Credit

How to request Gestlifes Consolidated Credit?

Do you want to consolidate all your debts into one and see money left over? So check out how to get Gestlifes credit without leaving home and without bureaucracy to fix your financial life!

Advertisement

Gestlifes Credit: simulate and contract online!

Gestlifes credit helps you organize your finances. Consolidated, it combines different debt installments into one and even reduces their value.

Therefore, it can be an excellent alternative. With it you continue to honor your debts. However, when doing so, you are faced with a value lower than the sum of the original installments.

After all, there are interest limits and other applicable fees here. So, to find out how to hire him quickly and easily, continue reading the article.

Below you will find step-by-step instructions on how to take out Gestlifes credit. So, see how to get your finances organized again.

Step by step to request Gestlifes Credit

Check out now how to request and take out consolidated credit without leaving home and without wasting time. With this, guarantee the best payment conditions and see your debts reduce!

Request online

To take out Gestlifes credit, first access the company's website. Soon after, click on “Simulate now”.

On the next page, fill in the number of months you want to pay the amount and what amount is needed for consolidation. Therefore, fill in other personal information according to the form.

During registration, also create an account. With this, you can access it to check how the proposal selection process is going.

If you are interested in one of them, follow the instructions, submit the necessary documentation and take out the credit!

Another recommendation for you: Consolidated Family Savings Credit

Gestlifes credit is one of the options available on the market for those who need to consolidate debts. However, it is not the only one. After all, today several institutions offer this product and help you find the best alternatives.

For example, the Family Savings consolidated credit can be an excellent option. To learn more about it and see if it meets your needs, click on the link below and find out more!

How do I apply for Family Savings Credit?

Discover the Família Poupança credit and see how to hire the solution for your financial life online and without leaving home!

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

7 tips on how to invest your savings

Making your money work for you is one way to increase your income! Discover tips on how to invest your savings safely.

Keep Reading

Discover Agricultural Credit: invest in your projects in different ways!

Discover Crédito Agrícola and its services and projects. So, see how to get financing to invest and get your dreams off the ground.

Keep Reading

Is Senhor Cartão safe? look here

Do you want to know if Senhor Cartão is safe? The answer is yes! But check out the reasons below. Click here and read the full article.

Keep ReadingYou may also like

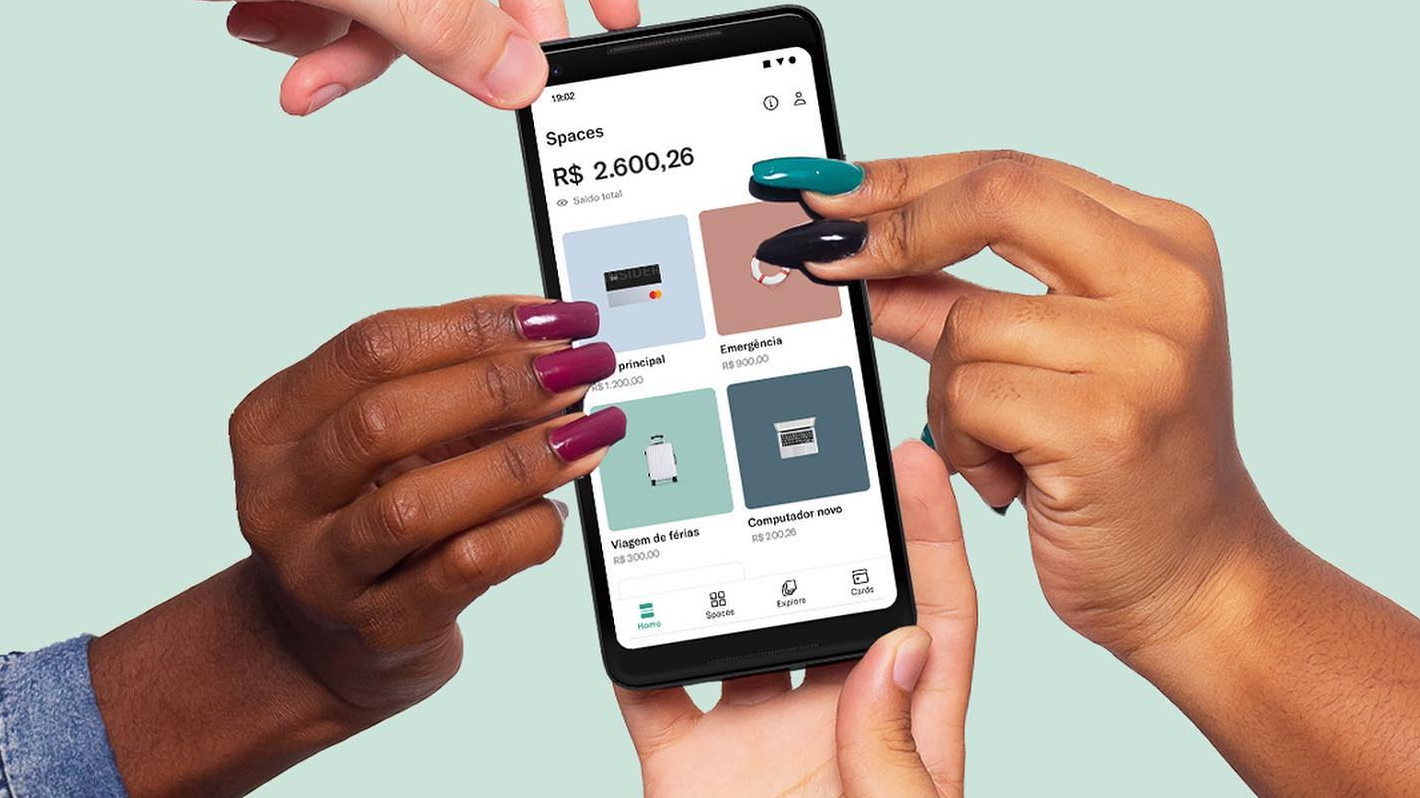

N26 accounts in Portugal: what are they and how to join?

N26 accounts in Portugal are diverse and each of them has its own benefits. Discover them now and find out the advantages they offer!

Keep Reading

Residence Visa for Study, Exchange, Internship or Volunteering: what is it?

Do you know what a Residence Visa is for study, exchange, internship or volunteering? It allows you to reside in Portugal for a while!

Keep Reading

How to choose credit cards? Know how to find good alternatives

Check out how to choose credit cards using our tips! It is important to pay attention to the flag, annual fee and benefits. Know more!

Keep Reading