Tips

Check out how to become a EuroBic Bank customer: see!

Looking for steps on how to become a EuroBic Bank customer? So you are in the right place! Check below the requirements and how to open an account with the institution! The request takes place in person.

Advertisement

Find out how to become a EuroBic Bank customer to access financial services and products

To become a customer of Banco EuroBic, citizens must follow certain steps and gather a series of documents. So, see how to do it here!

In fact, the EuroBic bank has existed since 2008 and offers a series of services in Portuguese territory. With it you can take out bills, insurance, cards and loans. Incredible, right?

Furthermore, as it has a very wide range of financial products, it serves both individuals and companies. Thus, it brings solutions to your finances and helps you develop.

Want to know more? So continue reading and check out, in the following items, a complete step-by-step guide on how to open an account at EuroBic bank!

Step by step to become a EuroBic Bank customer

Although EuroBic bank has digital channels – such as internet banking and a cell phone application – it is not possible to become a customer through these locations.

In other words, to open an account or purchase a service from EuroBic bank, you will need to go to one of its branches to request in-person assistance.

Documents to open an account

In order to open an account, as well as contract other services – such as cards, credits and insurance – it is necessary to have some documents on hand. Check out what they are:

- NIF;

- Proof of income;

- Proof of address.

The bank will then carry out an analysis and you can follow the processing and progress of the request online.

Discover other banking institutions and their products: see the Banco CTT Review

Now that you know everything about the EuroBic bank, how about finding out about other financial institutions that operate in Portugal? There are several of them.

Knowing them is a way to ensure that you choose the best service available according to your financial needs and plans!

Therefore, be sure to also check out CTT bank. It has a wide list of financial services and products. This way, it could be a great option for your life!

Click on the link below, then, and learn more about this financial institution and what it offers its customers, as well as how to become one of them to take advantage of these benefits.

How to become a Banco CTT customer?

Learn how to become a Banco CTT customer without complications or wasting time. This way, access a series of financial products and services!

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

NB White or NB Gold Card: which is best?

Between the NB White or NB Gold card, the second is more complete, as it has a rewards program and other advantages. Find out more here!

Keep Reading

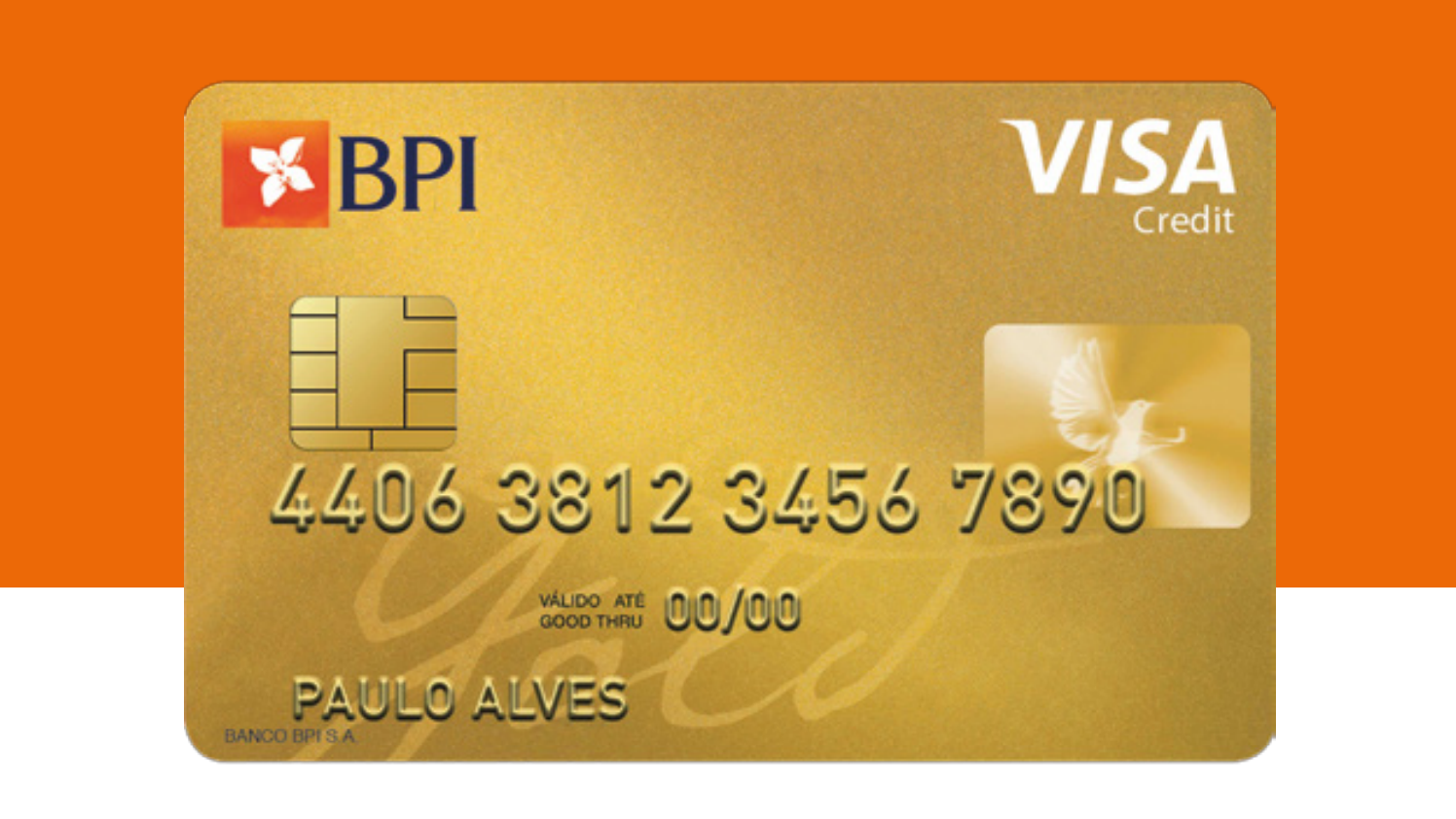

How to request and activate the BPI Gold credit card?

See how to request and activate BPI Gold, the premium card that brings advantages such as exclusive assistance and international coverage!

Keep Reading

Discover the Millennium BCP Classic credit card

The Millennium BCP Classic card is a good opportunity to get credit while living outside Brazil! Want to know more? See more here!

Keep ReadingYou may also like

How to get a credit card with a high limit in Portugal: tips and strategies

Having a high limit on your credit card may seem difficult, but it is possible, just follow some tips to take advantage of all the benefits.

Keep Reading

How to subscribe: Recovery and Resilience Plan!

How to subscribe to the Recovery and Resilience Plan? The program is broad and has several possibilities for you on the site, just check it out!

Keep Reading

Discover the Bankinter Youth account and its benefits!

The Bankinter Jovens account has countless benefits for those who are starting out in life now, but need opportunities. Know more!

Keep Reading