Cartões

Cartão BPI ou BPI Prémio: qual o melhor?

Quer escolher entre o cartão BPI ou BPI Prémio e não sabe por onde começar? Pois saiba que ambos oferecem vantagens incríveis, como cobertura internacional e descontos em parceiros. Compare aqui suas características!

Anúncios

Descubra o melhor cartão para você entre essas opções do BPI

Para escolher entre o cartão BPI ou BPI Prémio é imprescindível que haja o estudo deles a fundo em relação às vantagens e desvantagens que ofertam. Assim, conheça-os!

Ambos os cartões pertencem ao banco BPI. Esse, por sua vez, é uma instituição bancária portuguesa. Além de cartão, então, oferece conta corrente, seguros e outros produtos financeiros bem interessantes e importantes ao dia a dia.

Em relação aos cartões, destacam-se o cartão BPI ou BPI Prémio. Eles são duas das alternativas disponíveis e fazem muito sucesso. Assim, eles acabam sendo os que mais chamam a atenção do público, que tende a ficar em dúvida entre os dois.

Mas seus problemas em relação a isso acabaram! Com as informações completas que trouxemos sobre cada ferramenta de crédito você pode decidir sem qualquer dificuldade entre eles. Portanto, continue lendo e confira!

Cartão de Crédito BPI

O cartão de crédito BPI conta a tecnologia contactless, a bandeira de atuação é a Visa, o que permite o uso do programa de pontos exclusivo. Veja como solicitar aqui!

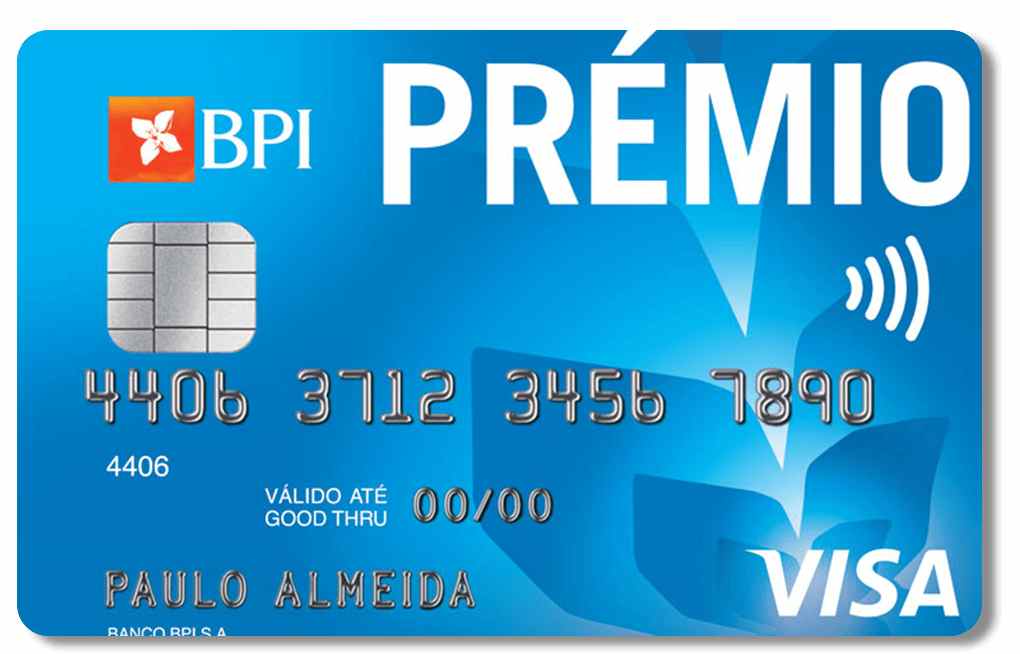

Cartão de Crédito BPI Prémio

O cartão de crédito BPI Prémio conta com programas de descontos em lojas conveniadas, que possibilita até 2% de desconto no valor da compra. Veja como solicitar aqui!

| BPI | BPI Prémio | |

| Anuidade | 20 Euros ou gratuita | € 14 |

| Aceita negativado? | Não informado | Não informado |

| Bandeira | Visa | Visa |

| Cobertura | Internacional | Internacional |

| Benefícios | Pagamento contactless, bandeira Visa Internacional, débito e crédito, possibilidade de não pagar anuidade, descontos em parceiros, possibilidade de contratar seguros adicionais | Pagamento por aproximação, até 2% de descontos em compras, até 15% de descontos em parceiros, bandeira Visa Internacional, cartão adicional com anuidade de 4 Euros, benefícios associados à bandeira |

Cartão BPI Prémio

O cartão BPI Prémio, como o nome já dá a entender, é uma versão Premium dos cartões de crédito ofertados pelo BPI. Ele oferece a função débito e crédito, sendo que para o primeiro se atrela a uma conta corrente.

Ainda, possui bandeira internacional Visa. Com isso, permite o uso no mundo todo, bem como permite compras a vista ou para pagamento no vencimento ou em parcelas. Assim, é bastante prático!

Você será redirecionado a outro site

Cartão BPI

Por outro lado, o cartão de crédito BPI é mais simples, porém isso não quer dizer que ele não tenha suas vantagens e destaques. Ele, assim como o cartão anterior, é de crédito e débito e conta com a bandeira Visa Internacional. Desde já, então, fica clara sua abrangência.

Ele também se atrela a uma conta corrente. E quando ela pertence ao BPI é possível dispensar a necessidade de pagamento de taxas de anuidade tanto para o cartão titular quanto para mais um. Assim, já começa com o pé direito!

Vantagens Cartão BPI Prémio

Para saber qual é o melhor, é interessante saber quais são os benefícios e os pontos negativos de cada um deles. Somente assim, afinal, será possível realizar uma comparação.

Dessa maneira, comecemos pelo cartão BPI Prémio. Dentre as vantagens que ele oferta destacam-se as seguintes:

- Bandeira Visa Internacional;

- Função débito e crédito;

- Pagamento por aproximação;

- Possibilidade de contratar mais um cartão na mesma conta;

- Benefícios associados à bandeira;

- Até 2% de desconto em compras;

- Até 15% de desconto em parceiros BPI;

- Possibilidade de contratar seguros conjuntamente.

Vantagens Cartão BPI

Por outro lado, são benefícios que identificamos em relação ao cartão de crédito BPI:

- Pagamento contacless;

- Bandeira Visa Internacional;

- Anuidade gratuita (na adesão à conta corrente);

- Descontos em parceiros;

- Possibilidade de contratar, conjuntamente, seguros;

- Cash Advance;

- Crédito gratuito e sem juros por até 50 dias;

- Anuidade gratuita para até 2 cartões.

Desvantagens Cartão BPI Prémio

Ainda, os dois modelos de cartões da BPI possuem seus pontos negativos. Por isso, eles devem entrar na conta para fazer a comparação e descobrir qual é o melhor para a sua vida!

No que diz respeito ao cartão BPI Prémio é possível citar como desvantagem:

- Cobrança de anuidade;

- Exclusividade para quem reside em Portugal, de modo que é preciso comprovar a residência fixa no país lusitano;

- Não há adesão online. Isto é, para fazê-lo é necessário ir até uma agência BPI e requerer pessoalmente a expedição do cartão.

Desvantagens Cartão BPI

Por outro lado, o cartão BPI também tem seus pontos negativos, dos quais se destacam os seguintes:

- Há cobrança de taxas de anuidade;

- O cartão é exclusivo para quem mora em Portugal, mais uma vez, de modo que é indispensável comprovar a residência portuguesa (embora não seja necessário ser natural de Portugal);

- Adesão ao cartão é exclusivamente presencial, não sendo possível fazê-lo pela internet;

- Para não pagar anuidade é necessário aderir à conta BPI.

Cartão BPI ou cartão BPI Prémio: qual escolher afinal?

Agora você já sabe os principais pontos sobre o cartão BPI e o cartão BPI Prémio. Com isso, é possível que ainda reste a dúvida: qual deles é melhor para fazer? Qual, então, solicitar perante o banco BPI?

Pois bem, saiba que essa é uma escolha pessoal. Afinal, é necessário levar em consideração o que você procura em um cartão de crédito, quais são suas prioridades e o que considera indispensável.

Da mesma forma, é necessário entender qual se encaixa no seu perfil, pois nem sempre é possível ter acesso a um cartão que nos interessa, uma vez que eles passam por análise de crédito e outras questões relevantes.

Por isso, a escolha, no final das contas, é sua. O que se deve fazer é comparar as opções tendo em mente o que você quer e o que não quer de forma alguma no seu cartão. Ainda, é interessante ter em mãos outras alternativas, como é o caso do cartão Millennium Caixa In! Não deixe de conhecê-lo e veja se ele não é a solução para você!

Como solicitar o cartão de crédito Caixa In?

Veja qual é o procedimento necessário para pedir o cartão de crédito Caixa In e assim ter acesso às inúmeras vantagens do cartão!

Em Alta

Conheça o cartão pré-pago Stream

O cartão pré-pago Stream é indicado para jovens de até 20 anos de idade e conta com benefícios exclusivos, como bandeira Visa. Descubra mais!

Continue lendo

Descubra os Melhores Cartões TAP para Viajar com Vantagens Exclusivas

Procurando um cartão TAP que ofereça vantagens? Descubra os melhores cartões para acumular milhas e desfrutar de descontos especiais!

Continue lendo

Movimento Júnior português: garanta desenvolvimento profissional para você!

Conheça o Movimento Júnior Português e saiba quais as vantagens que ele oferta aos universitários que estão entrando no mundo profissional.

Continue lendoVocê também pode gostar

Como aderir à corretora AvaTrade?

Uma das melhores corretoras de investimentos no mercado português está aqui. Veja agora mesmo como é simples aderir à Corretora AvaTrade.

Continue lendo

Cartão Bankinter Platinum ou Bankinter Power: qual o melhor?

Seja o cartão Bankinter Platinum ou Bankinter Power, ambos possuem tecnologia contactless e cobertura internacional. Compare e escolha o seu!

Continue lendo

9 sites para alugar casas em Portugal: encontre um lar

Quais os melhores sites para alugar casas em Portugal? A lista é grande, mas leva em conta o valor, local e condição do imóvel para arrendar!

Continue lendo