Credit

Discover Creditas personal credit!

Creditas personal credit comes in 3 different types and describes itself as having the lowest rates on the market. Is it really that? Find out more and see how to request it!

Advertisement

Creditas personal credit: guarantee low interest rates and online contracting!

Creditas personal credit is aimed at those looking for convenience and low interest rates and no bureaucracy. So, discover today everything it offers!

In fact, it is not just one type of credit. In other words, Creditas works with 3 different options that offer low interest rates. In this way, they allow extra money to be obtained without forcing the consumer to accept extremely high interest rates that are impossible to maintain.

Want to know more? So keep reading and see everything about this type of personal credit. For example, the modalities and how to hire.

How to apply for Creditas credit online?

See step by step how to apply for Creditas credit without complications or bureaucracy.

| Interest rate | From 0.89% per month |

| Payment deadline | 60 to 240 months |

| Approval | Online |

| Benefits | Lowest rates on the market, simulation and online hiring, without bureaucracy or intermediaries, access to a financial education platform, access to Creditas Store. |

How does Creditas personal credit work?

Firstly, Creditas personal credit comes in three forms. Are they:

- Loan with vehicle guarantee;

- Loan with property as collateral;

- And a payroll loan.

Therefore, the 3 types of credit that the company offers are based on guarantees. They can be the citizen's salary (consigned) or, vehicle or property. In this way, Creditas reduces the risks it assumes when offering a loan.

However, this is reflected in the possibility of limiting the interest that will accrue on the loan repayment installments. This way, everyone wins and the loan becomes a less painful reality.

Benefits

Discover the main advantages that Creditas personal credit offers you:

- 3 types of loan (Consigned; With property guarantee or; Car guarantee);

- Online simulation and request;

- Interest from 0.89% per month;

- Up to 60 months to pay loans with vehicle and loan guarantees and 240 months to pay off loans with property guarantees;

- Access to Creditas Store;

- Financial education platform, etc.

Disadvantages

On the other hand, not everything is rosy. As we saw above, only those who have assets in their name can take out a Creditas loan. Or rather, those who have assets such as property or a car or, alternatively, a steady job with registration.

Therefore, anyone who does not meet these requirements may no longer have access to credit and its lower interest rates.

How to get Creditas personal credit?

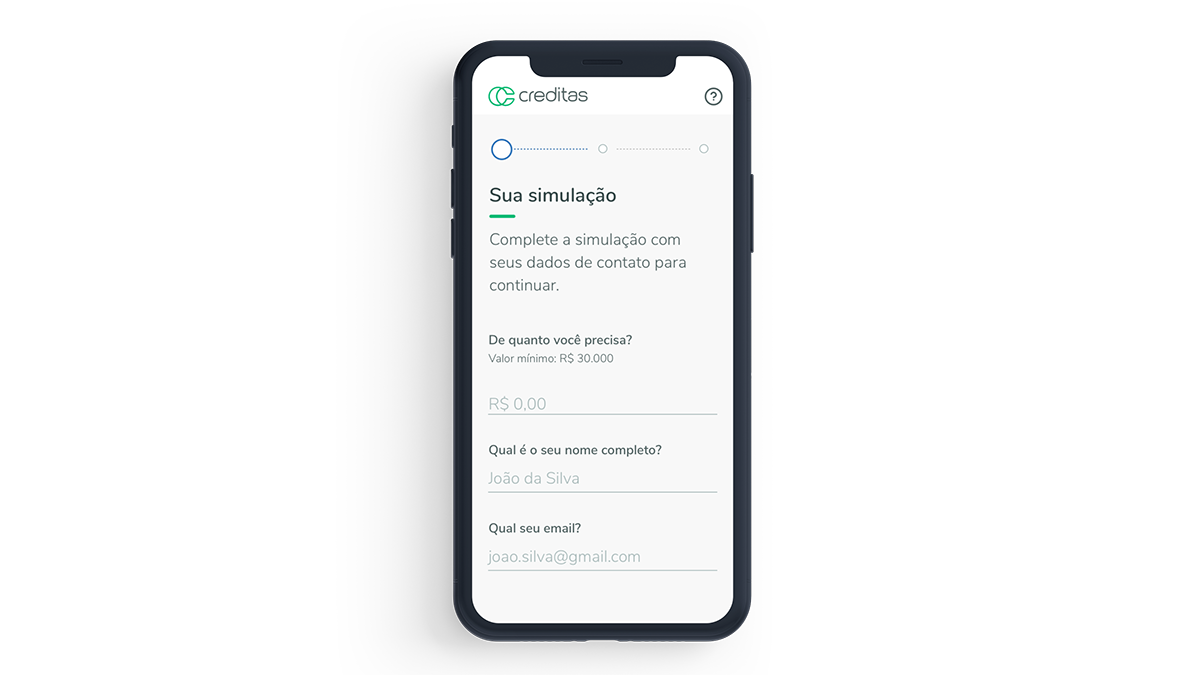

To do this, you need to access the Creditas website. Afterwards, click on “Simulate your credit” and on the option that interests you. That is, whether it is credit with a salary, vehicle or property guarantee.

Fill in the value you need, click on “Simulate now” and then fill out the form. You will receive a proposal and will immediately know the interest conditions and payment deadline. So, if you are interested, indicate acceptance, forward the documentation and wait for the money to arrive in your account! Finally, for more details, check out the link below!

How to apply for Creditas credit online?

See step by step how to apply for Creditas credit without complications or bureaucracy.

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

Savings account D: how to open yours?

The D Savings Account is easy to open. You can carry out the process both on your cell phone and on the institution's website with ease!

Keep Reading

How to teach children to save? Check out 7 tips

If you want to teach children to save, use games, offer pocket money and set an example of good financial organization yourself. Know more!

Keep Reading

Term Deposit for New AB Customers: how does it work?

Aimed at new customers, the AB Term Deposit works like a traditional savings account, with interest of up to 2% from TANB and without mobilization!

Keep ReadingYou may also like

Complete guide: Open an account with a bank in Portugal

Opening an account at any bank in Portugal is essential for anyone who wants to carry out monetary transactions and have financial freedom in the country.

Keep Reading

How to sign up for the NB Branco credit card?

Subscribing to the NB White card is a simple, quick and practical procedure. See here the step-by-step guide to access this financial product.

Keep Reading

How do I apply for the Banco Best Gold Visa card?

Learn how to apply for the Banco Best Gold Visa credit card, which has international coverage and the possibility of canceling the annual fee!

Keep Reading