Cards

Credit card and miles: understand the relationship and find the best options for traveling

The relationship between credit cards and miles allows you to transform expenses into travel credits. Keep reading to find out more about this and discover products of this nature!

Advertisement

Credit card with miles: how does it work?

A credit card with miles can make your travels much easier as you can exchange points for tickets. Therefore, it is one of the most sought after financial products!

In fact, a card that accumulates miles works like any other. That is, it has a limit, allows purchases on credit and has a monthly invoice.

Find the best airline ticket deals

Choosing the best airline ticket deals makes all the difference in your travels and your pocket. See the best places to buy them and important tips!

However, its difference from other cards lies in the fact that the amounts spent on them can be converted into miles.

In other words, the more you spend on the card, the more points and miles you accumulate. They, in turn, can be exchanged for airline tickets and, therefore, generate savings!

How to get a credit card with miles?

To do this, it is important that you find options that offer this type of advantage. But beyond that, you should also pay attention to some important details.

After all, a card will not be good just because it allows you to accumulate miles. It must also accompany other benefits so that it is truly attractive. See some!

Miles validity accumulation

Firstly, anyone looking for a credit card with miles must pay attention to the rules of the miles accumulation program.

To do this, analyze the proportion between Euros or Dollars spent and the accumulation of miles. While some cards offer 2 miles per Euro spent, others limit it to 1 x 1.

Also, analyze the expiry date of the miles. If it's too short, get out! After all, they are likely to expire without you even coming close to using them.

Annuity

It is common that when the card offers miles it also has a higher annual fee. So, keep an eye on the card’s maintenance value!

Consider whether the amount charged is justified and compensates for the miles you will accumulate. Otherwise, it may be worth investing in an airline points program instead of a miles card.

Travel Benefits

Does the card only offer miles as travel benefits? Well then, look better! There are several options on the market that offer travel insurance and other benefits.

Flag

When choosing your credit card with miles, be sure to analyze the brand it has. Preferably it must have the Visa or Mastercard seal.

These are the two most comprehensive flags in the world and, therefore, the most beneficial. Furthermore, they usually have their own points programs.

Scope of use

Finally, another detail that cannot be overlooked concerns the scope of use of the card. It is essential that a credit card with miles is international, for use around the world.

Discover some credit card options with miles

A credit card with miles can be very advantageous! So, how about learning about some options available on the market? Check out 3 of them below!

Millennium BCP TAP Gold

Millennium BCP TAP Gold is the result of a partnership between Millennium bank and TAP, a travel company. It is a credit card with miles.

With the Visa International flag, it offers a series of benefits. Among them are the miles you earn when joining the program.

In addition, your expenses are also converted into miles and you access other travel benefits. For example, it avoids queues at check-in.

Check out some of the main features of this credit card with miles:

- Annual fee of 80 Euros;

- International Visa Flag;

- Online membership;

- Earn 4,000 miles when you sign up for a credit card;

- Accumulate 1.25 miles for every 1.5 Euro spent on the card;

- Spend 8.5 thousand Euros on the card during the year and guarantee an additional 2 thousand miles per year;

- Earn 1 status miles for every 5 miles purchased with the card;

- Differentiated boarding and no queues at check-in;

- With insurance and travel assistance.

How do I apply for the Millennium BCP Gold credit card?

Ordering the Millennium BCP Gold card is a simple, online process. See how to apply and take advantage of its advantages, such as the points program!

Millennium BCP TAP Classic

Another credit card with miles that also results from the partnership between Millennium and TAP is the Classic. It is a little less robust than the previous alternative.

Despite this, it has good advantages and has a lower annual fee. Furthermore, it guarantees the accumulation of miles and can make your trips cheaper.

Find out more about the Millennium BCP TAP Classic credit card:

- Annual fee of 40 Euros;

- International Visa Flag;

- Online membership;

- Earn 1,000 miles when you sign up for the card;

- Spend 4 thousand Euros on the card during the year and guarantee 1 thousand additional annual miles;

- Earn 1 mile for every 5 miles purchased with the card;

- With insurance and travel assistance.

How do I request the TAP Classic card?

Do you want to apply for the TAP Classic card and obtain a series of travel benefits? So, check out the step-by-step guide to do it!

Millennium BCP TAP Business

Finally, the third and final option we have for a credit card with miles is the Millennium BCP TAP Business. He turns to companies.

Like the previous ones, it offers travel benefits. Check out its main features:

- Annual fee of 85 Euros;

- International Visa Flag;

- Online membership;

- Earn 4,000 miles when you sign up for a credit card;

- Accumulate 1.25 miles for every 1.5 Euro spent on the card;

- Spend 8.5 thousand Euros on the card during the year and guarantee an additional 2 thousand miles per year;

- Earn 1 status mile for every 5 miles purchased with the card;

- Differentiated boarding without check-in queues;

- With insurance and travel assistance.

How do I apply for the TAP Business credit card?

See here how to apply for the TAP Business card and enjoy all its benefits, such as international coverage, Visa brand, miles program and more!

Other benefits of credit cards that offer miles for travel

In addition to credit card options with miles, there are also other benefits that cards can offer that make your travels easier.

For example, many of them have travel insurance. They focus on lost luggage, vehicle rental, as well as the possibility of ticket cancellation.

There are also credit cards that grant benefits at airports. This is the case for those who give access to VIP lounges, as well as priority boarding.

Therefore, there are several travel benefits that you can find on cards! Furthermore, if you are looking for other credit card options, check out the NB Verde card.

How to apply for the NB Verde card?

With online membership, discover the step-by-step guide to requesting NB Verde, a card with international coverage full of advantages!

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

Where to buy cryptocurrencies in Portugal: best sites 2021

If you are interested in new investments, see a list of the best sites to buy cryptocurrencies in Portugal.

Keep Reading

SafeMoon cryptocurrency: what is it and how much is it worth? Discover!

Find out more about the SafeMoon cryptocurrency, an alternative with the potential for positive returns for investors, and find out if it is worth investing in!

Keep Reading

Discover AB Pétis Insurance: how does it work?

Do you want to protect your animal and your wallet from possible problems? Click now and find out how AB Pétis Insurance works!

Keep ReadingYou may also like

How do I request the Sustainable Employment Commitment?

Are you a businessman or unemployed person and want to know how to apply for the Sustainable Employment Commitment? Click here and discover everything!

Keep Reading

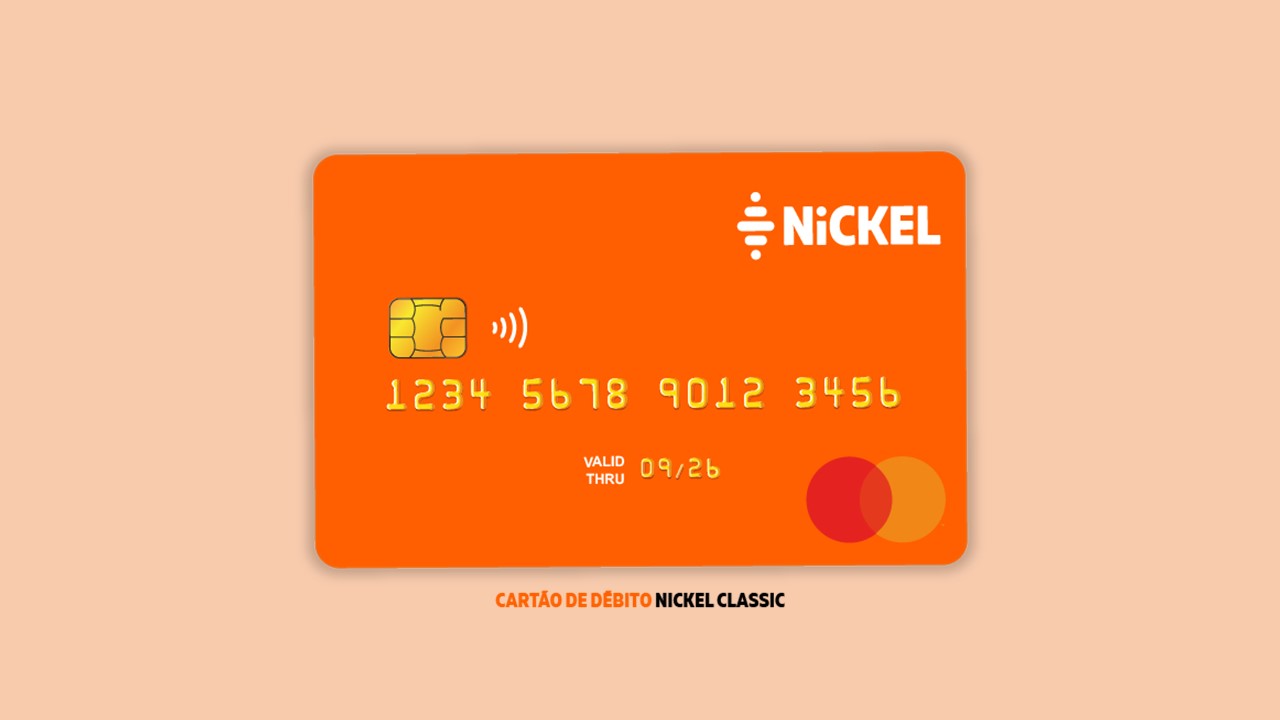

Nickel Classic debit card: how does it work?

Find out how the Nickel Classic debit card works. Click here and discover the advantages and disadvantages of subscribing to this card!

Keep Reading

Discover the Unibanco Points Program: accumulate and earn cashback on purchases

The Unibanco Points Program gives you cashback and points to exchange for benefits, such as beauty products, fashion, travel and much more!

Keep Reading