Cartões

Cartão de crédito zero anuidade: veja opções em Portugal

Quer um cartão de crédito e não pagar nada para mantê-lo? Então confira algumas opções sem anuidade disponíveis em Portugal. Eles ainda tem vantagens como programa de pontos, bandeira internacional e mais!

Anúncios

Saiba onde pedir cartão de crédito 0 anuidade

Com um cartão de crédito 0 anuidade você pode fazer compras e pagamentos sem precisar gastar com taxas de manutenção. Além disso, vários deles possuem benefícios!

Mas onde encontrar esse tipo de cartão e quais são as opções disponíveis? É isso que você descobrirá aqui, hoje. Continue lendo e conheça algumas alternativas!

Conheça o crédito consolidado Tenha Menos Dívidas

O crédito consolidado Tenha Menos Dívidas oferece menos despesas e mais dinheiro para você! Conheça-o e confira vantagens, como adesão online e até 84 meses para pagamento!

O que é um cartão de crédito 0 anuidade?

Um cartão sem anuidades é aquele que não cobra taxas de manutenção. Ou seja, você não precisa pagar uma mensalidade para o banco para que tenha acesso ao cartão.

Desse modo, basta que haja o pagamento correto das faturas, as únicas obrigações financeiras decorrentes do uso do cartão.

Você será redirecionado a outro site

O cartão de crédito 0 anuidade não possui outras taxas?

Depende. Afinal, caso haja atraso no pagamento da fatura – ainda que de um dia – o consumidor precisará pagar ao banco algumas taxas adicionais.

Dentre elas estão a multa de mora, correspondente à penalização pelo atraso na quitação da fatura. Outra se refere aos juros de atraso, que aumentam o valor da dívida.

Ainda, caso o consumidor parcele as faturas ou quite-as de modo apenas parcial o valor pendente também é acrescido de taxas de juros.

O cartão de crédito 0 anuidade tem outros benefícios?

Em geral os bancos justificam a cobrança de tarifas de manutenção dos cartões com o oferecimento de benefícios. Por exemplo, de programas de pontos ou descontos em parceiros.

Contudo, isso não significa que os cartões sem anuidade não tenham benefícios. O que acontece é que eles são mais limitados ou raros do que no caso daqueles que cobram taxas.

Desse modo, cabe ao consumidor optar por um ou outro. De um lado, um cartão com menos benefícios, mas que é mais barato; de outro, com mais vantagens no dia a dia, mas que cobra taxas de manutenção.

Conheça algumas opções de cartão de crédito 0 anuidade e saiba onde pedir

Nos itens que seguem você encontra várias opções diferentes de cartões de crédito que dispensam as taxas de manutenção. Continue lendo e veja quais são eles!

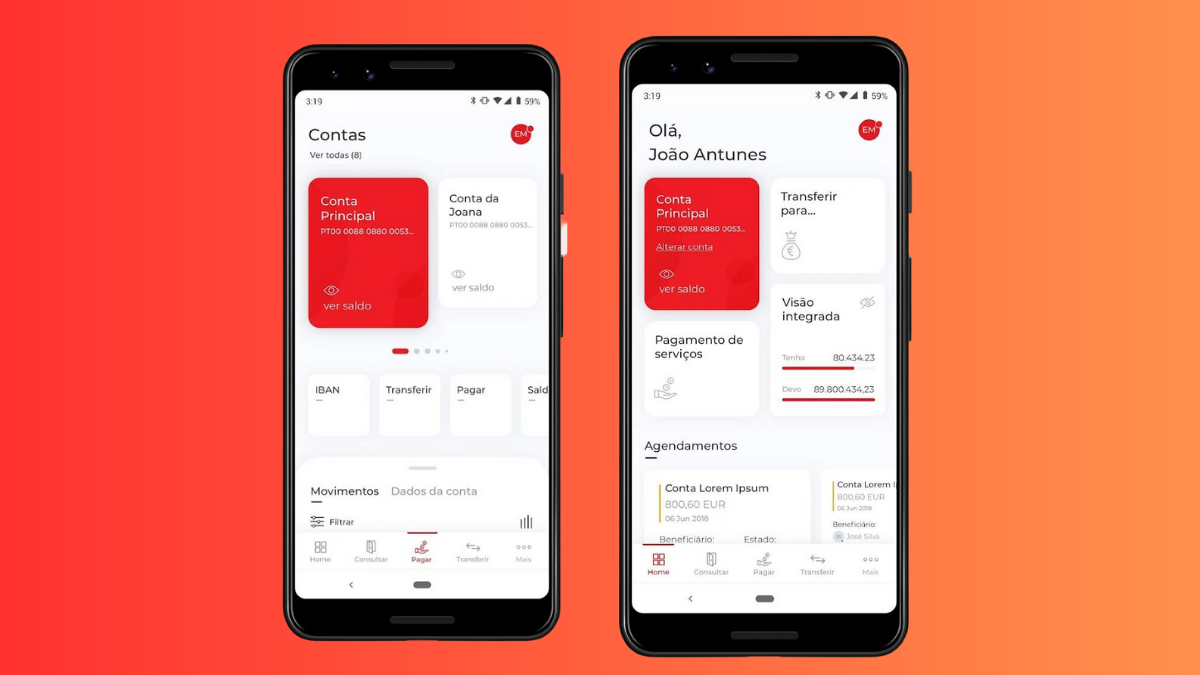

Cartão Millennium BCP Go! Changer

A primeira opção de cartão de crédito 0 anuidade que trouxemos para você pertence ao Millennium BCP. Esse banco possui uma série de cartões diferentes.

Este, que dispensa a cobrança de taxas de manutenção, destaca-se por se voltar aos jovens. Ele foi desenvolvido especialmente para quem tem idade entre 18 e 30 anos.

Além disso, ele conta com alguns outros diferenciais. Por exemplo, é feito em material biodegradável, a partir de cereais. Também, gera doações à Associação Brigada do Mar.

Esse cartão de crédito que dispensa anuidade permite contratação online. Todavia, para pedi-lo é necessário abrir, antes, uma conta no BCP Millennium, bem como estar com nome limpo.

Como solicitar o cartão BCP Go! Changer?

Saiba como solicitar o cartão BCP Go! Changer e tenha em mãos um produto responsável, sustentável e bastante útil!

Cartão BPI Gold

Continuando com a nossa lista de cartão de crédito 0 anuidade temos o BPI Gold. Ele é o único cartão do banco BPI que dispensa as taxas de manutenção.

Esse cartão possui bandeira Mastercard Internacional. Ele oferece comodidades como pagamento por aproximação (contactless) e amortização de valores sem custo.

Ainda, possui um aplicativo para acompanhamento das transações em tempo real. Acompanha alguns benefícios relacionados à bandeira, como descontos em parceiros.

Bankinter Power

O Bankinter também tem a sua opção de cartão de crédito 0 anuidade. Trata-se do cartão Bankinter Power, que acompanha bandeira Visa Internacional.

Além disso, essa é uma opção que possui tecnologia contactless, assim como permite o pagamento flexível da fatura. Aliás, é possível acompanhá-la pelo app MBWay.

Um dos pontos que diferencia esse cartão é que mesmo sem cobrar anuidade ele oferece um seguro contra acidentes pessoais ao consumidor.

Assim como as outras opções já citadas, esse é um cartão que somente está disponível para clientes Bankinter. Por isso, para solicitá-lo é preciso abrir uma conta na instituição.

Como solicitar o cartão Bankinter Power?

Aprenda aqui o passo a passo de como pedir e ativar o cartão Bankinter Power. E, assim, garanta um cartão de crédito internacional e abrangente!

NB Verde

O Novo Banco possui uma série de cartões e um deles é o NB Verde, que dispensa anuidade sem deixar de lado alguns benefícios bastante interessantes.

Ele oferece anuidade gratuita não só para um cartão, mas para até 2 deles. Além disso, ele também conta com duas bandeiras: Visa Internacional e Multibanco.

Desse modo, é possível usá-lo em Portugal e no restante do mundo. O cartão conta com cash advance, serviço MB Way e pagamento por aproximação.

Além disso, também conta com acesso ao programa Selects da American Express Selects. Ele dá acesso a descontos em lojas, hotéis e aventuras.

Para ter acesso a esse cartão, do mesmo modo como nas alternativas anteriores, há exigência de que o consumidor tenha uma conta no Novo Banco.

Como solicitar o cartão NB Verde Dual?

Veja como solicitar o cartão NB Verde Dual e, assim, garantir um cartão de crédito com duas bandeiras e sem anuidade!

WizInk Rewards

Por fim, fechamos a nossa lista de cartões de crédito que não cobram taxas de manutenção com o cartão Wizink Rewards, que se destaca por ter programa de pontos, bem como acesso à promoções que dão desconto em parceiros.

Esse cartão oferece como limite inicial até 6 mil Euros. Além disso, ele conta com bandeira Visa Internacional, aceita no mundo todo.

Com o programa de pontos Rewards, esse cartão de crédito 0 anuidade permite que seus gastos se convertam em pontuações. Elas, então, dão descontos em parceiros.

Além disso, também há o programa Wizink Extra, que todos os meses reúne promoções exclusivas para os clientes. Nelas é possível alcançar até 50% de desconto em produtos.

Diferentemente dos cartões anteriores, não há necessidade de abertura de conta para ter acesso ao cartão de crédito 0 anuidade. Contudo, há exigência de idade mínima de 21 anos.

E, por fim, se quiser saber como solicitá-lo, é só clicar abaixo para acessar um passo a passo completo. Não perca essa chance! Afinal, essa é uma das melhores opções disponíveis.

Como solicitar o cartão Wizink Rewards?

O cartão de crédito Wizink Rewards conta com um programa exclusivos de pontos Rewards, além de um limite inicial de até 6 mil Euros. Veja como solicitar!

Em Alta

Criptomoeda Win: vale a pena? Conheça!

Saiba mais sobre a criptomoeda Win, uma das principais alternativas para quem quer apostar nesse tipo de investimento. Confira agora!

Continue lendo

As melhores corretoras de criptomoedas em Portugal

Descubra quais são as principais corretoras de criptomoedas em Portugal e saiba onde vale a pena investir. Conheça mais aqui.

Continue lendo

Crédito Habitação BNI: até 30 anos para quitar!

O Crédito Habitação BNI traz uma proposta diferente que une consolidação de crédito, hipoteca e liquidez adicional! Saiba mais!

Continue lendoVocê também pode gostar

O que é a Bolsa de Documentos: praticidade e segurança!

Você sabe o que é a Bolsa de Documentos? Esse é um mecanismo realizado pelo governo português para facilitar o acesso de documentos virtuais.

Continue lendo

Cartão TAP Classic ou TAP Gold: qual o melhor?

Cartão TAP Classic ou cartão TAP Gold? Ambos oferecem vantagens em viagens, mas contam com características exclusivas. Compare!

Continue lendo

Baixe a app EuroBic Net: Simplifique sua vida financeira!

A app EuroBic Net oferece recursos para os clientes facilitarem as suas transações. Então, realize transferências, confira extratos e mais!

Continue lendo