Cartões

Como solicitar o cartão Wizink Rewards?

Aprenda hoje, em poucos passos, como solicitar o cartão Wizink Rewards, que se destaca cada dia mais por suas características únicas e muito vantajosas, como zero anuidade e cobertura internacional!

Anúncios

Cartão de crédito Wizink Rewards

Ao solicitar o cartão WiZink Rewards você se livra do pagamento de anuidade ao mesmo tempo em que garante acesso a uma série de benefícios. Então aprenda como fazer!

Em suma, esse é um cartão com adesão online e que dispensa taxas de manutenção. Ao mesmo tempo, apresenta vantagens como programa de pontos, descontos em estabelecimentos parceiros, segurança e comodidade!

Além disso, ele pertence ao banco digital WiZink, de origem espanhola, e conquista a cada dia mais clientes. Isso se dá, inegavelmente, pela facilidade que ele oferta junto aos seus benefícios. Interessou-se? Então continue lendo e veja como fazer o cartão!

Passo a passo para solicitar seu cartão Wizink Rewards

É bastante simples fazer o cartão WiZink Rewards. A adesão, como dito anteriormente, é online e não exige que você saia de casa. Contudo, antes de solicitá-lo, lembre-se de reunir documentação de comprovante de residência, de renda e de identidade.

Você será redirecionado a outro site

Solicitar online

Primeiramente, acesse o site do cartão WiZink e procure a opção “Aderir”. Ali, então, preencha um formulário online com dados como nome, endereço e outros que aparecerem em tela. Então, depois, escolha continuar o processo pelo telefone ou pelo próprio site.

Então, conceda outros dados que eventualmente sejam solicitados e siga as instruções em tela. Por fim, para terminar, digitalize os documentos necessários e requeridos ali e os encaminhe online. Aguarde, por fim, pela análise e resposta ao pedido.

Solicitar pelo app

A solicitação deve ser feita pelo site, enquanto o aplicativo do cartão WiZink Rewards serve apenas para acompanhar transações financeiras.

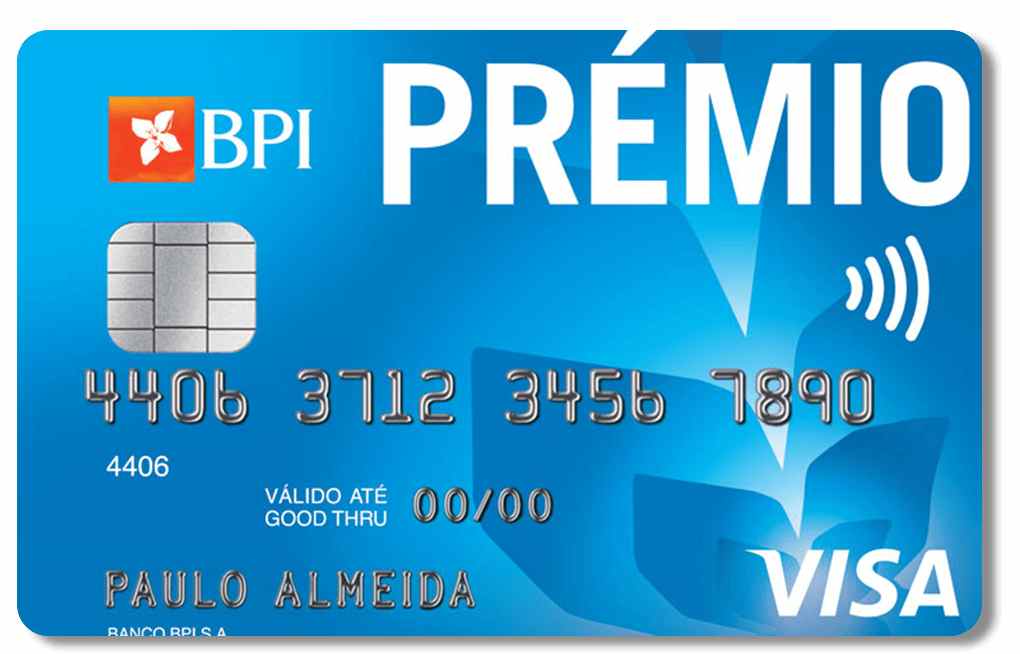

Alternativa recomendada: Cartão BPI Prémio

Todavia em dúvida se o cartão WiZink Rewards realmente é a melhor solução para você? Pois não se preocupe, o mercado está repleto de opções! Nesse sentido, uma delas, que convidamos você a conhecer agora é o BPI Prémio: cheio de vantagens, pode ser exatamente o que procuras! Então confira, abaixo, tudo sobre ele e compare!

| Wizink Rewards | BPI Prémio | |

| Anuidade | Isenta | € 14 |

| Aceita negativado? | Não informado | Não informado |

| Bandeira | Visa | Visa |

| Cobertura | Internacional | Internacional |

| Benefícios | Programa de pontos Rewards, limite inicial de até 6 mil Euros, aplicativo para controle do cartão, sem anuidade, solicitação online, até 50 dias de crédito sem juros, programa WiZink Extra com até 50% de desconto em parceiros, benefícios associados à bandeira. | Pagamento por aproximação, até 2% de descontos em compras, até 15% de descontos em parceiros, bandeira Visa Internacional, cartão adicional com anuidade de 4 Euros, benefícios associados à bandeira |

Cartão de Crédito BPI Prémio

O cartão de crédito BPI Prémio conta com programas de descontos em lojas conveniadas, bandeira Visa internacional, além de outros benefícios exclusivos. Veja como solicitar aqui!

Em Alta

Como solicitar o crédito pessoal Reorganiza?

O crédito Reorganiza pode ajudar você a reorganizar as finanças sem complicações. Confira aqui como contratá-lo sem sair de casa.

Continue lendo

Conheça a conta à ordem BIG 100%

Venha conhecer tudo sobre a conta à ordem BIG 100% Digital, a conta completa sem cobranças exageradas. Veja como funciona e se vale a pena!

Continue lendo

Crypto FX: Invista em Bitcoin e mais com o Banco Carregosa

Saiba como investir em Crypto FX pelo Banco Carregosa e tenha exposição ao mercado das mais populares criptomoedas, como Bitcoin e Ethereum.

Continue lendoVocê também pode gostar

Conheça o cartão de crédito TAP Fly +

O Cartão de Crédito TAP Fly + é uma nova modalidade para acumular milhas a cada compra realizada e conta com vantagens exclusivas! Saiba mais.

Continue lendo

Como pedir o cartão N26 You? Veja aqui!

Você pode solicitar o cartão de crédito N26 You através dos canais digitais oferecidos pela empresa! Veja aqui como fazer, e solicite hoje!

Continue lendo

Conheça o Seguro Hómin: segurança e proteção para o seu lar

Que tal investir na segurança da sua casa e da sua propriedade?! Para isso, conheça o Seguro Hómin e suas modalidades e benefícios!

Continue lendo