Credit

Best consolidated credits approved instantly: see!

Do you want to know which are the best consolidated credits with instant approval? So you are in the right place! Check out safe alternatives on the market!

Advertisement

We help you choose the best consolidated credits with instant approval

By counting on the best consolidated credits with instant approval, you can find quality financial solutions. Check out what they are!

How do I apply for Reorganiza credit?

Check out how to take out Reorganiza credit to consolidate your debts and make the most of your money.

What are instantly approved consolidated credits?

Credit consolidation refers to the possibility of combining more than one credit debt into the same installment.

Consider, for example, that you have a personal loan, a housing loan and a car loan open. With consolidation, everyone is charged in a single installment.

But what are the advantages of this? With consolidation, you stop paying different fees and credit rates and transform them into one.

Therefore, there are fewer additional charges on credits, allowing monthly savings of up to 60% on the amount previously spent.

This way, you can see money left in your budget without having to pay off existing debts.

With the best credits consolidated instantly, this is an incredible alternative for your finances and for saving.

However, there is a caveat here! When we talk about immediate approval, it refers to responses between 24 and 48 hours after the request.

After all, all banks and financial companies need to carry out an analysis of credit availability according to the customer's profile before granting it.

Therefore, it is not done overnight, but it also does not take long and in a few days it guarantees you the signing of the contract.

What are the best consolidated credits approved instantly?

Now that you know how consolidation works, how about checking out the best options for this operation that are available on the market?!

Keep reading and see some alternatives and details of what each one offers, as well as the benefits that come with them.

Millennium BCP consolidated credit

One of the best and safest alternatives available on the market for those who want to consolidate credits belongs to Millennium BCP.

With a variable payment term, it also offers variable payment options. For example, it is possible to contract between:

- Initial reduction of the installment for 24 months in consolidation or mortgage credit;

- Reduction in the value of the first 12 installments when there is no guarantee.

In other words, this is a consolidated credit that gives the contractor options to reduce the installments by offering real estate as collateral, in the format of a mortgage.

On the other hand, BCP does not provide exact or average payment terms, although mortgage consolidation can last up to 480 months.

Another point is that this option only allows the consolidation of credits contracted with BCP Millennium, so it is more exclusive.

How to request Millennium BCP consolidated credit

To find out how to request Millennium BPC consolidated credit, see below!

Montepio consolidated credit

Continuing with our list of the best consolidated credits with instant approval, we have that from Banco Montepio. It works with a minimum TAN rate of 8.700% and a maximum of 10.300%. On the other hand, the APR varies between 12.9% and 13.0%.

Montepio offers you up to 84 months to pay off the consolidation. It works with fixed rates, so you won't be faced with unpleasant surprises in the future.

Furthermore, the bank does not charge a fee for opening credit, and also offers the possibility of jointly taking out life insurance as a debt guarantor.

How to apply for Montepio Credit?

Check out how to apply for Montepio credit to consolidate your debts and organize your finances.

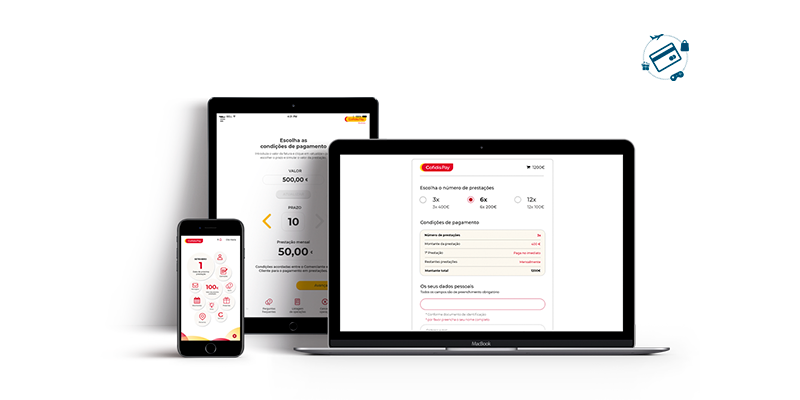

Cofidis consolidated credit

Cofidis bank also has an option that is among the best consolidated credits with instant approval.

It offers a period of between 24 and 84 months to pay off the loan, which can be approved online within 48 hours.

In addition, it works with APR from 9.4% and TAN from 7.95%. Among the advantages of this option are the fixed fees and the absence of an opening commission.

Also, be aware that you can contract an additional credit with the consolidation, paid with the other consolidated installments, which can be deposited in your account for use as you wish.

How to apply for Cofidis Credit?

Find out how to take out Cofidis credit without leaving home and see how you can reorganize your finances in a simple way!

Unibanco consolidated credit

Another option that stands out as one of the best consolidated credits with instant approval is that of Unibanco bank.

It also works with a maximum payment period of 84 months, with the minimum payment period being 2 years.

Its TAN rates start from 9.8%, while the minimum APR is 12.6%. With online hiring, there is no opening commission.

In the same way as Cofidis credit, this option also allows you to contract an additional amount, which will be deposited into your account, and which will be paid off together with the consolidated installments.

Furthermore, it stands out for its flexibility in terms and values, as well as for accepting credits and customers from any financial institution.

How to apply for Unibanco Credit?

Check out how to take out Unibanco credit to consolidate your debts and make the most of your money!

Cetelem consolidated credit

Cetelem bank also offers good options for instantly consolidated credit. With a term of up to 84 months, approval is immediate and online.

The TAN is one of the most attractive on the market, as it starts at 4.95%, while the minimum APR is 7.1%.

The installments are fixed and with equally fixed payment dates. Furthermore, with it you have the opportunity to hire additional value to continue new projects.

How to request Cetelem credit?

Check out how to take out Cetelem credit to balance your financial life and get your projects off the ground!

eLoan consolidated credit

Our list of the best consolidated credits with instant approval belongs to the eLoan financial institution.

Here it is possible to pay for consolidation between 12 and 84 months. Rates are variable, but in general the operation allows savings of up to 60% of the value of the original installments.

Additionally, you can simulate your credit online to know what to expect. Hiring also takes place online.

This consolidated credit has no additional fees and allows, like some of the other options, the contracting of an additional amount for new projects. Find out how to request it below!

How to request eLoan Credit?

Taking out eLoan credit is quite simple. Check out the step by step and rebalance your finances.

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

What is the best Caixa Geral de Depósitos credit card?

International, debit, for students, among others: see them all and find out which is the best Caixa Geral de Depósitos card for you!

Keep Reading

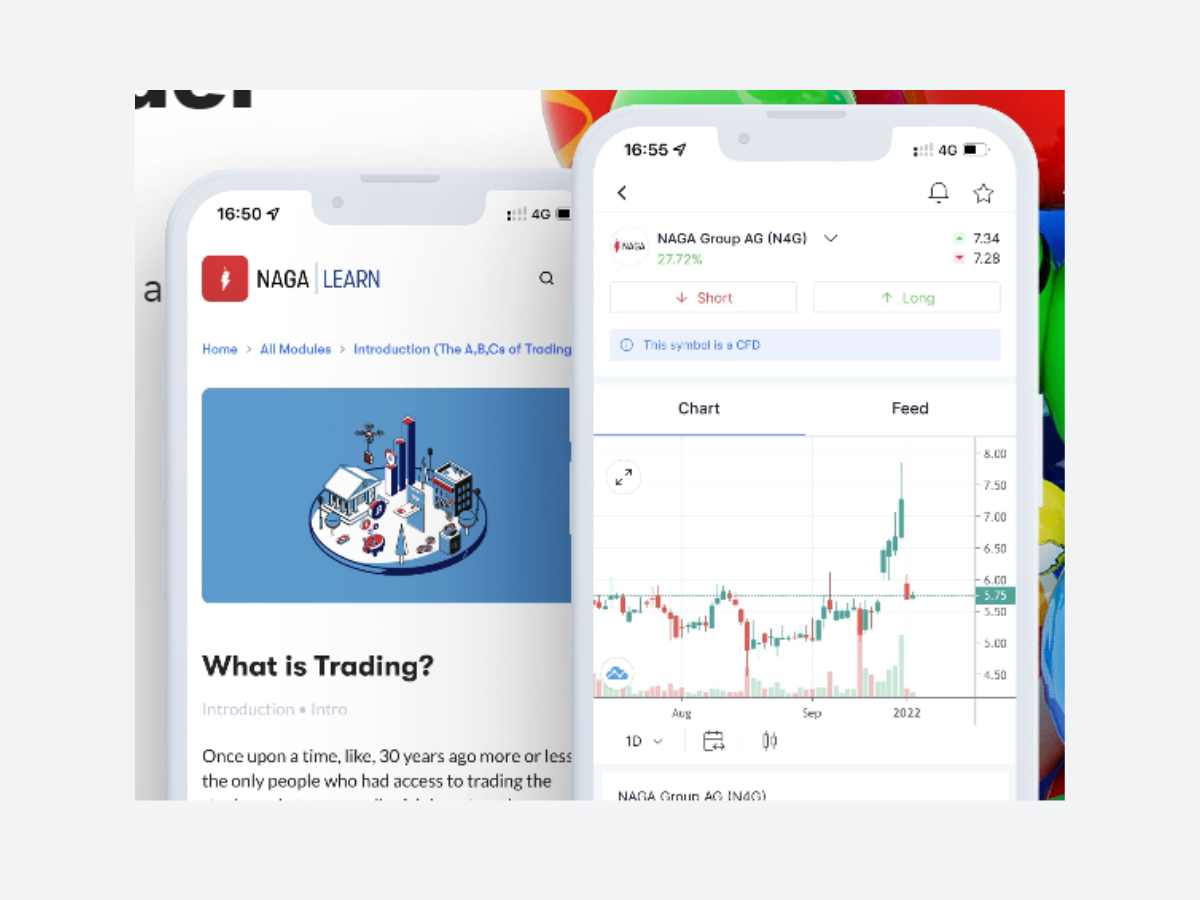

Here's how to trade with Naga: start with 950 instruments!

Understand how to trade with Naga and get a variety of investments in your portfolio: crypto, stocks, commodities and more!

Keep Reading

Paying with bitcoin is now possible: understand!

Did you know that it is possible to make hotel payments with bitcoin? Maximize your investments and see how to pay with bitcoin here!

Keep ReadingYou may also like

Instant credit: understand how it works and requirements to get it

Are you in need of extra money? Then check out how to get credit instantly with fair rates and a response within 48 hours!

Keep Reading

How to open your Santander digital account with Mundo 123?

Discover how to open your Santander account with Mundo 123, which gives you access to exclusive discounts and benefits. Here's the step by step!

Keep Reading

How to open your N26 Metal digital account?

How about opening the N26 Metal digital account, with the right to up to 10 subaccounts and countless other benefits? Learn the step-by-step instructions for joining here.

Keep Reading