Credit

How to apply for Younited credit online?

Younited credit is a great alternative for those looking for a loan, but don't want to deal with bureaucracy and wasted time. Below, see how to request it in just a few steps.

Advertisement

Credit Younited

The Younited credit option wins more customers every day. And this is no surprise, since the institution guarantees the fastest loan on the market with good payment conditions.

Younited Credit is a company that works exclusively online. Therefore, fintech joins others in the market to further increase competitiveness with its services. And they are quite interesting.

After all, they allow you to apply for a loan without leaving home and in just a few steps. Likewise, it has good interest rates that are aimed at the company's investors. Therefore, they are usually lower than the rates normally charged in the market.

Likewise, Younited credit is great for those who like security. Therefore, the installments are fixed and you know what they are right away. This avoids unpleasant surprises with changes in values during payment.

This, in fact, can take between 12 and 84 months. This way, it can give you a nice boost in paying off your debts at the same time that you have credit on the market. Did you like it? So check out the step-by-step guide below to apply for Younited credit.

Step by step to request Younited credit

Before checking out the step-by-step guide on how to apply for a loan from Younited, there are some caveats. They refer to the requirements to become a customer of the financial company and obtain credit from them. Check out what they are:

- Reside in Portugal, so that Brazilians can take advantage of it as long as they have residence in the Portuguese country;

- Be between 18 and 70 years of age;

- Have proof of income,

Furthermore, the Younited loan undergoes a credit analysis before being released. Therefore, there is no guarantee of approval. Below, check out how to apply for it in just a few steps and without leaving home.

Request online

You can request Younited credit directly on the financial institution's website. So, follow this step by step:

- Access the website;

- Find the type of credit you want (Personal, Auto, Consolidated or Works);

- Then, fill in the amount and deadline and click “Continue”;

- Therefore, if the simulation interests you, fill in your personal details and send the requested documents;

- Wait for the pre-approval response, which is immediate. She will present 5 investor proposals. Choose the one you like best and then follow the steps on screen to complete the loan;

- Finally, wait up to 48 hours to receive the amount into your account.

Request via the app

Unfortunately, there is no way to request Younited credit per application. This occurs precisely due to the lack of a company app. However, the website can be accessed both via cell phone and computer, so it is still possible to apply for the loan.

Recommended alternative: MrFinan personal credit

| Younited | MrFinan | |

| Interest rate | Variable | Variable |

| Payment deadline | 12 to 84 months | Uninformed |

| Approval | 48 hours | Uninformed |

| Benefits | Online request, transparency regarding stages and interest, interest-free advance payment. | Request online, consolidate your credits into a single loan and save up to 60% in total amount |

How to apply for MrFinan personal credit?

See how to apply for MrFinan personal credit, which can be perfect for those looking to cover other debts and organize their financial life.

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

Get to know Cifra7 consolidated credit: making money left over has never been so simple

Cifra7 consolidated credit helps you find financial solutions that reduce your debts and organize your finances. Know more!

Keep Reading

Discover eLoan consolidated credit: savings of up to 60% in installments

The eLoan consolidated credit has online simulation and contracting. It could be the solution for you to combine your debts into one, so take a look!

Keep Reading

How to join the BitPreço brokerage?

See how simple it is to join Corretora BitPreço and have access to the best market values for Bitcoin, Ethereum and other cryptocurrencies.

Keep ReadingYou may also like

BCP Cards: discover the main products and their advantages

BCP cards can be Visa or Mastercard and some have free annual fees. Learn more about them to choose the best!

Keep Reading

Discover the Millennium BCP Gold credit card

The Millennium BCP Gold credit card has contactless payment technology and the international Visa brand. Find out more!

Keep Reading

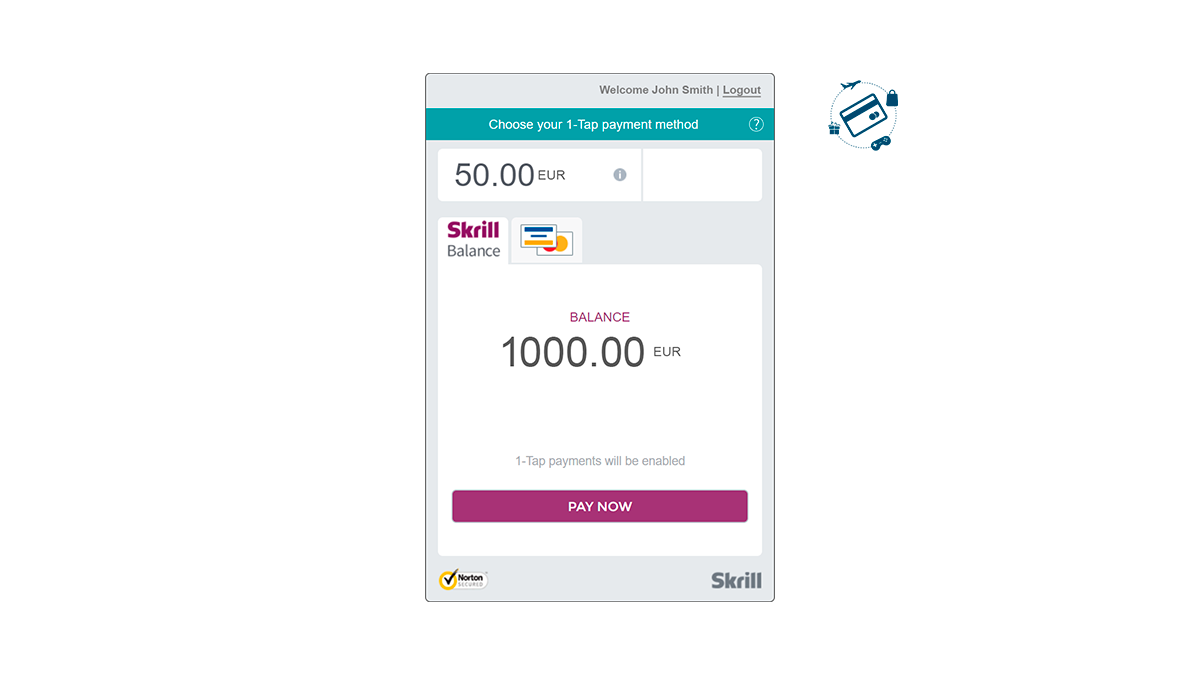

Get to know Skrill: receive, send and make payments with your digital wallet

Understand what Skrill is, how it works and the advantages of joining the multi-currency digital wallet that allows more than 100 payment methods.

Keep Reading