Credit

Understand the types of credit: personal, housing, consolidated and automobile

Are you in need of a loan? So it's important to understand what types of credit lines are available. Check out our guide to help figure out which type is best for you!

Advertisement

Discover the main types of credit and decide which is best for you!

Each type of credit has a specific purpose. While some have a commitment to use with value in an end, others dispense with this commitment.

Furthermore, they also differ in terms of the concession rules and their effects. Likewise, with regard to the release value and payment term.

Find out how to get your NISS easily

See the step-by-step guide on how to obtain the NISS in Portugal. After all, the NISS is mandatory and our guide teaches you how to obtain it simply and quickly.

Want to know more about this subject? So, keep reading and learn about the four types of credits. Furthermore, clear all your doubts about each of them. Good reading!

Types of credit: personal credit

One of the main types of credit is personal. It differentiates itself by not being committed to the use of money. In fact, this is the perfect type of credit for those who have several dreams to put into practice.

Do you want to travel, take a course or make your financial life more relaxed? Then this could be the perfect loan format for you. The money is deposited directly into your account and you can then use it however you want.

Who can apply for a personal loan? What are the values and deadlines?

Anyone who is not on the Banco de Portugal blacklist, who resides in the country and who has verifiable income can apply for this credit, simply pay the monthly installments after the contract.

Additionally, rates and terms vary depending on each loan. While those with a lower value can be paid in 12 months, those with a larger amount offer up to 84 months to pay.

Types of credit: housing credit

Another type of loan available on the market concerns housing credit. As the name already indicates, it has real estate purposes. For example, it could be to purchase property or land.

Likewise, for the renovation of a property, construction or mortgage. In this case, the consumer has a value available, but it must necessarily be used for the declared purpose.

When purchasing property, it is common for the bank to assume the debt with the construction company or developer, while the consumer owes it without seeing the color of the money.

In fact, it is natural for the property to serve as collateral for the financial transaction, which can reduce interest and the effort rate, reducing the spread.

What are the purposes of housing credit?

Check out the main purposes and types of housing credit present on the market:

- Purchase of constructed property;

- Purchase of land;

- Construction or renovation of property.

In the latter case, it is common for the amount to be made available little by little, according to the progress of the work. Furthermore, know that it can be useful for purchasing your first or second property, such as for vacation or rental.

What is the value and term of a housing loan?

As with other types of credit, this varies according to the consumer's conditions, the risk that the bank assumes and the existence of guarantees.

Types of credit: consolidated credit

Continuing with the types of credit available on the market, we have consolidated credit. It works in a very different way, as it allows the consolidation of credits.

That is, the joining of two or more debts from different credits into a single monthly installment. Consider, for example, someone who has outstanding credit card, personal loan and housing payments.

In this case, the consumer assumes three monthly installments. Each of the operations has its own fees and tariffs, which makes them more expensive.

By unifying them all into a single installment, with this type of credit, it is possible to have only one type of rate and tariffs, which leads to savings in monthly expenses to meet expenses.

Who can request consolidated credit?

Only those who have two or more open credits. The following types of operations can be used for consolidation:

- Credit card.

- Personal credit;

- Mortgage loans;

- Car credit and others.

Furthermore, only those who are not registered on the Banco de Portugal blacklist can take out this type of credit. In other words, the installments of the credits to be consolidated must be up to date and not have payment delays.

What is the value and term of a consolidated credit?

Once again, this varies depending on the consumer and the financial institution and the risk it assumes. In general, payment can take up to 84 months.

Types of credit: learn about car credit

The last of the types of credit we list here is automobile, which is also one of the most common on the market and is especially aimed at purchasing or exchanging a car.

Therefore, it has a specific use and is not freely applicable by the consumer. Often, as in the case of housing credit, the amount goes directly to the dealership and the consumer pays the installments to the bank.

In fact, credit is usually guaranteed by the financed car or another asset that the consumer owns, such as a property. This can help limit fees and risk.

Who can apply for a car loan? What is the value and deadline?

People who want to purchase a car and who are not on the Banco de Portugal blacklist can request this credit.

Furthermore, the term and value vary according to the amount of the car desired, the image of the consumer in the market and the risks he or she poses to the bank granting the credit.

Finally, if you would like to know a little more about the Banco de Portugal blacklist, mentioned several times in this article, go below and check out how to get out of it!

Find out if you are on the Banco de Portugal blacklist and how to get out: step by step!

Knowing whether you are on the Banco de Portugal blacklist is essential for everyone who has contracts with financial services. Learn today how to check if you are on the list and how to get off it!

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

How to get the Decathlon card? Look here!

To obtain a Decathlon card, access the official website, fill out the application, and then wait for the credit analysis and guidance!

Keep Reading

How does working at Atacadão Continente work?

Find out how working at Continente wholesale works, the company has more than 30 years of experience and offers more than 40 job vacancies!

Keep Reading

How to sign up for the WiZink Benfica card: check out the step by step!

Quick, easy and safe, see a step-by-step guide on how to sign up for the WiZink Benfica card online or at official points.

Keep ReadingYou may also like

How to mine bitcoin alone and for free? See our step by step!

Mining bitcoin alone is a process that anyone can carry out, as long as the step-by-step instructions are followed. Learn how it works here!

Keep Reading

How to apply for the Electric Mobility Card?

Applying for an electric mobility card in Portugal is simple, just access the MOBI.E website and request the energy company of your choice!

Keep Reading

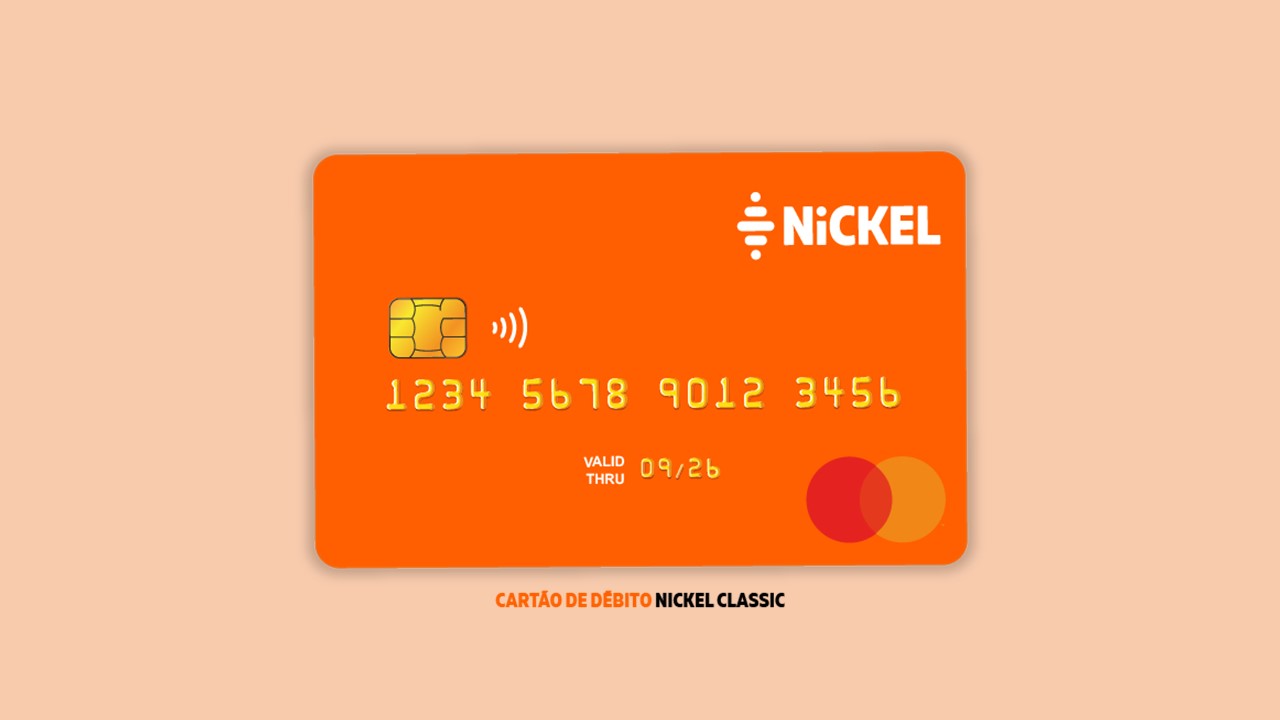

Nickel Classic debit card: how does it work?

Find out how the Nickel Classic debit card works. Click here and discover the advantages and disadvantages of subscribing to this card!

Keep Reading