Account

Discover the AB Premium Account: access more products and services for a reduced monthly fee

Discover AB Premium services, designed especially to boost your ActivoBank account. With reduced prices, it gives access to a series of financial products and services! Know more!

Advertisement

Find out everything about the AB Premium account: countless benefits for just €7.99 per month

Discover the AB Premium Account, it can make your ActivoBank account much more robust. Today is your chance to learn more about it and discover the advantages it offers.

In fact, this addition to the account stands out for giving you access to benefits in your account. With it, you can receive cashback on purchases and discounts on services.

See how to sign up for the AB Premium Account: access discounts, products and services!

Find out how to boost your Activo Bank account with AB Premium, which gives you cashback, personal credit options, medical assistance and more benefits! The step-by-step process for joining is simple, so check it out here!

Likewise, it also has insurance protection without the need to pay more for it, in addition to having advantages for investments on the stock market and safekeeping of securities.

All this for just 7.99 Euros per month. So this is a great way to get benefits at low cost. So, you won't be left out, will you?

Discover the AB Premium account and how it works!

In fact, the AB Premium account is not exactly a bank account. After all, it corresponds to an additional package of products and services.

So, by hiring her you add advantages to the bank account you already have with AB! However, to be able to hire, you must already have a bank account.

To hire Premium services, you need to invest €7.99 per month. Despite this, be aware that the services included in the package originally cost €53.56 per month.

Therefore, you achieve several advantages with a super discount! It has never been easier to access various products and benefits.

In fact, you can purchase the product under these conditions until December 31st of this year. On the other hand, you can cancel the contract at any time, as there is no loyalty!

Benefits

Discover the benefits that the AB Premium account gives you access to for just €7.99 per month:

- Active salary with reduced APR rate of 14.0% | TAN of 7.100%, without the need for a monthly commission, which is normally €2.99;

- Personal credit without opening commission APR of 8.4% | TAN of 7.000%;

- Cashback 3% on household expenses;

- 5 Immediate Transfers per month;

- Gold Seat in Investment Webinars;

- 2 Grant Order per month;

- Title safekeeping;

- Emergency medical assistance at home;

- Family Civil Liability Insurance;

- Debit card with no commission for availability;

- Free SEPA and MBWAY transfers;

- Visa Classic credit card with no availability fee and with APR 15% and TAN 13.700%;

- €13 in Stock Orders;

- No loyalty;

- Immediate use.

Disadvantages

The promotional package under these conditions can only be purchased until December 31, 2022. So, hurry up so you don't miss the opportunity!

How to subscribe to the AB Premium account?

Anyone who already has an ActivoBank account can purchase the Premium package via the app, telephone or at customer service counters. On the other hand, if you don't already have an AB account, you will need to open one.

Then, once you have an account open, you can request the additional service. Want to know how? Just access the link below! We did a complete step-by-step guide, so check it out!

See how to sign up for the AB Premium Account: access discounts, products and services!

Find out how to boost your Activo Bank account with AB Premium, which gives you cashback, personal credit options, medical assistance and more benefits! The step-by-step process for joining is simple, so check it out here!

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

What are credit simulation platforms? Discover everything about them!

Do you know what credit simulation platforms are and how they work? Check out everything about this type of tool below today!

Keep Reading

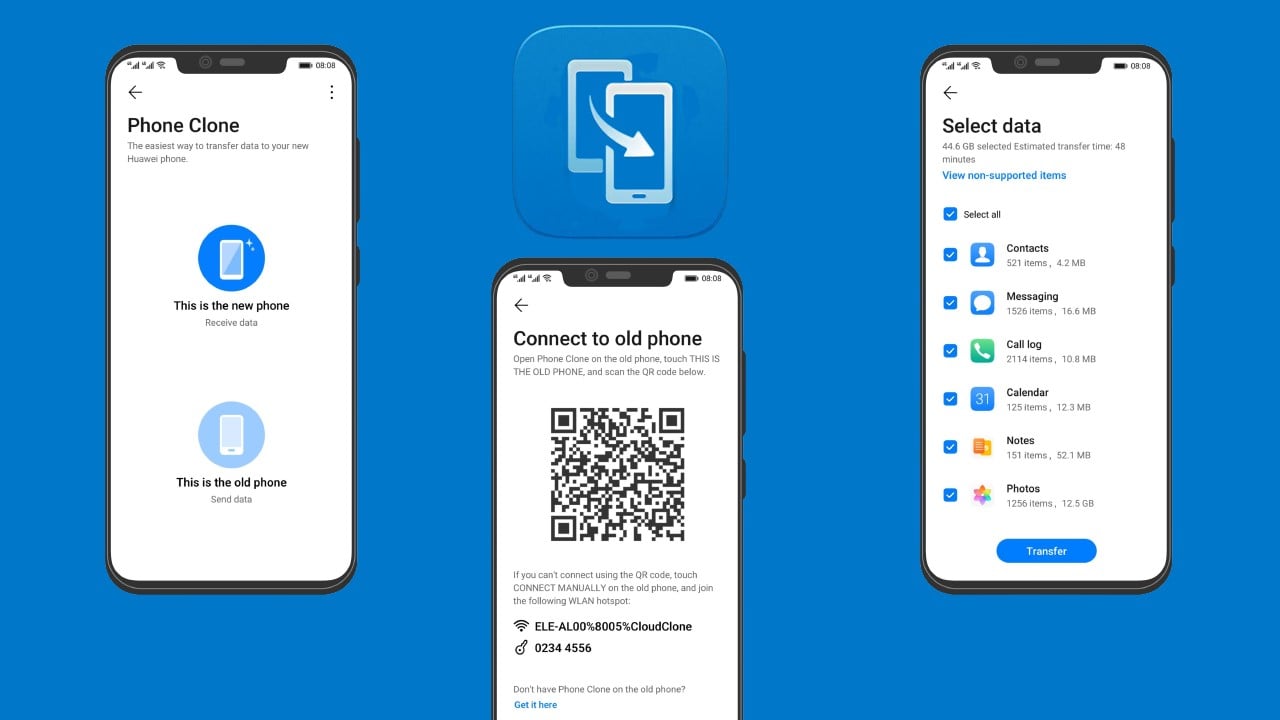

App Phone Clone: the solution to migrate your data

Don't depend on the internet! Transferring your data from an old device to a new one can be quick and easy using the Phone Clone app!

Keep Reading

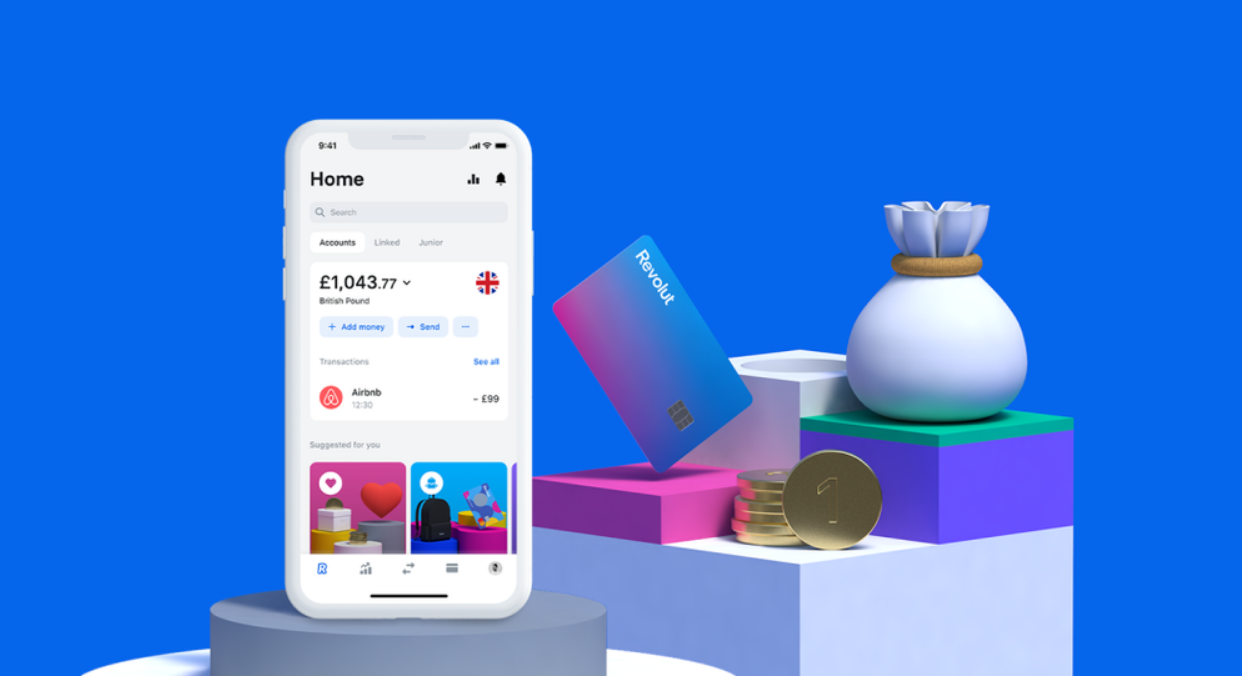

Discover the Revolut Standard credit card

Revolut Standard is a fee-free card that has an app for managing your finances online! Discover more advantages here.

Keep ReadingYou may also like

What are the types of home loan rates? Find out how they work

Are you going to apply for a loan to purchase or build a property? Find out what types of home loan rates are and see which ones are the best!

Keep Reading

Get to know the Bitcoin.com brokerage: what is it and how does it work?

Get to know the Bitcoin.com broker and how it works. Buy, sell and trade Bitcoin, Bitcoin Cash, Ethereum and selected cryptocurrencies.

Keep Reading

Aid of 125 euros to minimize the rise in inflation: find out more

In addition to paying 125 euros to minimize the rise in inflation, the Portuguese government also proposes other aid. Get to know them!

Keep Reading