Tips

How to manage school expenses?

Back to school comes with a series of bills that can weigh on your budget. See how to manage school expenses and check out practical tips!

Advertisement

See practical tips on how to manage school expenses

Managing your school expenses is just as important as managing your other financial obligations. Therefore, it is important to keep an eye on them.

After all, there are several expenses that can arise from studies. In addition to monthly fees, there are school materials, transportation, food in canteens and others.

How do I apply for Child Benefit?

Find out in detail how to request Child Benefit and receive compensation and replacement for lost hours and salary!

Therefore, having them under your management helps you control them, as well as organize yourself so that they fit within your budget.

Below, check out tips on how to manage school expenses practically. Also, see tips for saving on them!

Learn how to manage school expenses and save

Check out 4 essential steps for those who want to manage school expenses efficiently.

Keep all expenses at the tip of your pencil

The first step to managing school expenses is to have all expenses at your fingertips. Consider among them:

- Registration value;

- Tuition;

- School supplies;

- Transport costs to attend classes;

- Food expenses, etc.

Request receipts for all payments

Whenever you make a payment for a school expense, especially tuition and food costs, ask for a receipt.

It is important especially for two factors. The first is to help manage and map your expenses.

The second, in turn, refers to the possibility of deducting school expenses from the IRS, as we will see later.

Plan for the long term

A long-term schedule can help a lot in managing school expenses. With this, you can be more aware of all your expenses.

Still, you can see ways to save. For example, there are institutions that offer discounts for quarterly or semi-annual payments.

Furthermore, when planning, you do not let variable or periodic expenses – such as registration fees or new materials – go unnoticed.

Know when higher and additional expenses are necessary

The fourth step to managing school expenses is to consider additional expenses. For example, replacement of materials and uniforms.

How to save on school expenses

By managing your school expenses you can also find smart ways to save! Check out tips for this below.

Take advantage of promotions

Try to make your purchases of school materials, uniforms and the like, during promotional seasons.

Many establishments take advantage of the return to school to offer promotions and discounts. So, do some market research before going shopping.

Buy only what you need

Another important point is to buy only what you need. There is no need for several of the same materials or for purposes that are not even related to classes.

So, wait for something to finish before looking to buy a new one. Often the durability of a material is much greater than expected.

Reuse what you already have

Are there any materials left over from the last school year? So see which ones are still in usable condition!

For example, you can reuse backpacks, pencil cases, pencils and pens that are still in good condition. Also, notepads, binders, rulers and other materials.

Another possibility is also to reuse used materials from other students, when books are still in good condition and are compatible with the teaching program.

There are several online forums, as well as exchanges on social networks, that put students who are interested in this trade in contact.

So, try to find out more about it and see if it’s an opportunity to save!

Request an IRS deduction

Finally, our last tip for saving on school expenses is to take advantage of them and request a deduction from the IRS.

With this, you have the obligation to pay less tax rates to the public authorities, since you find discounts resulting from educational expenses. Check out how it works below!

How does the IRS deduction for school expenses work?

Under Portuguese law, each household has the right to deduct up to 30% of expenses arising from educational purposes from the IRS. The discount is limited to 800 euros.

This deduction can occur from expenses incurred with the education of any of the family members.

In fact, be aware that these expenses may refer to early childhood, university or specialization education.

Likewise, in education in foreign languages, music and theater. Therefore, it does not just refer to traditional education.

However, for expenses to be eligible for IRS deduction, they must be related to educational establishments that are part of the national education system.

Or, that their educational purposes are recognized by the competent ministries.

Check out some examples of expenses that allow IRS deduction:

- Monthly fees for nurseries or kindergartens, schools and universities;

- Manuals and school books necessary to follow classes;

- General school materials (for example: notebooks, binders, pencils, pens, etc.), when purchased from the school or educational institution bookstore;

- Expenses for meals in canteens and food establishments present within education units;

- Rent amounts necessary for the student to stay at school, when they come from another region and need to move;

- Registration and registration fees;

- Nanny expenses.

All deductions require a receipt, it should be noted. Therefore, always try to have it on hand, as it is what proves the origin of the expenses.

What cannot be deducted from the IRS?

On the other hand, there are some expenses that, even if they arise from education, do not allow for tax deduction.

So, look at some examples:

- School materials when purchased in supermarkets or other establishments that do not correspond to the school institutions' internal bookstores;

- Materials of an electronic and computer nature;

- Clothing and footwear for physical education;

- Musical materials and instruments.

Therefore, although it is possible to deduct school expenses from the IRS, not all of them are. Therefore, to ensure maximum savings, try to purchase materials in bookstores at educational institutions.

And, if you want to know about CTT housing credit as a way to own your own home, just access the content below. Click and check it out!

How to take out CTT Housing Credit?

CTT Housing Credit has special and uncomplicated conditions that help you achieve your dream of owning your own home. Check out how to hire him!

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

How to request and activate the NB Gold credit card?

Check out who can apply and how to activate the NB Gold card without leaving home, in the comfort of your home, and guarantee several benefits!

Keep Reading

How to request the CTT card?

The CTT card has several benefits, such as a cashback program, Mastercard brand and international coverage. See how to request!

Keep Reading

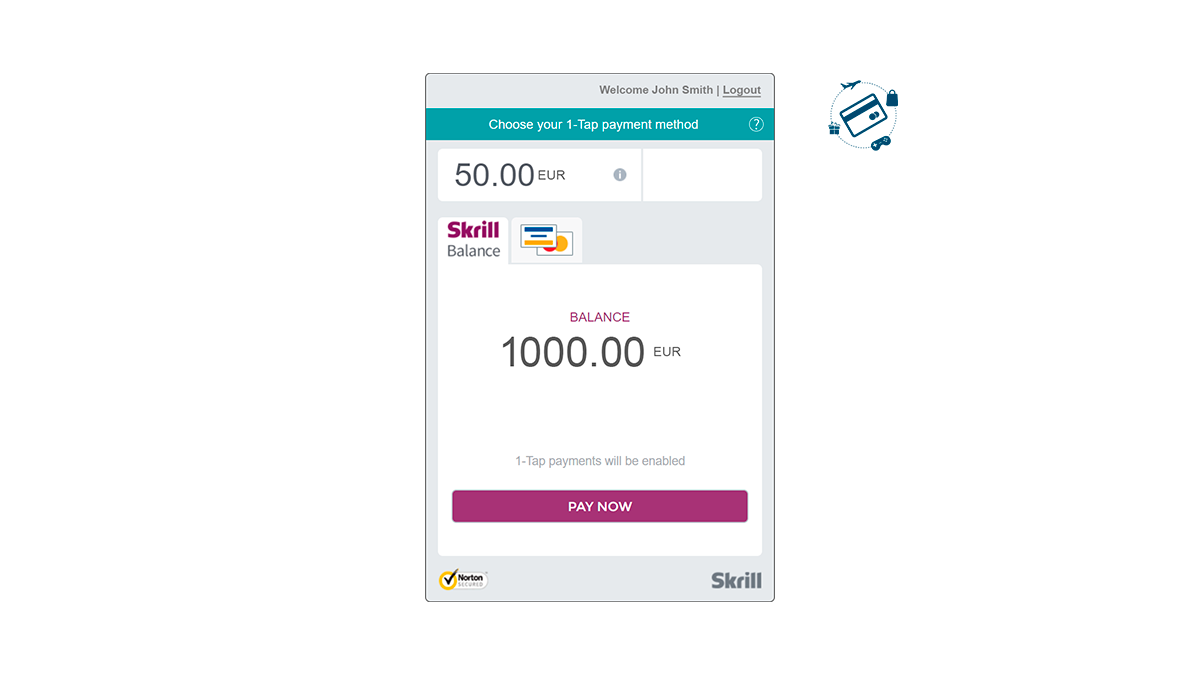

Get to know Skrill: receive, send and make payments with your digital wallet

Understand what Skrill is, how it works and the advantages of joining the multi-currency digital wallet that allows more than 100 payment methods.

Keep ReadingYou may also like

How do I request Cetelem consolidated credit?

Organizing your finances and getting extra money for projects is possible with Cetelem credit. Learn the step by step and hire him.

Keep Reading

IRS Jovem: what is it?

Do you want to know what IRS Jovem is and how to apply? This is a benefit for all young people who want partial tax exemption!

Keep Reading

How to request Gestlifes Consolidated Credit?

Need to fix your financial life? Get to know Gestlifes credit and see how it can help. And check out how to simulate and request!

Keep Reading