolut Metal Card Advantages

To make the best choice between a Revolut Standart or Revolut Metal Card, consumers must know all the characteristics of the products. And one of the most relevant information is its advantages.

- Access to a free UK digital account;

- Medical insurance abroad;

- Luggage insurance and delayed flights;

- Virtual cards are disposable, providing more security in your purchases;

- Access to LoungeKey Pass;

- Cashback Program (money back);

- Access to concierge service.

Revolut Standart Card Advantages

As previously mentioned, to make the best choice between the Revolut Standart or Revolut Metal Card, it is important to compare the versions. After all, even if they are from the same institution, their characteristics and advantages are different. Look.

- Access to a free UK digital account;

- Possibility to make purchases in national and international establishments;

- The application process is done entirely online;

- Exemption from annual fees;

- Free IBAN in euros.

Disadvantages Revolut Metal Card

However, like any financial product, the Revolut Metal card has disadvantages. Knowing this information is important, especially to make the best choice.

In a general scenario, one of the main disadvantages is the annual fee payment. In other words, to access all the exclusive benefits of the product, holders pay a fee of €13.99 per month.

Furthermore, for the physical card to be sent to your home, a fee will be charged. This is without counting transfers during weekends, a service for which holders must pay.

Disadvantages Revolut Standart Card

Just like the advantages, knowing the disadvantages of cards is important. After all, to choose between the Revolut Standart or Revolut Metal Card, every smallest detail is relevant.

Although it is a card that does not charge cardholders any annual fees, there are some disadvantages compared to the previous model. After all, unlike Metal, Standart doesn't have many exclusive advantages.

However, if you are looking for a basic product, it will meet all your needs. And, just like the previous one, you must pay a fee for shipping the physical model to your home.

Revolut Standard card or Revolut Metal card: which one to choose?

Now that you know all the features and advantages of the Revolut Standart or Revolut Metal Card, it's time to compare the versions and choose the one that best meets your needs.

After all, as mentioned, even if they are issued by the same financial institution, their characteristics and benefits are different. Comparing all this information is important to make the best choice.

In general, the Metal model is recommended for consumers looking for more benefits in their daily purchases. In other words, it serves a specific type of consumer, especially those who like to travel.

On the other hand, even though its advantages are minor, the Standart model is ideal for those looking for a good ally in their routine purchases. With an entirely online application, the approval process is immediate in this case.

Therefore, to make the best choice, remember to compare the versions and choose the one that meets your consumption profile. This is the best way to avoid any problems related to this in the future. However, if you are looking for another card option, check out the BPI card.

BPI Credit Card

The BPI credit card uses contactless technology, its operating brand is Visa, which allows the use of the exclusive points program. In addition to free annual fees and discounts from various partners! See how to request here.

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

Disney Plus: watch series, films and documentaries in one place

Find out what Disney Plus is, if it's worth it and what you can find when you join this service full of series, films and documentaries.

Keep Reading

e-Residency program: virtual citizenship in Estonia to undertake!

The e-Residency is a virtual Estonian citizenship for those who want to undertake. So, create your foreign company and make your idea grow!

Keep Reading

How to request and activate the Bankinter Premier credit card?

See how to request and activate the Bankinter Premier card and enjoy incredible benefits, such as international Visa and travel insurance!

Keep ReadingYou may also like

How to apply for Family Allowance 2022?

Find out how to apply for Family Allowance to get financial help and maintain the education and well-being of your children and children.

Keep Reading

How do I apply for the Unibanco Classic credit card?

See step by step how to apply for the Unibanco Classic credit card, a card that has a free annual fee and numerous benefits!

Keep Reading

Discover Creditas personal credit!

Creditas personal credit can be a great option for those who need money and are looking for low interest rates. Find out more about him!

Keep Reading