Cartões

Conheça os Bancos Digitais com Cartão de Débito!

Fuja da burocracia dos balcões e continue tendo acesso a benefícios como o cartão de débito físico através dos Bancos Digitais!

Anúncios

Bancos Digitais: descubra as melhores opções com cartão!

Cada vez mais os Bancos Digitais são opções viáveis, seja pela praticidade ou pelas vantagens, como facilidade em se ter um cartão de débito. Afinal, você resolve tudo online, e tem a segurança de usar o cartão para pagar suas contas.

Conheça o Portal das Finanças: veja como funciona, serviços principais e como usar

O Portal das Finanças é um site que pertence à Autoridade Tributária e Aduaneira de Portugal. Portanto, ali é possível encontrar informações e serviços financeiros e fiscais.

Mas quais são os melhores bancos digitais em Portugal? Você sabe como escolher o melhor para você?

Então, fique atento que vamos te mostrar algumas opções que oferecem cartão de débito para facilitar suas transações do dia a dia.

Quais vantagens de um banco digital?

Pelo fato dos bancos digitais não possuírem balcões e atendimentos pessoalmente, isso diminui as cobranças de taxas das contas. Assim, isso facilita a criação da sua conta!

Normalmente, nos bancos digitais não há cobrança de comissões de abertura e de outros encargos habituais, como transferências. Além disso, todos os processos são muito simples e livres de grandes burocracias.

Você consegue gerenciar tudo através de seu smartphone. Aliás, alguns bancos facilitam transações e câmbio de moedas, como também investir em ações e aplicar dinheiro.

Ademais, você pode continuar a ter seus cartões de débito físicos! Assim, conta com as vantagens de um banco tradicional, mas com a praticidade de estar online!

Você será redirecionado a outro site

Cartão de débito

O cartão de débito é uma opção segura e prática para realizar seus pagamentos. Isso porque ele oferece a vantagem de você realizar pagamentos diretamente sem precisar carregar seu dinheiro.

Melhores cartões Mastercard em Portugal

Escolher um cartão pode ser difícil! Quais vantagens e taxas levar em consideração? Veja os melhores cartões Mastercard em Portugal!

Além disso, vários bancos digitais oferecem benefícios exclusivos no uso do cartão de débito. Desse modo, vamos conhecer qual é a nossa lista de bancos digitais com cartão de débito?

Veja 5 Bancos Digitais que oferecem cartão de débito!

Listamos 5 opções para você conhecer e decidir qual é a que vale mais a pena para você!

ActivoBank

O ActivoBank é um dos bancos digitais mais interessantes. Sendo um banco português, ele não é 100% online. Assim, possui alguns balcões espalhados pelo país. Contudo, o foco de sua ação está nos processos online.

Abrir a conta neste banco é totalmente gratuito. Além disso, o mesmo vale para a disponibilização do seu cartão de débito e transações e compras sem taxas dentro da zona do Euro.

Por outro lado, para abrir a sua conta, você precisa de documento de identificação, número fiscal, comprovativo de morada e comprovante de rendimentos em Portugal.

Ademais, você precisa fazer uma videochamada para comprovar sua identidade. E, para finalizar seu processo de abertura, precisa fazer um depósito de 100 €.

Então, se você quer fazer a transição para um banco digital, mas que ainda possui opções físicas, esta pode ser uma boa opção.

Moey!

Este é um banco português exclusivamente digital e direcionado ao público jovem. Você não tem custos de adesão nem de manutenção.

Um ponto para se observar, as contas do banco digital Moey! só permitem realizar transferências bancárias dentro do espaço SEPA. Ou seja, apenas os países da União Europeia e alguns outros, como Reino Unido, Mônaco, entre outros.

Para abrir sua conta, você precisa de documento de identidade, ser maior de 18 anos, ter residência em Portugal e acesso a algum celular.

Além disso, você pode ter acesso a cartão de débito tanto físico quanto digital, sem nenhum tipo de custo de disponibilização.

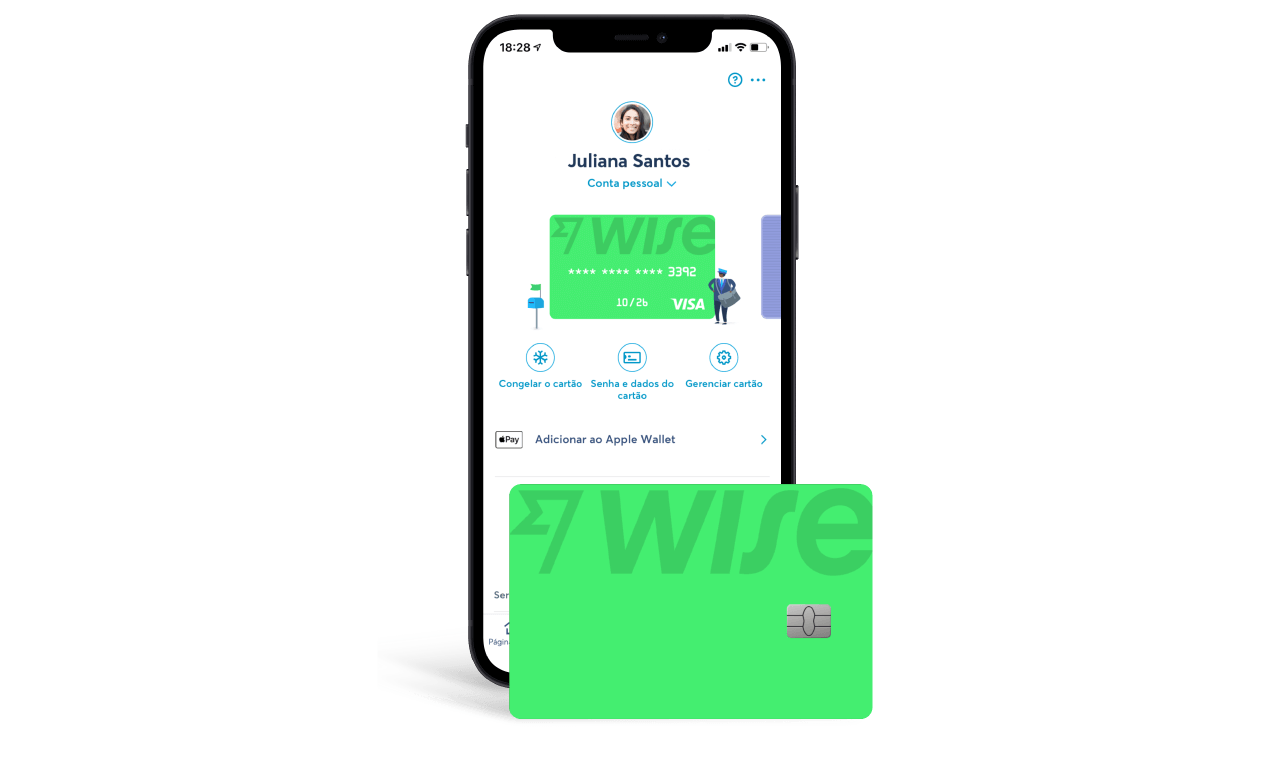

Wise

Esta é uma empresa digital que não é exatamente um banco. Mas tem funções muito similares. Assim, é uma ótima opção de conta multi-moeda para quem quer fazer transações em diferentes países.

São mais de 50 opções de moedas para fazer suas transferências com o dinheiro em sua conta. Assim, a principal vantagem é essa redução nas taxas cambiais, sem tarifas camufladas.

Além disso, a empresa disponibiliza cartão de débito internacional com ótimas vantagens. Contudo, o valor é de 7 euros.

Para abrir sua conta, não há taxas de manutenção nem de assinatura. Assim, você só precisa comprovar sua identidade através do próprio celular.

Como solicitar o cartão Wise?

Solicitar o cartão Wise é muito fácil. Afinal, acontece de forma online e rápida, sem qualquer tipo de complicação.

OpenBank

Esta opção é do banco Santander e tem base na Espanha. Assim, o OpenBank é uma conta à ordem, gratuita e sem cobrança de comissões. Além disso, esta opção oferece um Cartão Я42 totalmente grátis.

Ele funciona tanto como cartão de débito tradicional, quanto como cartão de viagem com vantagens exclusivas. Contudo, para ativar a segunda opção é necessário o pagamento de uma mensalidade de 7,99€ para uso.

Ademais, você pode abrir tanto online, quanto entrando em contato por telefone com os canais de atendimento. Basta apresentar sua identidade e comprovativo de morada.

Independente da forma, a adesão é muito prática e você pode realizar todas suas transações pelo seu smartphone.

Como pedir o cartão de débito R42?

O cartão R42 possui cobertura internacional e bandeira Mastercard, além de outros benefícios. Então, não deixe de conferir, hoje, o passo a passo para requerê-lo de forma fácil e cômoda!

BIG

O Banco de Investimento Global é mais uma opção de um banco digital português. Assim, você pode abrir sua conta 100% online através de uma videochamada. Só é necessário ter comprovativo de residência, NIF e Cartão Cidadão.

Além disso, você precisa depositar 2000€ para poder ativar sua conta. Por outro lado, não há nenhum tipo de taxa de abertura ou manutenção.

Aliás, você pode realizar vários investimentos com sua conta BIG, desde a poupança, até diferentes fundos além de poder solicitar um cartão de débito internacional da bandeira Mastercard.

Essa opção conta com tecnologia contactless e seguro viagem e proteção para suas compras. Mas, possui taxa de adesão e manutenção. Confira como aderir ao BIG lendo o nosso passo a passo disponível no botão abaixo.

Como abrir sua conta à ordem BIG 100%?

O banco BIG oferece a opção de conta online cheia de benefícios. Quer saber como abrir a sua? Confira o passo a passo e aproveite!

Em Alta

Como e onde comprar criptomoedas em Portugal facilmente?

Onde comprar criptomoedas em Portugal? Para investir nesse mercado em alta é preciso saber boas opções de onde comprar. Descubra aqui!

Continue lendo

Apoio Social Comunidade de Inserção: o que é?

O Apoio Social Comunidade de Inserção é um auxílio da Segurança Social. Seu objetivo é ajudar pessoas em exclusão social a se reintegrar!

Continue lendo

Como pedir o cartão de crédito Caixa Platina?

Pedir o cartão Caixa Platina é simples e você aproveita diversas vantagens especiais, como bandeira Visa e cobertura internacional!

Continue lendoVocê também pode gostar

BPI Net Empresas: veja o que é, como funciona, vantagens e desvantagens

O serviço BPI Net Empresas veio para facilitar a gestão das finanças do seu negócio. Conheça mais sobre ele e como usar sem complicações!

Continue lendo

Cartão Wizink Flex ou Wizink Rewards: qual o melhor?

Cartão Wizink Flex ou Wizink Rewards? Ambos possuem bandeira Visa internacional, além de vantagens exclusivas como descontos e seguros. Veja!

Continue lendo

Como pedir o Cartão de Débito 14/17? Veja o passo a passo

Veja o passo a passo e todos os documentos para pedir o Cartão de Débito 14/17, uma solução financeira perfeita para jovens!

Continue lendo