Account

Discover the BIG 100% current account

Having an account at Banco BIG can be a great advantage. The account is completely digital and practical! See how it works!

Advertisement

Discover everything about the BIG 100 account: manage your money with ease

The BIG 100% current account is offered by the Portuguese Banco de Investimento Global. This is an ideal opportunity for those who want a simple account option, with traditional bank functions, but without undue charges.

| Fees | No maintenance commission |

| Benefits | Investment in savings Credit card application, among others. |

How to open your BIG 100% current account?

BIG bank offers the option of an online account full of benefits for you. Want to know more about how to open your account? It's super easy!

Well, the account has no maintenance costs. In fact, the rates are fair and at affordable prices, you can carry out different day-to-day transactions!

Furthermore, this is a digital account that has savings, investments and advice! In other words, all access will always be done online! So, keep reading and check out all the information about the BIG 100% Digital account!

How does the BIG 100% account work?

The Big 100% Digital account offers innovation, speed, as well as a selection of the most profitable global products.

With your account you will be able to carry out a series of basic movements, such as transfers, deposits, payments, schedule operations and schedule to receive notifications.

Additionally, you have the right to use checks. Furthermore, you can request a VISA credit card. This is without an annual fee!

So, all of this is at your disposal when you open your BIG 100% account. But to do this, you need to make a minimum deposit of 2000 euros.

Benefits

A BIG account is a great advantage for those looking for practicality without losing the quality and efficiency of their transactions. Therefore, some advantages of becoming a BIG customer:

- Account without annual fee

- Remote Customer Service

- 50% commission on Euronext Lisbon, for just 30 days

- In the first 3 months of use you can make a Super Deposit that yields 2% from TANB!

- Digital opening, without leaving home

- Free transfer between BIG accounts

- No termination fee

- Visa card with no annual fee

- Transfer of securities from another bank without charge.

Disadvantages

Opening a BIG account may have some disadvantages, such as:

- Need to deposit 2000 euros to open your account;

- Charge for interbank transfers

Furthermore, with the information offered by the bank, we did not find any other negative points!

Therefore, offering all the usual operations, the BIG 100% account is recommended for those who want to simplify their access to banking procedures.

How to use your BIG 100% account?

Now that you know more about the BIG 100% account, know that using it is very easy. So, you can use your account via cell phone and the internet.

Additionally, you can open your account at a bank branch or via the internet. In fact, few documents are required.

Come check out our step-by-step guide and find out how to open your account right now! Start enjoying all the benefits of a BIG account, click on the link below!

How to open your BIG 100% current account?

BIG bank offers the option of an online account full of benefits for you. Want to know more about how to open your account? It's super easy!

About the author / Filipe Travanca

Reviewed by /

Senior Editor

Trending Topics

Best investments for 2022: which options to choose?

Betting on the best investments for 2022 in Portugal is a good way to secure your future and let your money work for you.

Keep Reading

Edutin Carpentry Course: learn online and for free!

Edutin Academy offers a Carpentry Course for you to enrich your CV without having to spend anything! Study online!

Keep Reading

Santander Debit Card: how does it work?

Find out how the Santander debit card works. In addition to being useful for everyday payments, it offers discounts and rewards!

Keep ReadingYou may also like

Do you want to take out ActivoBank Car Credit? So see everything you need to know

Learn how to hire ActivoBank Automobile Credit to finance your vehicle and pay in up to 48 installments!

Keep Reading

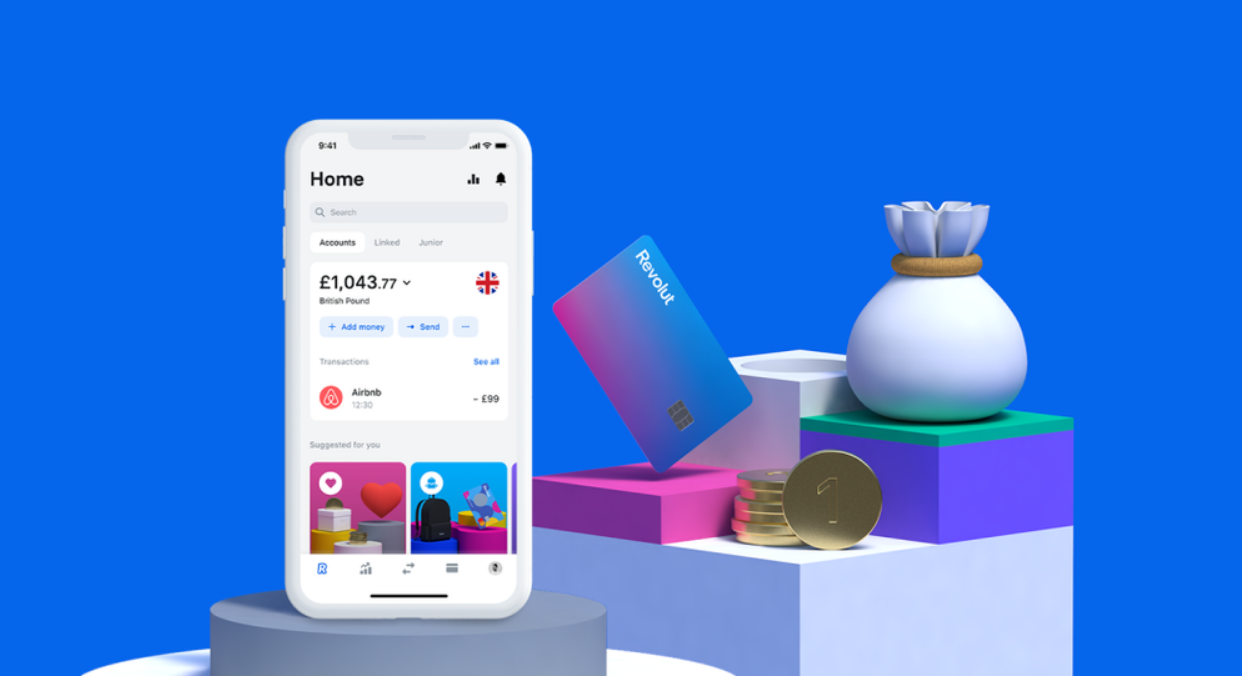

Discover the Revolut Standard credit card

Revolut Standard is a fee-free card that has an app for managing your finances online! Discover more advantages here.

Keep Reading

Premium Increasing Term Deposit: what is it?

To join the Crescente Premium Term Deposit you only need a Santander card and deposit the amount to earn the money!

Keep Reading