Account

Millennium BCP Savings Account: Save as much and whenever you want!

Learn how to save safely with the Millennium BCP Savings Savings Account! The minimum deposit limit is just €25 to start saving!

Advertisement

Millennium BCP Savings Account: freedom to save!

If you want to know more about how the Aforro Millennium BCP Savings Account works, rest assured as we will offer you all the necessary information. This way, you can start investing in the best savings option for you!

So, the Aforro Millennium Savings Account is an option from the BCP (Banco Comercial Português) savings center. And it is an ideal account for those who want to save money without major risks!

Find out how to open your Millennium BCP Savings Account now!

You can open your current account at BCP today through the website. Then, you can easily open your Aforro Savings account without leaving home and start saving!

So, if you want to know more details about how this savings works, what the rules and available income are and even whether it is a worthwhile savings, keep reading the text!

How does the Millennium BCP Savings Account work?

The Aforro BCP Savings Account is an opportunity to realize and obtain small income with your money.

Firstly, this is a savings model that has an investment period. Thus, it is semester-based, but renewable for a total of 29 semesters. However, each semester will present different performance.

Therefore, Poupança Aforro's income is 0.25% in the first half of its investment, following TANB! On the other hand, in the second half of investment, you can reach interest of 0.5% from TANB!

From the third semester onwards, until the last one you leave invested, you will receive the current rate, that is, it follows Portuguese inflation. So, after the second semester of investment, the bill stops being so worth it!

Advantages and disadvantages

As we said above, the main disadvantage of the Aforro BCP Savings Account is the interest rate after the second semester, which means that there is no real income, just a natural appreciation of the amount deposited.

However, one of the advantages is the fact that the minimum deposit limit for the account to work is just 25 euros. Remembering that the maximum deposit is 100 thousand euros! So, know how much you intend to deposit in advance!

In fact, there are no mandatory deliveries, you can make the reinforcements monthly or at the best time for your financial situation!

One point that could be negative is that although the movement can be carried out at any time, there is a total commitment to the interest that it generates on the amount. In other words, the ideal is to leave the money until the end of the term!

How to open and use your Millennium BCP Aforro Savings Account?

Saving with the Millennium BCP Aforro Savings Account just got a lot simpler, right? So, you can open your account right now! To do this, you just need to contact BCP!

Don't you want to have all your doubts answered to open your account safely? So, if you want to check what documents are needed and how to open your account, you can check out an exclusive step-by-step guide!

So, don't waste any more time, access the link below and find out all the details on how to use and open your Aforro BCP Savings Account and save your money!

Find out how to open your Millennium BCP Savings Account now!

You can open your current account at BCP today through the website. Then, you can easily open your Aforro Savings account without leaving home and start saving!

About the author / Filipe Travanca

Reviewed by /

Senior Editor

Trending Topics

Discover the R42 debit card

The R42 debit card has numerous benefits, such as free withdrawals, digital account and Mastercard brand. Check out more advantages here!

Keep Reading

How to join the eToro broker? Learn here!

See how to join the eToro broker and enter the world of investments with an offer of more than 3000 assets available to trade.

Keep Reading

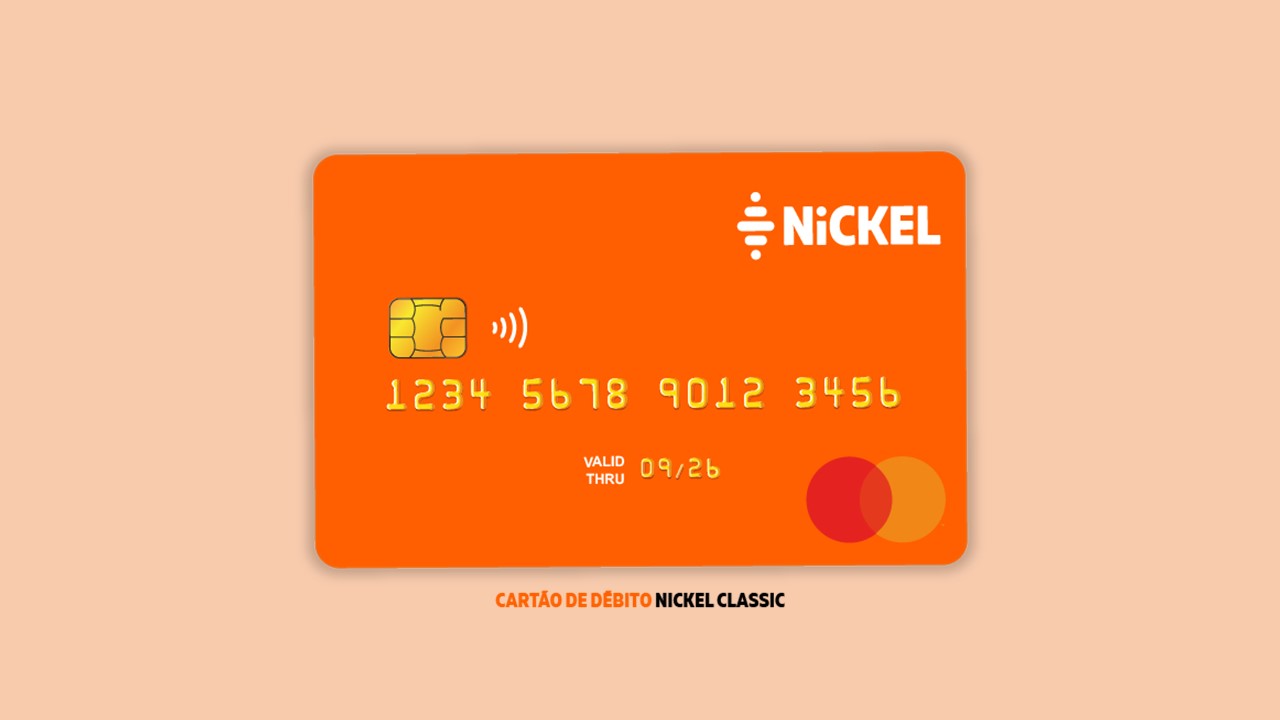

Nickel Classic debit card: how does it work?

Find out how the Nickel Classic debit card works. Click here and discover the advantages and disadvantages of subscribing to this card!

Keep ReadingYou may also like

Discover the Activo Bank credit card

Do you want a card full of benefits, such as a points program and partner promotions? Find out everything about the Activo Bank credit card!

Keep Reading

Aid of 125 euros to minimize the rise in inflation: find out more

In addition to paying 125 euros to minimize the rise in inflation, the Portuguese government also proposes other aid. Get to know them!

Keep Reading

Millennium BCP Gold or Millennium BCP Platinum Card: which is best?

Millennium BCP Gold or Millennium BCP Platinum Card? Both offer the Millennium Rewards Program and exclusive benefits. Compare!

Keep Reading