Dicas

10 dicas para poupar mais no dia a dia

Economizar é um hábito que precisa ser desenvolvido, estimulado e mantido. Então confira nossas dicas para o dia a dia e poupe o máximo de dinheiro possível para você realizar suas metas!

Anúncios

Veja dicas de ações simples que fazem a diferença na hora de poupar dinheiro!

Mas, afinal, o que significa poupar? Poupar faz parte de uma metodologia comportamental. Ou seja, está ligada com o ato de criar um hábito. Por isso, conhecer algumas dicas para poupar mais no dia a dia pode ser fundamental.

Ademais, é importante dizer que poupar não é só guardar dinheiro, é também a redução de gastos e a eliminação de desperdícios! Pois muitas vezes não enxergamos gastos desnecessários e nem agimos para evitar o desperdício.

Como gerenciar as despesas escolares?

A volta às aulas acompanha uma série de contas que podem pesar no orçamento. Veja como gerenciar as despesas escolares e confira dicas práticas!

Desse modo, preparamos uma lista com 10 dicas para você, incluindo ações e novas posturas para cortar gastos supérfluos e criar uma reserva financeira!

Confira 10 dicas para poupar mais no dia a dia!

Antes de irmos às dicas, o ponto mais importante do ato de poupar é você sempre se lembrar que nenhum valor é pequeno demais. Economizar é uma ação a longo prazo, que envolve multiplicação de pequenos valores.

Nesse sentido, o que pode parecer um valor muito pequeno, se torna um montante de grande valor com o passar do tempo, quando junto de outros.

Então, vamos descobrir logo quais são essas dicas e o que fazer para parar de gastar tanto e poupar?

Você será redirecionado a outro site

1. Controle seus gastos

A dica mais importante para começar a poupar é saber onde se gasta. Então anote tudo o que você compra, coloque todas as informações necessárias, se foi no cartão, em dinheiro, qual data e valor.

Você vai se surpreender ao ver o quanto acabamos gastando no final de um dia!

A partir disso, você será capaz de encontrar o que é supérfluo dentro do seu dia a dia e será capaz de cortá-lo do seus gastos e economizar!

2. Planeje seus gastos e pesquise

Seja o que for, não compre sem planejamento! Saiba o que você quer comprar, quanto você quer comprar e quanto você está disposto a pagar! Quanto mais planejado, menor vai ser a chance de desperdiçar seu dinheiro.

Outro benefício que vem com o planejamento é que você consegue fazer pesquisas de preços em diferentes lugares e escolher o menor gasto! Leve tudo em consideração! A pesquisa e o planejamento nunca são demais.

3. Cuidado com saldos

Essa é uma dica que sempre surpreende quem quer poupar. À primeira vista, saldos e promoções podem parecer uma boa oportunidade para economizar dinheiro, não é mesmo? Mas essa não é a verdade!

Muitas vezes, as lojas criam uma situação de pressão para que você compre, dizendo que aquele preço só estará disponível por poucos dias. Entretanto, a questão mais importante é, você precisa daquele produto?

Não é tudo que está em saldo que vale a pena ser comprado. Por isso, só compre o que você realmente quer ou precisa, levando em conta o planejamento de seus gastos.

4. Não coma por impulso!

A alimentação é um dos lugares onde mais gastamos superfluamente e sem planejamento. Assim, quando for ao mercado, leve a listinha, saiba o quanto você quer gastar e não ultrapasse seu orçamento.

Não pense que você tem que comer menos! Você pode continuar a comer da forma que quiser, mas, se você sabe que todo dia gosta de comer um doce, planeje a compra desse alimento previamente.

Compras em atacado costumam valer muito mais a pena do que no varejo! Ademais, considere levar marmitas para o trabalho e outros lugares onde possa esquentar.

Apesar de você gastar um pouco de tempo cozinhando, no fim do mês vai sentir o alívio no bolso! Além de ser mais saudável para seu corpo.

5. Considere itens de segunda mão ou de exposição

Esta é uma ótima dica tanto para poupar no dia a dia quanto para ajudar o meio ambiente. Muitas vezes objetos em segunda mão estão em estados de conservação perfeitos. Assim, vale a pena conferir sítios e lojas especializadas nesse nicho.

Contudo, verifique as possibilidades de troca e se os preços estão realmente mais baratos. Muitos lugares cobram preços semelhantes a produtos novos.

Ademais, ítens que ficam em exposição podem sair mais baratos, mas podem apresentar alguns pequenos danos. Confira tudo!

Como escolher cartões de crédito? Saiba encontrar boas alternativas

Está em dúvida sobre como escolher cartões de crédito de qualidade? Então não deixe de conferir as nossas dicas para facilitar a sua vida e encontrar boas alternativas.

6. Pague à vista

Lojas físicas costumam oferecer descontos para quem pagar à vista. As máquinas de cartão costumam cobrar porcentagem das vendas. Mas, a loja não vai te oferecer essa possibilidade.

Então, é importante desenvolver o hábito de perguntar para o vendedor se existe a possibilidade de abatimento do valor caso do pagamento em dinheiro.

7.Reuniões em casa

Crie o hábito de encontrar os amigos em casa em vez de bares ou outros pontos de encontro. Sai muito mais barato se comprarem bebidas e comidas no mercado e dividirem por todos.

Além disso, você pode colocar uma música enquanto conversam e se divertem. Aliás, para além de poupar, essa é uma boa dica de um evento mais aconchegante e intimista para aqueles amigos próximos.

8.Peça emprestado

Não é vergonha nenhuma pedir coisas emprestadas. Às vezes você só precisa usar o produto por um dia, seja uma roupa ou um objeto.

Porque gastar dinheiro e prejudicar o meio ambiente e seu bolso se você pode simplesmente pegar com alguém e depois devolver com todo o cuidado? Afinal, amigos são para isso, não é mesmo?

9.De olho na energia elétrica

Sabe aquele produto que fica com uma luzinha acesa o dia todo? Então, ele está gastando alguma quantidade de eletricidade. Pode até ser pouco, mas como falamos no começo, poupar não tem a ver com o montante.

Se não está usando um eletrônico ou eletrodoméstico, tire da tomada e coloque quando for usar. É uma ação simples e você vai sentir o impacto no fim do mês.

10.Crie um objetivo para sua economia

Para encerrar nossa lista, este é um dos pontos mais importantes. Sempre que queremos algo, devemos querer com algum propósito. Qual é o seu?

Estabelecer uma meta ajuda muito a te manter no hábito de poupar no dia a dia. Porque toda vez que vai gastar com algo supérfluo, você se lembra do porque está poupando!

E lembre-se, nenhum objetivo está errado! O que vale é o seu desejo!

Agora que vimos uma série de dicas e os conceitos mais fundamentais sobre poupar no dia a dia, vamos colocar esse hábito em prática? O seu bolso vai agradecer a longo prazo!

Conheça o Programa de Pontos Unibanco: acumule e ganhe cashback em compras

O Programa de Pontos Unibanco oferece aos clientes oportunidades de gastar e ganhar recompensas por isso!

Em Alta

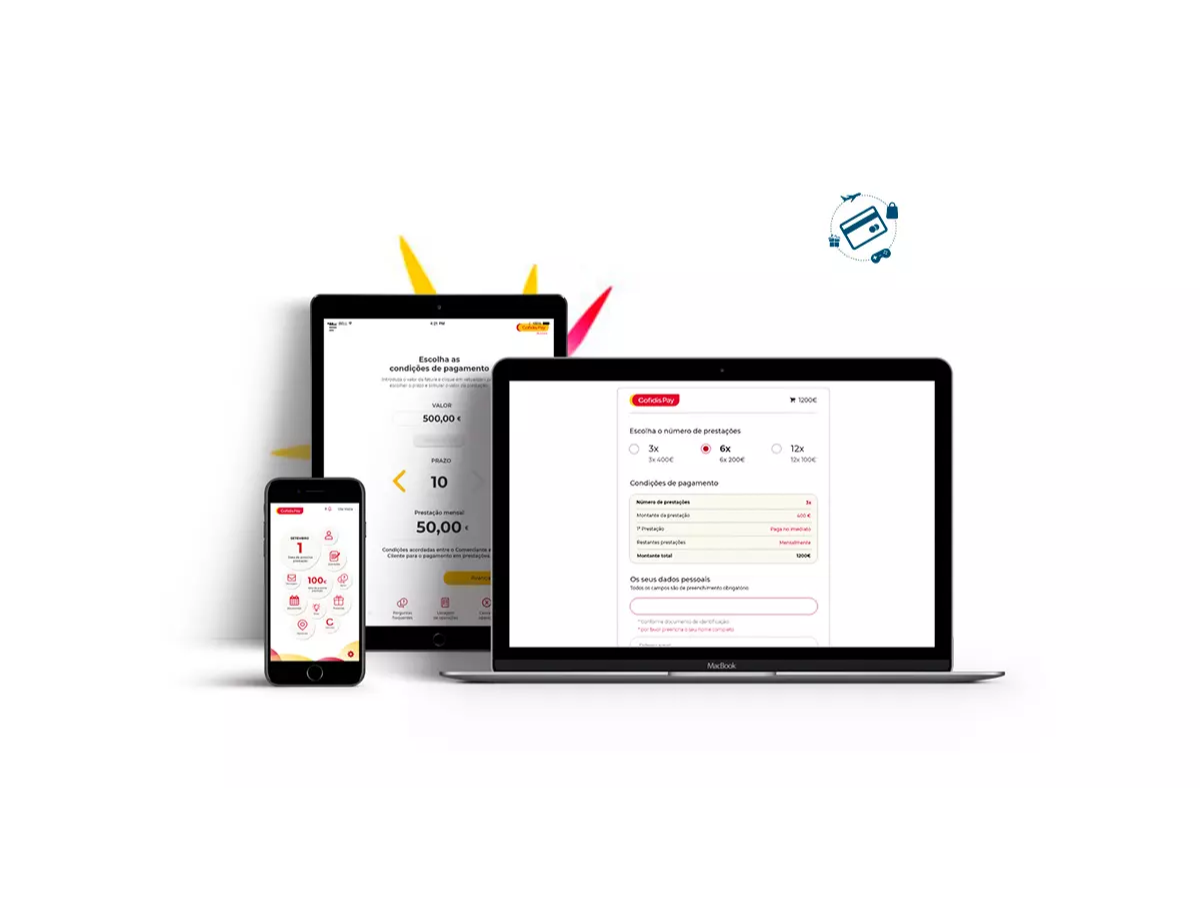

Conheça o crédito consolidado Cofidis: até 84 meses para pagar!

O crédito consolidado Cofidis é uma solução para quem precisa organizar dívidas. Veja todas as vantagens que ele oferece!

Continue lendo

Sites financeiros ilegais: como evitar golpes?

Como evitar sites financeiros ilegais? O mais importante é estares atento e manteres o pé no chão com as promessas de investimentos.

Continue lendo

Como contratar o Crédito Habitação BPI? Confira passo a passo

Quer contratar Crédito Habitação BPI? Então confira, aqui, como solicitá-lo online e sem sair de casa e conquiste a casa dos seus sonhos!

Continue lendoVocê também pode gostar

Conheça a conta digital da EuroBic 365 e seus benefícios!

A conta EuroBic 365 é repleta de benefícios, como possibilidade de acesso a descontos, cartão de crédito e débito, seguro e mais. Conheça!

Continue lendo

Como conseguir empréstimo em Portugal: 5 dicas valiosas!

Pesquisar os bancos mais conhecidos e saber os tipos existentes são dicas sobre como conseguir empréstimo em Portugal e sair do sufoco.

Continue lendo

Conta N26 Metal ou Conta N26 You: qual a melhor?

Se você está em dúvida entre a conta N26 Metal ou N26 You, saiba que ambas são 100% digitais e oferecem vantagens exclusivas. Compare!

Continue lendo