Account

Discover Bankinter’s Mais Ordenado account and its benefits!

The Bankinter Mais Ordenado account has no annual fee and helps you save and profit at the same time! Want to know how? So keep reading and see everything about her!

Advertisement

Discover everything about the Bankinter account: No fees and remuneration

So, have you ever thought about not paying fees and getting paid for having an account? Because the Bankinter Mais Ordenado account offers exactly that. So, get to know it in detail!

Firstly, this is a current account that belongs to the Bankinter bank, in Portugal. In short, it is special because it guarantees the client the payment of fees every six months. They are calculated based on the account balance during the semester. In this sense, it is possible to receive up to 252 Euros.

In addition, it has other amenities. In addition to having traditional current account services, it also offers a card. Anyway, want to know more? So continue reading and see everything about this financial option below!

How to open an account at Bankinter?

See the step-by-step guide on how to open a Mais Ordenado Bankinter account and have access to all the benefits!

| Bankinter Most Ordered Account | Bankinter Card | |

| Fees | No commission; | No commission |

| Benefits | Interest-bearing account for the first 2 years with payment of up to 252 Euros; MBWay app; Unlimited national and credit transfers on SEPA; Access to the BK Power credit card, which has no commission; Possibility of access to salary overdraft. | International Visa Flag, Contacless; Exemption from the €0.50 fee when refueling at gas stations; Payment flexibility: between 3% and 100% of the outstanding amount; Online membership. |

How does Bankinter's Mais Ordenado account work?

This is a current account that comes with a credit card. To be able to use it, it is necessary to domicile the salary for it; Likewise, a minimum turnover of 800 Euros per month must be presented.

Whoever does this can then count on a fee-free account with rewards. These are revealed in the payment of remuneration on the account. It is 2% to 5% and applies every 6 months to the customer's balance.

However, to access this it is necessary to keep the account at the bank for at least 6 months. Also, it is not possible to have housing credit related to the account. On the other hand, the remuneration program ends after 2 years of joining.

Advantages and related products

Check out the main benefits of the Bankinter Mais Ordenado account:

- No annual fee;

- Online membership;

- Interest-bearing account for the first 2 years with payment of up to 252 Euros;

- MBWay application;

- Unlimited national and SEPA credit transfers;

- Access to the BK Power credit card, which has no commission;

- Possibility of access to salary overdraft.

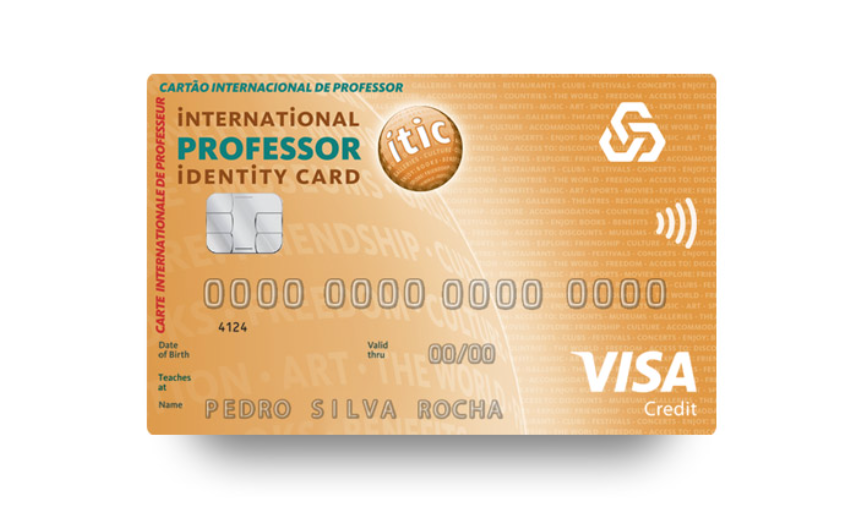

Furthermore, the account guarantees access to an international card with a Visa brand and which also offers benefits.

Disadvantages

Among the negative points of the Mais Ordenado Bankinter account are:

- Need to relate the salary to the account;

- Maintain monthly transfers of at least 800 Euros;

- Remuneration for only 2 years.

How to use your Mais Ordenado Bankinter account?

You can use it through internet banking, through the app or using your debit and credit card. So, have the freedom to make transactions the way you prefer!

Finally, below, see details on how to open the account.

How to open an account at Bankinter?

See the step-by-step guide on how to open a Mais Ordenado Bankinter account and have access to all the benefits!

About the author / Aline Augusto

Reviewed by /

Senior Editor

Trending Topics

How to apply for the Caixa ITIC credit card?

Caixa ITIC credit card: how to apply? Discover how to secure the card that offers exclusive benefits for your purchases.

Keep Reading

Discover the Bankinter Platinum credit card

The Bankinter Platinum credit card has several benefits, such as insurance and international coverage. See more about the financial product!

Keep Reading

How to request and activate the Bankinter Power card?

Ordering and activating the Bankinter Power card is very simple. Learn in just a few steps how to get an international card with no annual fee!

Keep ReadingYou may also like

Plus500 or Binance brokerage: which is more worth it?

For those who want to invest in cryptocurrency, choosing the broker is as crucial as the currency. But which one is more worth it? Plus500 or Binance?

Keep Reading

Discover the Montepio + Vida credit card

The Montepio + Vida credit card has numerous benefits, international coverage, free membership, among others. See more about him here!

Keep Reading

How do I request the Jovem Novo Banco debit card?

See how to apply for the Jovem Novo Banco debit card and get a series of advantages, such as free annual fees and international coverage!

Keep Reading