Educação Financeira

Certificados de Aforro: o que são e quanto rendem?

Para quem está em busca de novos investimentos ou está começando a investir, os Certificados de Aforro são perfeitos. Veja como funciona.

Anúncios

Certificados de Aforro: faça investimentos seguros!

Quer saber o que são os Certificados de Aforro e quanto rendem? Esse é um ótimo investimento para quem está procurando títulos com baixo risco.

Assim, com juros compostos e rendimento trimestral, os Certificados de Aforro são uma das opções mais procuradas por pequenos investidores. Esse tipo de investimento é realizado desde 1960.

Corretora Casa de Investimentos: veja seu dinheiro crescer e garanta seu futuro

A Casa de Investimentos ajuda você a encontrar as melhores alternativas para o seu dinheiro crescer. Conheça a opção e tenha maior rentabilidade, além do auxílio de especialistas do mercado.

Além disso, existem diversos tipos de séries condizentes com períodos históricos específicos. Assim, atualmente a série que circula no mercado para subscrição é a série E. As outras não estão mais disponíveis.

Então, todas as informações desse texto são relativas à série mais recente. Contudo, se você tem um investimento em outra série verifique suas regras específicas. Quer mais informações para fazer seu investimento? Então continue lendo.

O que é Certificados de Aforro?

Primeiramente, os Certificados de Aforro são títulos de dívida pública que rendem de forma controlável. Mas, o que isso significa?

Quando você adquire Certificados de Aforro, você está emprestando dinheiro ao Estado Português. Assim, você recebe o juros do dinheiro em retorno. Este é um investimento de risco praticamente nulo.

Isso porque o Estado oferece a garantia de pagamento. Além disso, essa é uma ótima opção para famílias e pessoas que querem começar a poupar. Por isso, ele é muito fácil de subscrever e resgatar.

Por outro lado, existe uma cobrança de impostos sobre o rendimento trimestral, são 28% do lucro. Contudo, o valor que você recebe já tem a taxa do imposto descontada.

Você será redirecionado a outro site

Duração

Aliás, o investimento funciona trimestralmente, de acordo com os juros.

Ou seja, quando você faz a aquisição de certificados de aforro, pode retirar o montante investido mais os juros em três meses.

Contudo, o período de investimento total é de 10 anos. Ademais, existem diversos mecanismos para te beneficiar quanto mais tempo você deixar seu dinheiro investido.

Além disso, não existe nenhum encargo ou punição por retirar o valor antes dos 10 anos.

Quem pode adquirir?

Qualquer pessoa pode adquirir os Certificados de Aforro. Você só precisa disponibilizar alguns documentos. Menores de idade, inclusive, também podem ter Certificados de Aforro.

Contudo, não podem amortizar antes de chegarem aos 18 anos, a não ser que sejam emancipados. Aliás, é possível adquirir o investimento para si ou para terceiros, mediante preenchimento de formulário disponível.

Ademais, esses são títulos não-transmissíveis. Ou seja, você não pode revendê-los ou dá-los a outras pessoas. A única possibilidade de mudança é no caso de falecimento da pessoa que detém os Certificados de Aforro.

E, nesse caso, são os herdeiros responsáveis pela amortização ou transferência nominal. Enfim, vamos ver quanto rendem os Certificados de Aforro?

Quanto rendem Certificados de Aforro?

Primeiramente, vejamos como o juro é calculado. A taxa base de juros que regula os Certificados de Aforro é a Euribor.

Assim, como o investimento é trimestral, o valor da Euribor é a média dos três meses referentes ao investimento.

Além disso, acrescenta 1% a média. Pronto, assim você tem o valor do juros dos seus Certificados de Aforro. Ou seja, esse é um investimento de rentabilidade flexível.

Tudo sobre Fundos de Investimento Imobiliário

Quer saber tudo sobre Fundos de investimento imobiliário? Então você está no lugar certo. Confira, hoje, como eles funcionam e as vantagens em apostar neles!

Aliás, esse valor não pode ser superior a 3,5% nem inferior a 0%. Ou seja, você sempre lucrará. Ademais, ao fim de cada trimestre, sua taxa de juros do período é adicionada ao montante.

Assim, gerando um investimento de maior valor e consequentemente gerando mais lucro no trimestre seguinte. Ou seja, esse é um sistema de capitalização de juros.

Permanência

Além disso, como dito anteriormente, você ganha prêmios de permanência. Esse valor é adicionado à taxa base.

Por exemplo, do segundo ano até o quinto, você ganha mais 0,5%. Já do sexto ao décimo ano, ganha mais 1%.

Ou seja, quanto mais tempo você deixar seu dinheiro investindo no período de 10 anos, mais você ganha.

Ademais, cada unidade de Certificado vale um euro. Contudo o mínimo de investimento é de 100 €. Enquanto isso, o máximo pode chegar a 250.000 € por Conta Aforro!

Como subscrever Certificados de Aforro?

Quer saber como adquirir seus novos Certificados e começar a investir? Então saiba que é muito fácil adquirir os Certificados de Aforro e realizar seu investimento.

Além disso, você pode fazer sua subscrição a qualquer momento, dependendo apenas dos horários de atendimento.

Aliás, não há taxas para o procedimento de subscrição, o que é um ótimo investimento.

E, como dito, qualquer um pode subscrever a qualquer momento, mas onde você pode fazer esse processo? São duas formas bem simples, presencial e virtual!

Presencial

A primeira forma de você subscrever pode ser através de qualquer estação dos CTT. Assim, você precisa apresentar um documento de identificação e um número de contribuinte.

Além disso, você deve ter uma Conta Aforro, que também pode ser aberta em um balcão do CTT ou do IGCP.

Assim, você deve associar sua conta bancária onde é vinculado o resgate e os pagamentos.

Online

Por outro lado, é possível fazer o processo virtualmente. Para isso, você já deve possuir a sua Conta Aforro.

Então, basta entrar no sistema AforroNet, disponibilizado pelo IGCP. Assim, basta realizar seu cadastro e pode gerenciar totalmente a compra de Certificados de Aforro.

Desse modo, você não depende do horário de funcionamento dos balcões para subscrever.

Ademais, nesse sistema também é possível você gerenciar seus dados, alterando endereços e conferindo sua carteira a qualquer momento.

Conclusão

E então? Gostou de saber o que são e quanto rendem os Certificados de Aforro? Não perca essa oportunidade e faça seus investimentos.

Mas, como dissemos, é importante que você tenha uma Conta Aforro. Quer saber como você pode subscrever a essa conta?

Preparamos um passo a passo perfeito para você entender melhor como funciona esse processo. Clique no link abaixo e descubra como começar seu investimento o quanto antes!

Como subscrever em uma Conta Aforro?

Ter uma Conta Aforro é a chave para começar seus investimentos de forma segura. Veja como fazer para subscrever e abrir a sua o quanto antes.

Em Alta

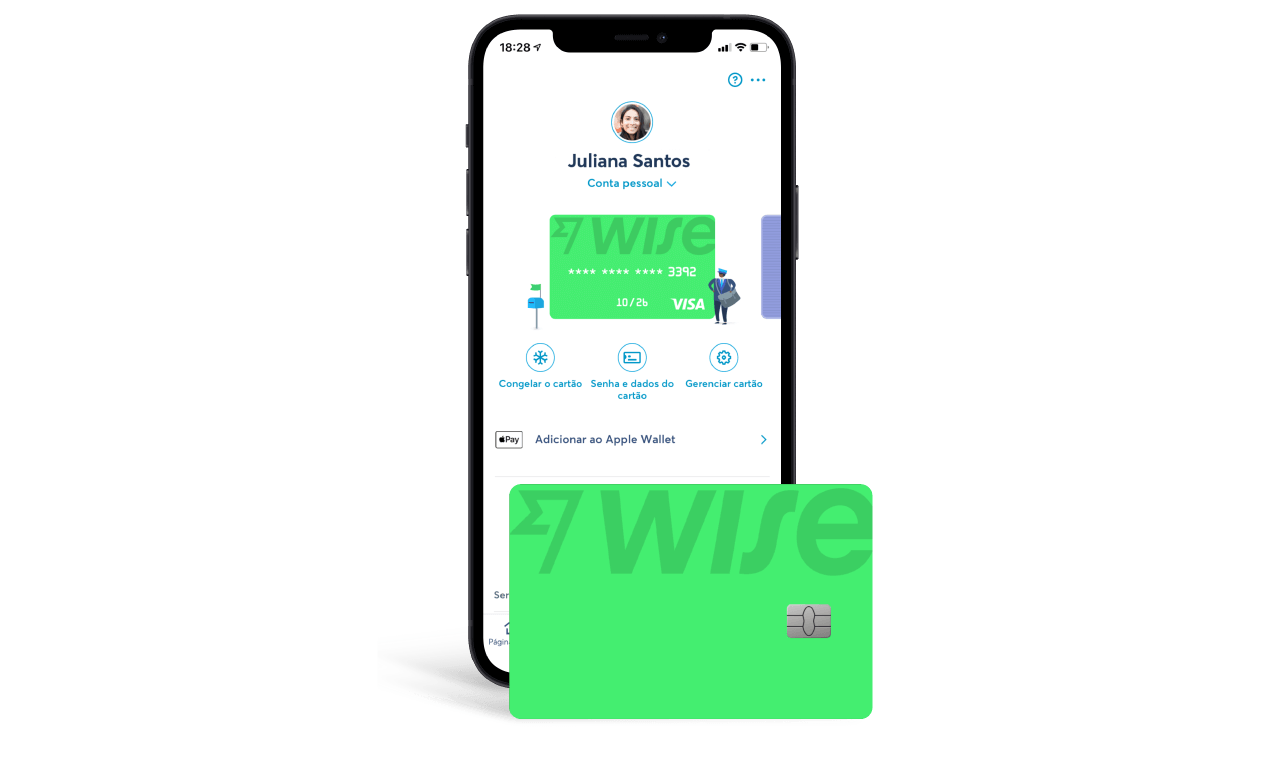

Conheça o vantajoso cartão de débito Wise

Com bandeira internacional e prática adesão online, o cartão de débito Wise possibilita transações em 50 moedas diferentes! Saiba mais!

Continue lendo

Como solicitar o cartão Netshoes? Veja aqui!

Para fazer o cartão de crédito Netshoes, você precisa acessar a página oficial e realizar a adesão online! O processo é rápido, veja aqui.

Continue lendo

Cartão de Cidadão 2023: novidades e como renovar

Em 2023 o Cartão Cidadão terá novidades. Assim, o documento será mais seguro e com design novo. Lembre-se de renovar o seu antes de vencer!

Continue lendoVocê também pode gostar

Conheça o crédito consolidado Gestlifes: até 120 meses para quitar!

O crédito consolidado Gestlifes pode ser uma excelente opção para reorganizar dívidas já existentes. Conheça e confira suas vantagens!

Continue lendo

Cartão Banco Best Gold Visa ou Banco Best Gold Plus: qual o melhor?

Seja o cartão Banco Best Gold Visa ou Banco Best Gold Plus, ambos possuem cobertura internacional e várias vantagens. Compare e escolha!

Continue lendo

Conheça o cartão de débito Best Visa Electron

O cartão de débito Best Visa Electron pode ser excelente para quem quer comodidade para pagamentos e compras no dia a dia. Conheça mais!

Continue lendo