Credit

Discover BBVA personal credit!

Did you know that BBVA personal credit can help you buy a house, a car or travel? Approval takes up to 24 hours and interest rates are fixed! So find out more about it and see if it’s worth it for you!

Advertisement

BBVA personal credit: fixed interest rates and up to 72 months to pay off

BBVA personal credit is advantageous and can help you achieve your dream of owning your own home, changing your car, taking a trip or organizing your bills. Find out more about this financial option!

The loan is managed by Banco Bilbao Vizcaya Argentaria, famous by the acronym BBVA. Who manages the credit, then, is BBVA Consumer Finance, an arm of the institution that is responsible for transactions like this. So, keep reading to find out more about him and whether he’s worth hiring!

How to apply for BBVA Personal Credit?

See today the step-by-step guide to applying for BBVA credit and getting extra money and organizing your financial life or achieving your dreams!

| Interest rate | Fixed TAN of 9% and APR of 11.4% |

| Payment deadline | 12 to 72 months |

| Approval | In 24 hours |

| Benefits | Fixed interest rates, loan available for any purpose, good payment terms, online contracting |

How does BBVA personal credit work?

BBVA personal credit is quite simple and traditional. Firstly, there is a proposal with a credit request that is made by the citizen to the bank. Then, it analyzes the applicant's credit history and documents.

There is no need to specify what the credit will be used for, so there is freedom to direct the values. Furthermore, the payment period can be quite long, reaching up to 72 months.

Another interesting point is that credit has fixed interest rates. This means there are no surprises or variations. It is possible to know right away how much you will receive and how much will be paid, upon return, to the bank.

Therefore, this is a classic and personal loan that can help anyone who needs extra money, whatever the reason!

Benefits

Discover the main advantages that BBVA personal credit offers:

- Fixed interest rates (TAN of 9% and APR of 11.4%);

- Up to 6 years for payment (72 months);

- Online hiring;

- Amounts available for any purpose, with no need to prove the purpose of the credit.

Disadvantages

On the other hand, the negative point that we identified in the service is that it limits the loan to R$ 30 thousand euros. Therefore, it may be insufficient, depending on the customer's needs. However, in this case it is possible to seek other types of credit from the institution.

How to get BBVA personal credit?

In this sense, it is necessary to access the BBVA website and the specific personal credit page. Then, select the option to contact the bank and fill out a form with your details and a proposal. Finally, wait for contact from the institution. Anyway, for more details, check out the link below.

How to apply for BBVA Personal Credit?

See today the step-by-step guide to applying for BBVA credit and getting extra money and organizing your financial life or achieving your dreams!

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

DS Credit Intermediaries: find assistance when taking out credit!

DS Intermediários de Crédito is free and helps you find the best line of credit according to your profile. Know more!

Keep Reading

How to subscribe to a Savings Account?

Signing up for an Aforro Account is very simple. You must open your account in person at one of two types of official establishments!

Keep Reading

How to order the EuroBic Soft card?

The EuroBic Soft card has international coverage and the possibility of exemption from annual fees. Check out how to request yours here!

Keep ReadingYou may also like

Complete guide: Open an account with a bank in Portugal

Opening an account at any bank in Portugal is essential for anyone who wants to carry out monetary transactions and have financial freedom in the country.

Keep Reading

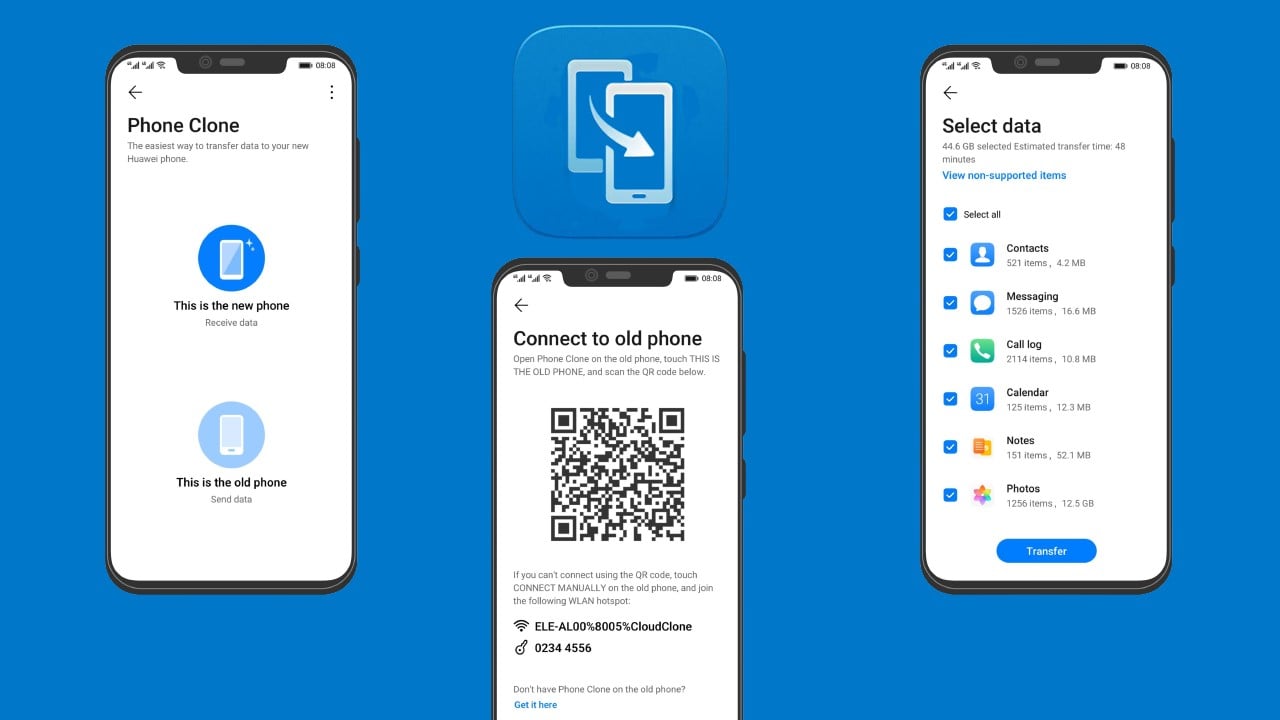

App Phone Clone: the solution to migrate your data

Don't depend on the internet! Transferring your data from an old device to a new one can be quick and easy using the Phone Clone app!

Keep Reading

Discover the NB Verde Dual credit card

Free annual fee for up to two cards and access to the Amex and Visa points programs: find out more about the NB Verde Dual credit card!

Keep Reading