Crédito

Simulador CréditoConsolidado.pt: como utilizar?

O simulador CréditoConsolidado.pt é uma ferramenta perfeita para quem precisa renegociar suas dívidas. Assim, podes realizar a simulação virtual pela internet! Veja como!

Anúncios

Simulador CréditoConsolidado.pt: descubra como utilizar com um clique!

Quer saber como se faz para utilizar o simulador CréditoConsolidado.pt? Fica tranquilo, que te mostraremos todos os detalhes. Primeiramente, saibas que este é um sítio. Ou seja, toda a simulação é realizada virtualmente.

A instituição recolhe dados de diversos bancos na internet e oferece as melhores opções de poupança para ti. Assim, confira agora mesmo o sítio do simulador CréditoConsolidado.pt.

Mas, caso te interesses, podes conferir um passo a passo sobre como realizar a simulação e utilizar o sítio. Então, continua lendo esse texto para obteres todos os dados dessa função.

Passo a passo para utilizar o simulador CréditoConsolidado.pt!

Primeiramente, para utilizar o simulador CréditoConsolidado.pt, precisas acessar o sítio da instituição financeira. Vale lembrar que todo o processo da simulação se dá online!

Em seguida, preenche os dados requisitados sobre teus créditos. Por exemplo, é necessário informar o montante da tua dívida, a soma das prestações, em quantos meses desejas pagar e se precisas de um valor adicional de crédito.

Assim, clica em “receber oferta”. Nesse momento, já ficarás a saber do montante que poderá poupar. Contudo, essa será apenas uma estimativa, primeiro o simulador precisará analisar seus dados.

Desse modo, mais adiante, poderás consultar o melhor crédito que te farás poupar ao máximo. Assim, depois de escolheres a melhor opção, ao utilizar o CréditoConsolidado.pt, ele cuidará de todos os detalhes para ti.

Você será redirecionado a outro site

Pelo telemóvel

Além da opção online, podes optar por entrar em contato com o simulador CréditoConsolidado.pt através dos números telefónicos. Aproveite que é grátis!

Assim, pode entrar em contato para tirares dúvidas sobre como funciona a simulação. Então, entre em contato pela app do WhatApp. Para isso, entre no sítio e clique na opção “Fale conosco”, no canto superior da tela.

Então, clica na opção WhatsApp. Tu serás redirecionado e, assim, poderás conversar com um atendente.

Ademais, pode contactar o telefone: +351 220 931 950. É assim que deves utilizar o CréditoConsolidado.pt!

Alternativa recomendada: Crédito pessoal moey!

Não é que utilizar o simulador CréditoConsolidado.pt é fácil e prático? Com ele, você consegue renegociar as tuas dívidas. Mas, se estiveres em busca de algum tipo de crédito pessoal, que tal conheceres uma nova opção?

Então, tu já ouvistes falar do crédito pessoal moey!? Essa é uma oportunidade única de uma instituição financeira atenta ao mundo jovem e às necessidades de todos.

Dessa maneira, se buscas por um montante significativo de dinheiro, com taxas baixas e prazos longos, que tal conheceres as opções que a moey! te oferece?

Caso queiras saber mais sobre como esse crédito pessoal funciona e quais as vantagens que ele oferece, podes consultar a qualquer momento o nosso conteúdo. Clica abaixo e saiba mais sobre as condições do empréstimo moey!

Conheça o crédito pessoal moey!: vantagens exclusivas!

O crédito pessoal do banco moey! surgiu para facilitar sua vida, com solicitação online sem burocracias! Então conheça como ele funciona e veja quais são as taxas.

Em Alta

Como solicitar o cartão Wizink Rewards?

Descubra aqui o passo a passo de como solicitar o cartão Wizink Rewards sem anuidade e tenha acesso às vantagens exclusivas!

Continue lendo

Saiba como contratar a Finance Star e tenha assistência para empréstimo!

Ao contratar a Finance Star Crédito Pessoal você tem assistência de qualidade para contratar o crédito de sua preferência. Saiba como fazer!

Continue lendo

Como solicitar o crédito pessoal Reorganiza?

O crédito Reorganiza pode ajudar você a reorganizar as finanças sem complicações. Confira aqui como contratá-lo sem sair de casa.

Continue lendoVocê também pode gostar

Como solicitar o Crédito Pessoal Santander?

Saiba hoje mesmo como contratar o crédito Santander sem sair de casa e sem perder tempo. Assim, tenha dinheiro para conquistar seus sonhos!

Continue lendo

Vale a pena fazer um PPR como investimento?

Subscrever a um investimento PPR vale muito a pena, porque pode aproveitar as melhores taxas de rendimento em poupança com abatimento no IRS!

Continue lendo

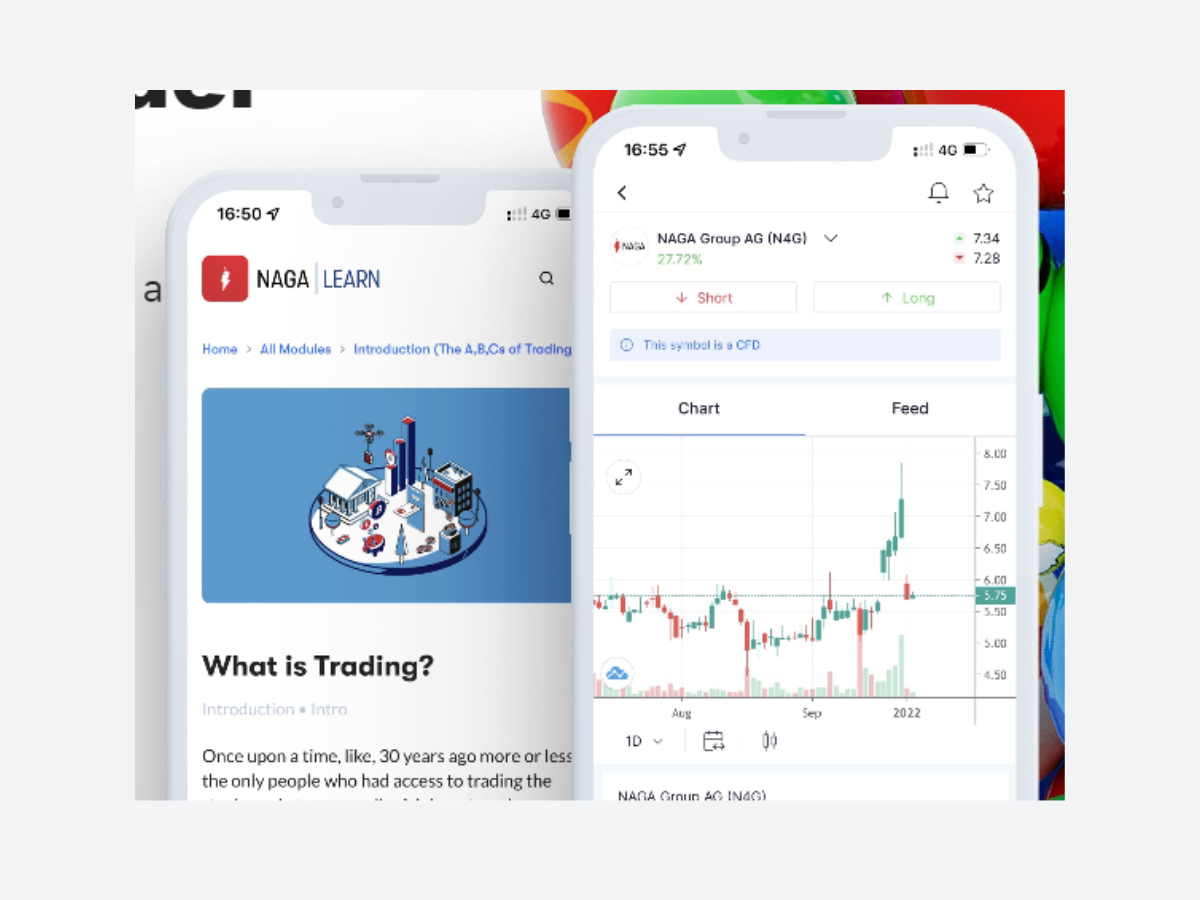

Veja como negociar com a Naga: comece com 950 instrumentos!

Entenda como negociar com a Naga e consiga variedade de investimentos na sua carteira: cripto, ações, commodities e mais!

Continue lendo