Cards

Discover the Revolut Metal credit card

Looking for a credit card full of benefits? Then discover the Revolut Metal card, which offers different and perfect benefits for those who love traveling, such as health, flight and baggage insurance.

Advertisement

Discover everything about the Revolut Metal credit card!

The Revolut Metal card is one of the most differentiated on the market. And this is no surprise, as it has numerous advantages ranging from insurance and international flags to cashback. So, get to know it and find below everything about this credit option, its advantages, disadvantages and how to apply for it.

Revolut Metal Credit Card: how to apply?

The Revolut Metal credit card has numerous benefits, has the two main brands in the world (Visa and Mastercard), in addition to having a Cashback program! See how to request here.

| Annuity | €13.99 per month |

| Do you accept denial? | Uninformed |

| Flag | Visa or Mastercard |

| Roof | International |

| Benefits | Cashback, access to airport VIP lounges, international travel insurance, refund of tickets for purchased events that you cannot attend, online membership. |

How does the Revolut Metal card work?

This card works in a very comprehensive way. After all, it can contain a Mastercard or Visa brand and in both cases it is international. It also offers both debit and credit purchase options, which can be in cash or in installments. Likewise, it offers the possibility of transfers and withdrawal of amounts.

Benefits

Check out all the advantages you can find when opting for the Revolut Metal card:

- Access to the LoungeKey pass;

- Free access to the VIP lounge for the customer and up to 3 other companions for flight delays of 1 hour or more;

- Online membership;

- Priority customer support;

- Access 5 cryptocurrencies;

- Virtual card;

- Cashback of 0.1% for purchases made in Europe and 1% for purchases made outside the European continent;

- Concierge to help manage your lifestyle;

- Free IBAN account in euros;

- Exchange rate in 30 fiat currencies (no monthly ceiling);

- Payments in more than 150 currencies at the interbank exchange rate;

- No fees for ATM withdrawals up to €600 per month;

- International health insurance;

- Flight and baggage delay insurance.

Disadvantages

Among the main disadvantages of this Revolut Metal card are:

- Annual fee charge without the possibility of resetting it;

- Need to pay fees of 2% on monthly withdrawals exceeding 800 Euros;

- Cashback is limited to 13.99 Euros per month;

- Only those who have a Revolut account have access to the card;

- Access to the account and services is limited to those residing in Portugal.

How to get the Revolut Metal credit card?

Anyone who lives in Portugal can obtain a Revolut Metal card in just a few steps. To do this, simply open an account, which occurs completely online through the institution's website. Likewise, via the mobile app.

Credit card applications for those who already have a Revolut digital account also take place online. Again, it can be done via the website or app. Therefore, to find out how to request it in more detail, check out the content we have prepared below!

Revolut Metal Credit Card

The Revolut Metal credit card has numerous benefits, has the two main brands in the world (Visa and Mastercard), in addition to having a Cashback program! See how to request here.

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

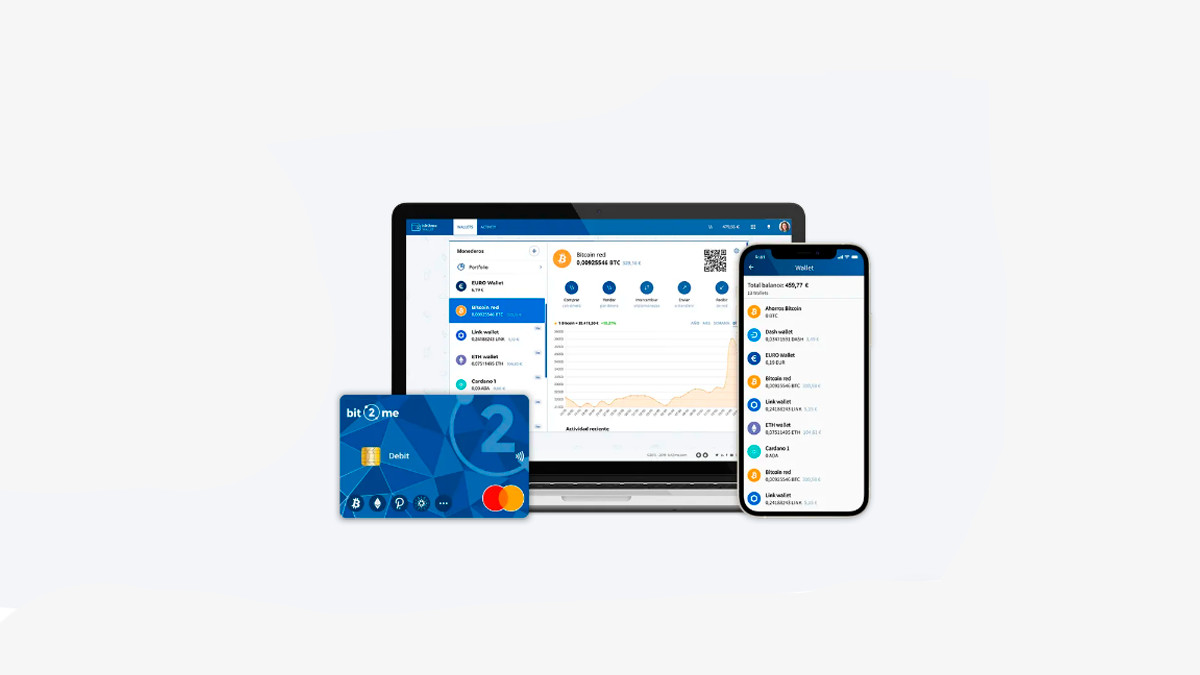

Get to know the Bit2me broker: what is it and how does it work?

To enjoy cryptocurrencies at the best price, discover what the Bit2me broker is: see the advantages and disadvantages!

Keep Reading

What is the Document Exchange: practicality and security!

Do you know what the Document Exchange is? This is a mechanism implemented by the Portuguese government to facilitate access to virtual documents.

Keep Reading

Best credit cards in Portugal 2023

We've listed the best credit cards in Portugal, so you have the opportunity to compare benefits, such as cashback, insurance and more!

Keep ReadingYou may also like

How to apply for a Residence Visa for Independent Professional Activity or Entrepreneurial Immigrants?

Discover how to apply for your Residence Visa for Independent Professional Activity or Entrepreneurial Immigrants in a simple way!

Keep Reading

How to participate in the Millennium BCP Rewards Program?

The program that gives value to your money and helps you save: discover how to participate in the Millennium BCP Rewards Program!

Keep Reading

NB Green or NB Gold Card: which is best?

In doubt between NB Green or NB Gold cards? Both are international and have advantages. See everything about it and find out which is the best choice.

Keep Reading