Cards

Banco Best Gold Visa or Banco Best Gold Plus card: which is best?

Choosing between the Banco Best Gold Visa or Banco Best Gold Plus card can be difficult. After all, each of them offers exclusive advantages, serving different consumer profiles. Do you want to know more about these financial products? Continue reading!

Advertisement

Discover the best card for you

First of all, choosing between Banco Best Gold Visa or Banco Best Gold Plus is complicated. This is because these types of credit have their own characteristics, each one suitable for different consumer profiles.

However, only consumers who live and work in Portugal can choose between Banco Best Gold Visa or Banco Best Gold Plus. This product is recommended for consumers who travel a lot, mainly due to its unique advantages.

After all, in addition to being an international credit card, its advantages are unique and offer comfort and security in daily transactions. It is worth mentioning that purchases can be made in cash or in installments, in physical or virtual establishments.

So, if you want to know more about the main features of Banco Best Gold Visa or Banco Best Gold Plus, see the comparison table and find out which model is best for you.

How do I apply for the Banco Best Gold Visa card?

Learn how to apply for the Banco Best Gold Visa credit card, which has international coverage and the possibility of canceling the annual fee!

How do I order the Banco Best Gold Plus card?

Learn how to apply for the Banco Best Gold Plus card which, among its advantages, has a miles program and a Visa card!

| Best Gold Visa Bank | Best Gold Plus Bank | |

| Annuity | 20€ | 40€ |

| Do you accept denial? | Uninformed | Uninformed |

| Flag | Visa | Visa |

| Roof | National and international | National and international |

| Benefits | Possibility of getting rid of the annual fee | Cashback and Miles Program |

Best Gold Plus Bank Card

Firstly, Banco Best Gold Plus is an international credit modality, issued under the Visa brand. Linked to Banco Best, users can send the request via the internet.

Holders of this credit card can make transactions in cash or in installments. It is worth mentioning that these purchases can be made in all establishments, physical or virtual, as long as they accept the Visa brand.

In addition, holders must pay €40 towards the annual fee. As for the APR rate, that is, the one charged when the consumer fails to pay the invoice, it will be 15.6%.

And, as with any type of credit available in Portugal, consumers must have flexible payment management. Otherwise, your financial health could be harmed.

Best Gold Visa Bank Card

First of all, there are some differences between Banco Best Gold Visa or Banco Best Gold Plus, as well as similar characteristics. One of the main ones is that it is an international card, issued under the Visa brand.

In other words, users can make purchases in cash or in installments, in physical or virtual establishments, as long as they accept the Visa brand. But unlike the first modality, the annual fee charged is €20.

Furthermore, users can be exempt from paying this fee as long as they open a digital account with the bank. However, it is worth mentioning that these digital accounts are more robust than common accounts, in addition to having an effective cost rate of 12.6%.

However, like most credit cards in Portugal, users have flexibility to pay invoices. And this can be a big problem, especially for those who cannot control their card spending.

Best Gold Plus Bank Card Advantages

Now that you know the main features of Banco Best Gold Visa or Banco Best Gold Plus, know that the advantages of the Gold Plus model are unique and exclusive. See what they are.

- The entire application process is carried out online;

- Users can make purchases at national and international establishments;

- Access to contactless payment technology;

- Holders can control all operations through the financial institution's application;

- Access to brand and digital account benefits;

- Exclusive discounts at partner establishments;

- Access to a cashback and miles program;

- between others.

When filling out the information for the request, the user must choose between the cashback or miles program. So, remember to choose the best one for your profile.

Best Gold Visa Bank Card Advantages

Just like Gold Plus, Banco Best's Gold Visa model has unique features and advantages. So, before choosing between Banco Best Gold Visa or Banco Best Gold Plus, check out the exclusive benefits.

- The application process is also done online;

- Accepted in national and international establishments;

- Access to contactless payment technology;

- Operations can be monitored through the institution's official app;

- Exclusive benefits of the brand and digital account;

- Exclusive discounts at partner stores;

- Users can get rid of the annual fee;

- between others.

However, to check out more exclusive benefits of this financial product, simply access the card's official page.

Disadvantages of Best Gold Plus Bank Card

As with any financial product, the Banco Best Gold Plus card has disadvantages. One of the main ones is the annual fee of €40. The exemption will only be valid in the case of the Best Gold Visa.

Another disadvantage is that this credit card can only be requested when customers open a digital account. So, if you already have a product at another institution, you probably won't be able to manage two cards.

Disadvantages of Best Gold Visa Bank Card

As previously mentioned, all credit cards have disadvantages, and with Gold Visa this is no different. In short, one of the main disadvantages is, without a doubt, the annual fee of €20.

However, consumers can exempt themselves from paying this fee. However, unlike normal digital accounts, they incur fee charges. Therefore, if you already have an account with a financial institution, it is not worth opening another one.

Banco Best Gold Visa or Banco Best Gold Plus card: which one to choose?

Finally, choosing between Banco Best Gold Visa or Banco Best Gold Plus can be complicated, but by comparing the modalities, you can find the one that best meets your needs.

Therefore, analyze the advantages and disadvantages of both modalities, balancing the characteristics of both. This is the best way to avoid frustration when purchasing a financial product that you do not like.

And if you've made it this far, but still aren't sure of the best option for your financial life, don't worry! We have separated more exclusive content so that you can discover another very interesting alternative available on the market: the Unibanco Life card. Click the button below and check it out!

How do I request the Unibanco Life card?

With zero annual fees and benefits, such as a points and cashback program, it is possible to apply for the Unibanco Life credit card online. See how!

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

Discover the TAP Platinum credit card

With a miles program, the TAP Platinum credit card is perfect for those who like to travel in comfort and style. See other advantages!

Keep Reading

Comparajá: compare services and products for free and without leaving home

See how Comparajá can help you find the best services with the lowest rates. It's easy to decide what to hire, and it's free!

Keep Reading

Discover the Revolut Metal credit card

The revolut metal credit card has a cashback program, international coverage, among other benefits. See more here!

Keep ReadingYou may also like

How to order the EuroBic Soft card?

The EuroBic Soft card has international coverage and the possibility of exemption from annual fees. Check out how to request yours here!

Keep Reading

How to join Bitcoin Up?

How to join Bitcoin Up? The entire process is quick and can be done online with little personal information.

Keep Reading

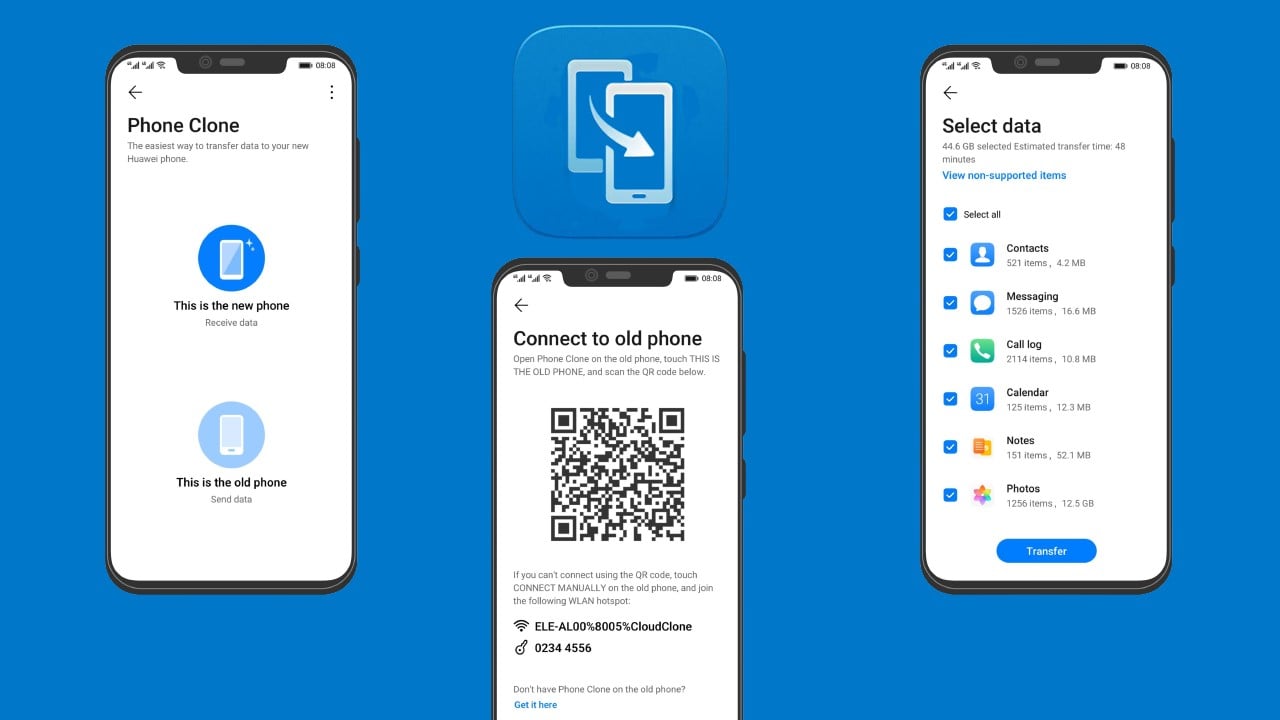

App Phone Clone: the solution to migrate your data

Don't depend on the internet! Transferring your data from an old device to a new one can be quick and easy using the Phone Clone app!

Keep Reading