Cards

How do I order the TAP Fly + card?

The TAP Fly + Card is an excellent option for consumers who make several trips. But what is the application process for this financial product? Check out more information below.

Advertisement

TAP Fly+ card

The TAP Fly + Card is mainly recommended for people who like to accumulate miles to exchange for airline tickets. Issued under the Visa brand and with international coverage, the customer starts accumulating miles from the first purchase. So, check out today how to request your TAP Fly + card to enjoy all its advantages!

Well, holders can make purchases in cash or in installments with the TAP Fly + Card, as long as the establishment is accredited with the Visa brand. By requesting this model, the holder has access to exclusive advantages and features.

Although the model charges an annual fee of €40 for its holders, all the benefits are worth it. However, it is important to be aware of the APR of 15.3%, as it can harm your financial life.

Anyway, the TAP Fly + card deserves to be highlighted for several reasons, one of which is the Miles Program. Furthermore, the holder of this financial product can purchase airline tickets in up to 3 interest-free installments.

Step by step to request your TAP Fly + card

Firstly, before requesting the TAP Fly + Card, consumers should check whether this model meets their needs or not. After all, even though it makes your everyday shopping easier, there are more options on the market that are recommended.

However, if you are looking for a model that provides Program and Miles and air ticket installments in up to 3 interest-free installments, this model is suitable for you! Check out how to issue your card below!

Request online

To request this card, consumers must access the financial institution's official page. When entering the page, click on “Join now”. And then, correctly fill in all the requested data.

The institution will ask about the characteristics of your credit card model, as well as personal data. Therefore, have proof of residence and income on hand, as well as other documents that will be requested during completion.

Request via the app

Unfortunately, the TAP Fly + credit card can only be requested via the official website. In other words, the financial institution does not have an application to control the management of its model, not even to request this product.

Through the official application, consumers can only monitor the balance available on their card. Furthermore, it is possible to change the payment method, make payments, unlock the card and change the limit.

Recommended alternative: Conforama Card

Are you in doubt about whether or not to apply for the TAP Fly + card? If you don't know whether or not this model is suitable for your consumer profile, it's worth getting to know more financial products that can compensate.

One of the alternatives for this financial product is the Conforama Card. However, before requesting any of the models, it is important to compare the alternatives and choose the one that best meets your needs.

| TAP Fly+ | Conforama | |

| Annuity | 40€ | Exempt |

| Do you accept denial? | No | Uninformed |

| Flag | Visa | MasterCard |

| Roof | International | International |

| Benefits | Miles Program | Exclusive discounts |

How to apply for the Conforama credit card

The Conforama credit card has numerous benefits, such as no annual fee, among others. Click here and see how to request!

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

Discover the magic of the Wizink app: Simplify your financial life!

The Wizink app is an advantage for customers to manage their accounts, make transfers and request services without leaving home.

Keep Reading

Discover the best Novo Banco debit cards!

Need a card for everyday purchases? So discover Novo Banco’s best debit cards and be surprised!

Keep Reading

Unibanco Atitude or Unibanco Clássico: which is the best card?

Unibanco Attitude or Unibanco Clássico? Both have international coverage, cashback program and more! See which one is best for you!

Keep ReadingYou may also like

Unibanco app: login and benefits Unibanco Pontos

The Unibanco app offers many facilities, you can access and log in to Unibanco points! Don't be left out, take the opportunity to save.

Keep Reading

How to manage school expenses?

With the return to school, there is nothing better than knowing how to manage school expenses to ensure savings. See tips!

Keep Reading

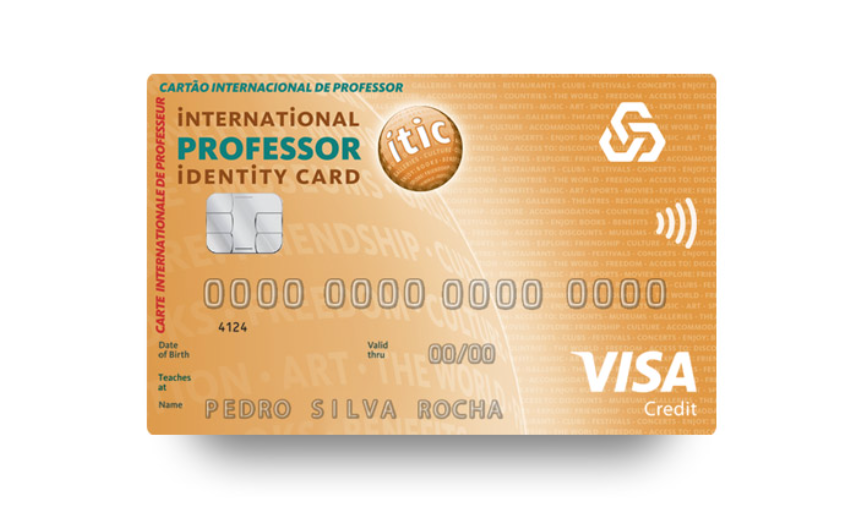

How to apply for the Caixa ITIC credit card?

Caixa ITIC credit card: how to apply? Discover how to secure the card that offers exclusive benefits for your purchases.

Keep Reading