Crédito

Conheça o crédito pessoal MrFinan!

O MrFinan crédito pessoal é perfeito para quem acumula mais de uma dívida e precisa de um alívio financeiro. Conheça, hoje, como ele funciona!

Anúncios

Descubra tudo sobre o MrFinan crédito pessoal

O MrFinan crédito pessoal pode ser perfeito para quem precisa organizar as finanças e dívidas. Com ele, é possível conquistar isso sem sair de casa, em poucos passos. Veja!

Ele funciona com uma modalidade especial de empréstimo. Assim, volta-se especialmente para quem já tem dívidas de créditos contratados. Com ele, então, é possível se obter taxas menores ao mesmo tempo em que se concentram as dívidas em um lugar só. Conheça mais.

Como solicitar o crédito pessoal MrFinan?

O Crédito pessoal MrFinan pode ser perfeito para quem está em busca de um empréstimo para cobrir outras dívidas e organizar sua vida financeira.

Como funciona o crédito MrFinan?

Esse crédito ocorre na forma consolidado. Diz-se que um crédito é consolidado quando ele se apresenta para fins de acumular várias prestações em uma só. Isto é, considere que há várias parcelas de dívidas que passam a ser pagas em uma só.

O que ocorre, então, é que o valor pago mensalmente pela consolidação dessas dívidas é menor do que a soma delas individualmente. Ou seja, com isso é possível diminuir suas despesas mensais e ainda assim honrar com suas parcelas.

No caso do Mrfinan crédito pessoal ele promete a redução dos valores das parcelas em até 60%. Ou seja, ao unificar mais de um tipo de dívida com o Mr Finan você pode pagar apenas 40% do que pagava, antes, na soma delas!

Você será redirecionado a outro site

Vantagens

Veja, então, quais são as principais vantagens desse crédito pessoal:

- Contratação online;

- Concentre suas dívidas em uma só parcela, economizando até 60%;

- Organize suas finanças e faça sobrar dinheiro no orçamento;

- Aumente seu poder de compra;

- Simplifique seus pagamentos.

Desvantagens

Por outro lado, nem tudo são flores. Afinal, o MrFinan crédito pessoal também impõe requisitos para contratação. E um dos principais se refere à residência em Portugal. Isto é, é imprescindível que o contratante more em terras portuguesas.

Contudo, note que brasileiros que residam em Portugal e que tenham ou não cidadania portuguesa podem requerer esse crédito. Para isso, porém, devem preencher os demais requisitos, e alguns deles são desvantajosos, a depender da situação.

Por exemplo, é necessário ter comprovação de rendimento, que deve ser estável. Assim, há necessidade de comprovação de renda, o que nem sempre é possível.

Como fazer o crédito pessoal MrFinan?

Fazê-lo é bastante simples e descomplicado. Afinal, a solicitação ocorre de forma completamente online. Outro fator interessante é que a resposta é imediata. Dessa forma, não há necessidade de espera de horas ou longos dias para saber a possibilidade de obter crédito.

Assim, basta acessar o site do MrFinan crédito pessoal e lá clicar em “Pedir um Crédito”. Lá também é possível usar, já na página inicial, um simulador de juros. Seja como for, você deverá inserir o montante total dos créditos (soma das dívidas com bancos ou financeiras).

Depois, continue e preencha as demais informações que serão requeridas em tela. Dentre elas estão nome completo, endereço válido em Portugal, endereço de e-mail e telefone para contato.

Assim, basta concluir os passos, encaminhar a solicitação ao MrFinan de crédito pessoal e esperar alguns segundos ou minutos e obter a resposta.

Como solicitar o crédito pessoal MrFinan?

O Crédito pessoal MrFinan pode ser perfeito para quem está em busca de um empréstimo para cobrir outras dívidas e organizar sua vida financeira.

Em Alta

Programa Creche Feliz: o que é?

Se tens um filho com idade para frequentar uma creche, conheça o que é o Programa Creche Feliz: tenha acesso gratuito!

Continue lendo

Chave Móvel Digital: conheça e assine documentos pelo celular!

A Chave Móvel Digital é uma maneira de autenticar assinaturas em documentos digitais. Saiba como funciona e como obtê-la!

Continue lendo

Cartão Banco Best Gold Visa ou Banco Best Gold Plus: qual o melhor?

Seja o cartão Banco Best Gold Visa ou Banco Best Gold Plus, ambos possuem cobertura internacional e várias vantagens. Compare e escolha!

Continue lendoVocê também pode gostar

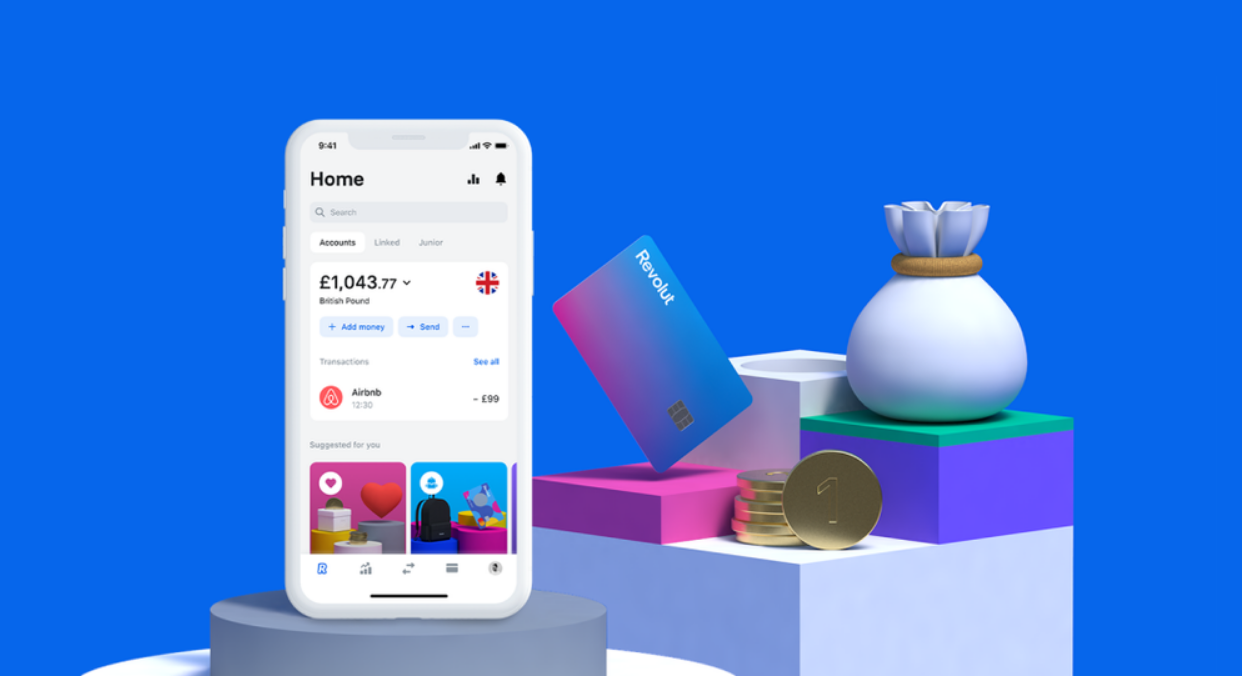

Conheça o cartão de crédito Revolut Standard

Revolut Standard é um cartão sem taxas que possui aplicativo para gerenciamento das finanças online! Descubra mais vantagens aqui.

Continue lendo

Como aderir ao Cartão de mobilidade elétrica?

Aderir ao cartão de mobilidade elétrica em Portugal é simples, basta aceder o site MOBI.E e solicitar pela companhia de energia a sua escolha!

Continue lendo

As melhores linhas de crédito pessoal em Portugal 2022

Precisa de dinheiro para ajeitar sua vida financeira? Veja quais são as melhores linhas de crédito pessoal em Portugal da atualidade!

Continue lendo