Credit

Cetelem Fast Credit: get up to 75,000 euros in 84 months!

Quick Credit from Cetelem bank is an opportunity full of advantages to change your life by carrying out the project you want, regardless of the area. Come and find out all the details!

Advertisement

Don’t postpone what’s important – With Cetelem Personal Credit, your success story starts now!

With Crédito Rápido Cetelem, that project you have been wanting for so long can finally be realized. This credit is the key to turning your plans into reality.

Whether it's a trip, renovating your dream home or taking a leap in your career, Crédito Rápido Cetelem is the ally that is always at your side. With a simple and quick process, you can have the money you need.

After all, life is made up of opportunities that deserve to be seized, without obstacles in the way. So, find out about the interest rates, deadlines and amounts you can withdraw with this bank's personal credit!

Discover how to make your goals tangible and enjoy the freedom to turn dreams into achievements. Continue reading and see how Cetelem Rapid Credit can be the answer you are looking for.

What is Cetelem Fast Credit?

Quick Credit offered by Cetelem bank is an opportunity to make your dreams come true with a financial loan that can reach up to 75 thousand euros and paid in up to 84 months in installments!

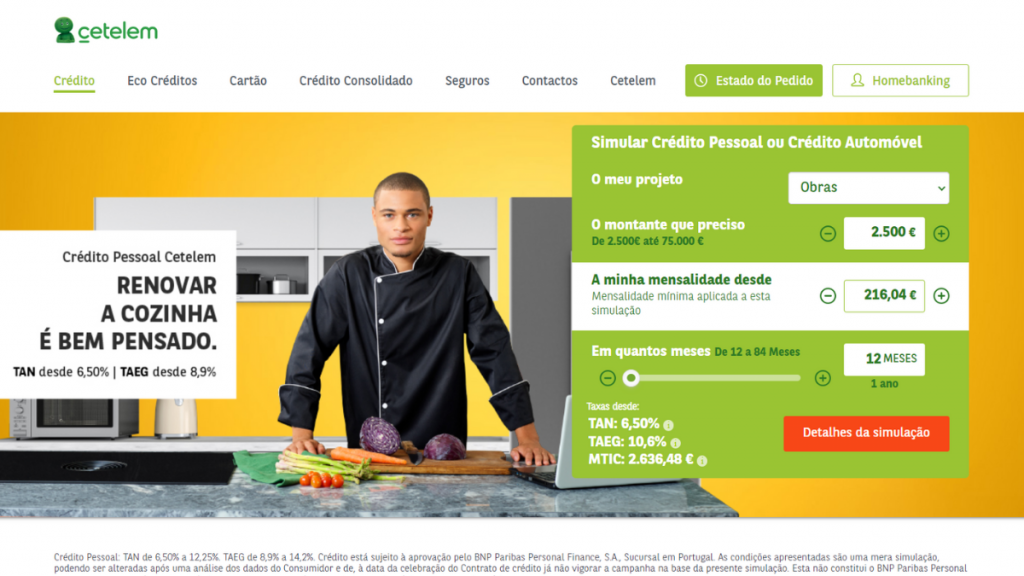

So, choose your personal project and request the amount you need. It is worth noting that APR rates start at 8.9% and TAN start at 6.5%, depending on the amounts and terms requested.

For more information, it is possible to simulate the ideal scenario directly with the bank. Furthermore, if you have any questions, you can also talk to a customer service representative and an agent to find the best option.

Advantages and Disadvantages of Cetelem Fast Credit

The main advantage of this credit is the amounts they make available to customers. Furthermore, the terms and conditions such as rates are among the most interesting on the market!

Furthermore, you can carry out the entire process without having to leave home, which is a differentiator that highlights Cetelem bank. The quick deadline for the amount to arrive in your current account is another attraction, it takes a maximum of 48 hours!

Furthermore, no disadvantages were found, but it is worth highlighting the importance of researching other financial institutions to compare credit and interest rate options to choose the most advantageous one for you!

Where to use Cetelem personal credit

There are several types of Cetelem Fast Credit. Thus, it is possible to request to use as car credit or other types of vehicles, both new and used, purchasing however you want.

Furthermore, you can use the credit for works, renovating your home, decorating or remodeling, however you want! Another possibility is to use the money for training, that is, investing in education!

It is also possible to invest in the area of health and travel, for example. In the latter case, you can make that trip of your dreams come true! Furthermore, you can also use the credit for a personal project, up to 2,400 euros!

How to apply for quick cetelem credit

It is necessary to carry out a simulation directly on the Banco Cetelem website. So, on the home page, click on the credit tab to see all the possibilities! Then fill in the information in the right field.

Therefore, you will need to enter the objective of the credit, the amount you want, the monthly payment you think you can pay and the available payment term! In fact, while simulating, the fields will self-regulate to help!

When finished, click on the red “simulation details” button. Thus, you will be redirected to a new page where you must choose between applying for insurance, or going without insurance, that is your decision!

What is the purpose of credit insurance?

An insured credit means that in the event of personal accidents and even death, your acquired asset is safe for your heirs!

In fact, clauses also cover temporary disability, absolute and permanent disability and involuntary unemployment!

Finalizing your credit application quickly!

Furthermore, you will need to log in to the bank's website, providing your NIF, email and cell phone number! So, just wait for the bank to analyze your request!

Furthermore, remember that it is essential to send the requested documentation so that the credit request can be granted by Cetelem! In just 48 hours the credit will be in your current account!

What documents are needed to finalize your membership?

In fact, in order to have the money in your current account, you need to send some documents to Cetelem bank. Among them, it is important to provide proof of identification, such as the Citizen Card.

In addition, you need to send proof of residence, be it a water, gas, electricity, telephone bill, etc. You must also send proof of your IBAN, which could be a bank statement, ATM receipt, among other options.

Furthermore, proof of pension, Model 3 of the latest IRS or even the last pay slip from contract holders may be requested depending on whether their income is self-employed, employed or a pensioner.

Recommended alternative: Mortgage Credit Solutions!

Now that you know how Credit Rápido Cetelem works, what the deadlines, fees and much more are, don't waste time and ask for your money as soon as possible, your future awaits!

But, on the other hand, how about finding out about a website or a company that helps you find the best home loan option available in Portugal? This is Soluções Crédito Habitação, the ideal option for those who want to save money.

With the best rates on the market, it is possible to save up to 20% when taking out credit for those looking for a new home, or even renovation!

So, don't miss the opportunity to find the most affordable credit and save! Access the link below and find out how Soluções Crédito Habitação works and change your life, change your home!

Housing Credit Solutions

You can join Housing Credit Solutions to find the best offer for your new home! Take advantage of the lowest spread on the market!

About the author / Filipe Travanca

Reviewed by /

Senior Editor

Trending Topics

How to use the Linha Valor Platform: credit in 48 hours!

To use the Linha Valor platform you need to access the website and fill out all your details carefully and wait for contact from the institution!

Keep Reading

How to join Naga and open an account?

Find out here how to join Naga to invest in more than 950 assets, such as crypto, commodities and more! Account opening is free.

Keep Reading

How to sign up for the My Nickel card: meet the agents!

To sign up for the My Nickel card you need to go to one of the official agents! They are located in everyday establishments in the country!

Keep ReadingYou may also like

Discover the best Novo Banco debit cards!

Need a card for everyday purchases? So discover Novo Banco’s best debit cards and be surprised!

Keep Reading

Residence Permit: what is it and how to apply?

The Residence Permit is a document allowing you to stay in Portugal. It can be temporary or permanent, see which one is yours!

Keep Reading

Discover the TAP Gold credit card

National and international coverage, Visa brand, miles program and many other advantages. Discover the TAP Gold credit card here!

Keep Reading